Insights

Referencing Data on a Specific Worksheet with =INDIRECT

The =INDIRECT function permits referencing information in a workbook using strings of text. This can be a very handy tool when you want to create dynamic references in formulas without changing the formulas themselves. It is also a terrific way to reference data on different worksheets.

Excel: Dynamic Column Reference in a Financial Model

This video explains how to use SUMIF and the INDEX + MATCH function combination in Excel to dynamically reference columns in a financial model. This has been particularly useful to me when I am organizing a company’s data by location or product category.

Excel for Models: =SUMIF() Introduction

This video provides a quick introduction to the =SUMIF() function in Microsoft Excel. The video also provides a quick demonstration of what is likely the most common use of =SUMIF() in a financial model: organizing monthly information into quarters and annual periods (skip to 1:15 for this example).

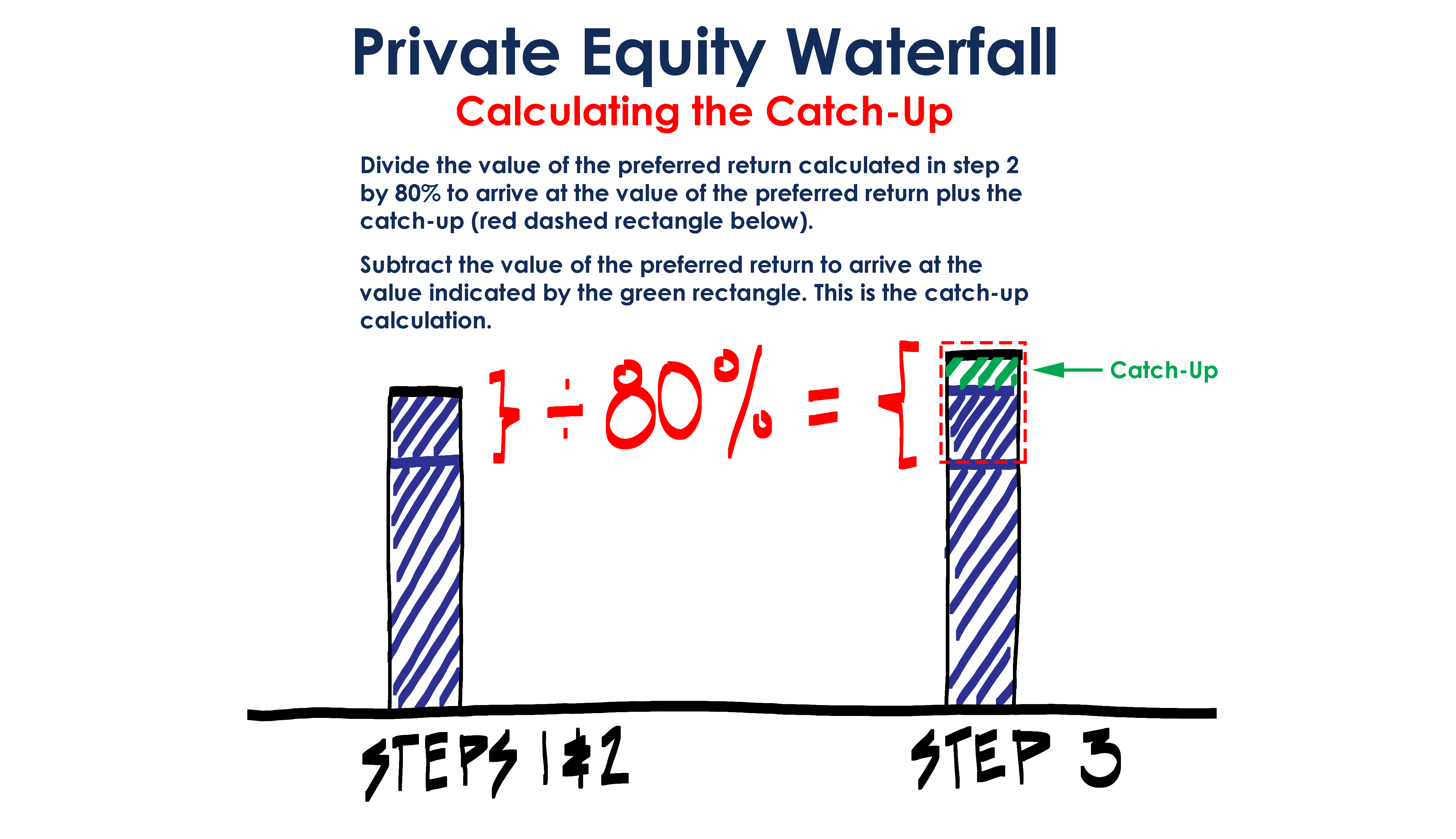

Private Equity Catch Up Calculation

The calculation behind the catch-up provision that determines the general partner’s (GP) carried interest at a private equity fund can cause some confusion. In this post we will explain the math in the Excel template available on ASM.

Who Invented EBITDA?

EBITDA is often criticized as an imperfect measure of earnings to use broadly in comparing the profitability of companies across industries. But the concept wasn’t developed for this purpose. It was invented by billionaire investor John Malone.