Insights

LBO Pro Forma Balance Sheet Adjustments

The purpose of this post is to translate the language surrounding purchase accounting into a financial template with instructions that cover the balance sheet adjustments for most control transactions.

Example Due Diligence Lists and Deal Process Overview

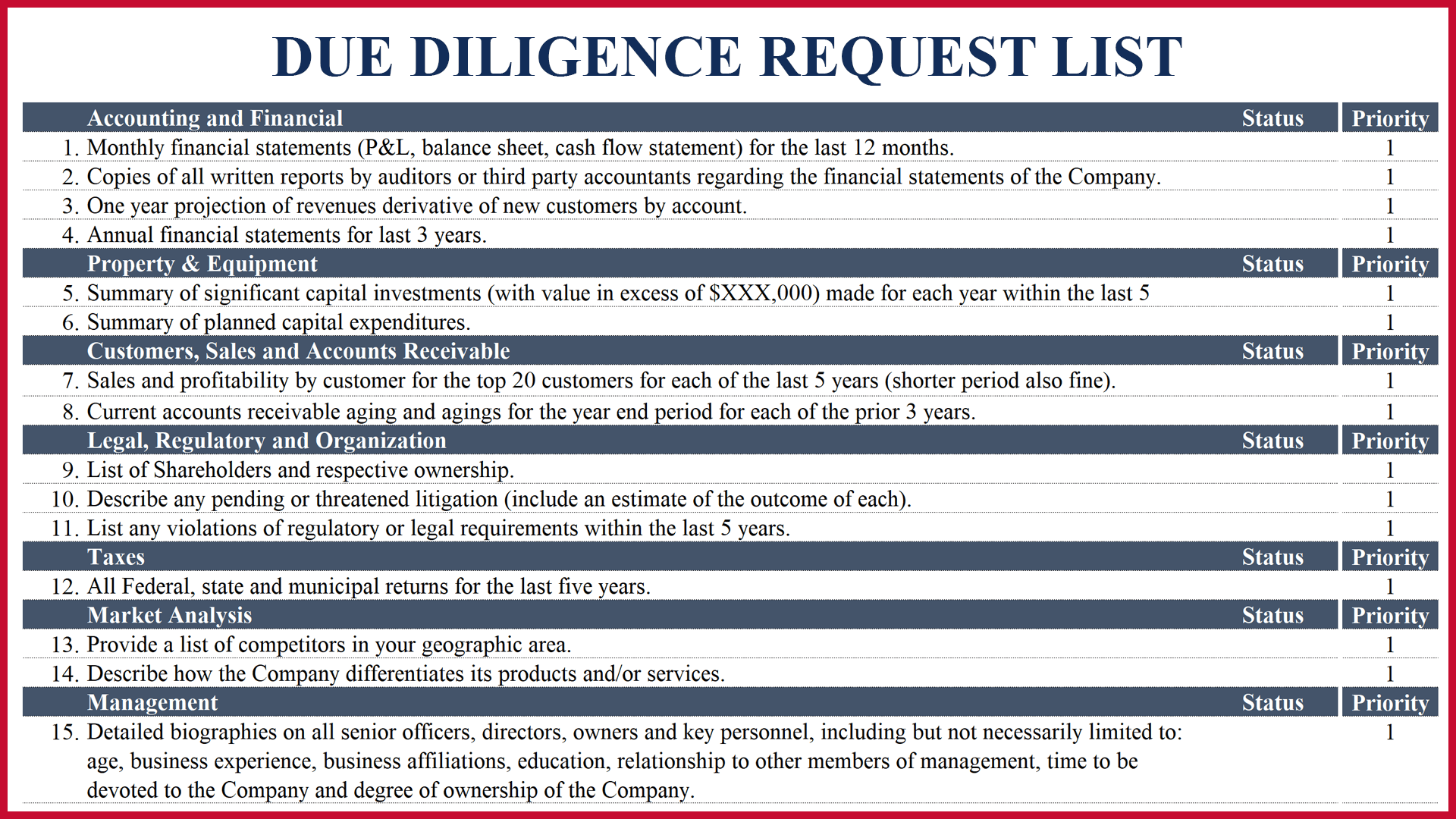

Providing an initial due diligence list is often a great way to initiate transaction-related dialogue with a CEO or management team interested in exploring a capital raise or sale of the business. Typically a due diligence list will evolve and expand as interest in a transaction grows, but it can be intimidating if the initial list provided is too thorough. Collecting a large amount of company data and presenting it in a shareable format takes considerable effort, which makes a short diligence list a helpful introduction. The template available for download contains two such due diligence lists.

Excel: List All Worksheets in a Workbook on One Tab

If you are working with dozens of worksheets that are formatted in identical fashion (think of a company that has multiple locations with the same line items), then the ability to list all of these worksheets on one tab can be extremely helpful. As you will see in the template available for download, this permits retreiving data with the =INDIRECT function from each individual worksheet.

Excel: Reference the tab name in a cell.

Occasionally when you are working with a lot of tabs it helps to have a reference to the tab name on the worksheet. An example might be a workbook containing financials for 100 restaurants.

Excel: Summing cells across multiple worksheets with one formula.

Tips for working with data across multiple worksheets in the same Excel workbook.

The single biggest requirement to make maximum use of these tricks is to have all of your data laid out in identical format across tabs.