Insights

Senior Debt Summary of Terms (or Term Sheet)

This post references an example Senior Debt Summary of Terms, which is available for download. The company described in the document is entirely fictional.

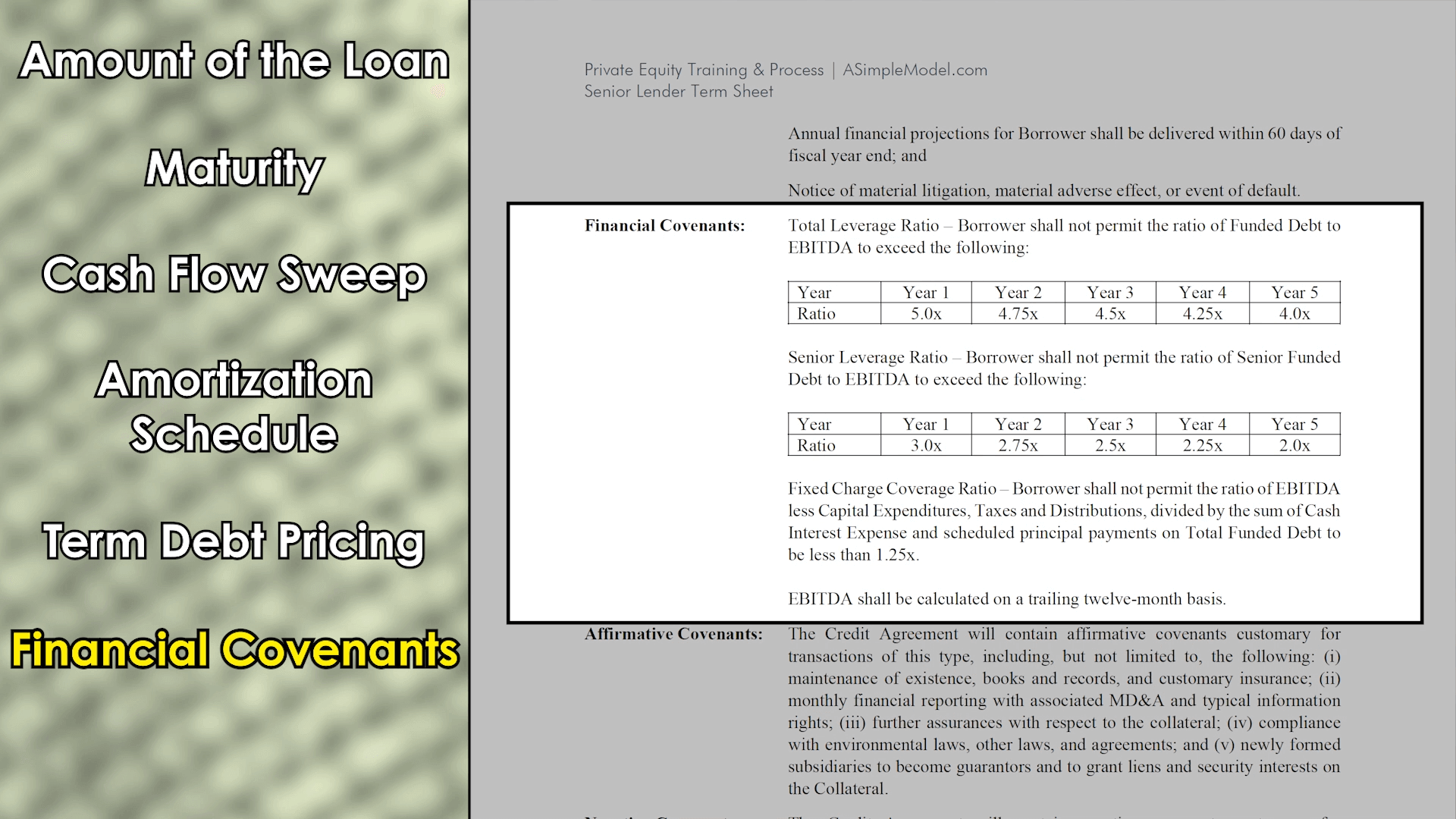

Fixed Charge Coverage Ratio (FCCR) in Private Equity Transactions

The fixed charge coverage ratio is used to measure a company’s ability to cover its “fixed charges” (largely debt-related payments but this can include additional obligations as you will see below) due in any given period. The definition provided here and elsewhere generally refers to “fixed charges,” which can be a little frustrating (akin to a dictionary defining “legendary” as “based on legends”). To clarify, we will start with a simple visual and expand on this by including the definition a senior lender might use in a term sheet.

Private Equity Debt Ratio Analysis

In a control private equity transaction, debt is commonly employed to acquire a business. This debt creates obligations of interest and principal payments that are due on a timely basis. If these payments are not made creditors can take action to recover the sums borrowed by the company.

Private Equity: A Primer on the Letter of Intent (LOI)

A Letter of Intent (LOI) is a largely non-binding document entered into by the potential sellers and buyers of a company. This document helps serve as a guide for the documentation required to consummate the transaction (the “definitive agreements”).

Intercreditor Agreement Overview

I once worked on a transaction where every item had been negotiated and all documentation was drafted and in final format, but a single number in the Subordination and Intercreditor Agreement nearly caused the entire transaction to fall apart.