Insights

The Unbearable Lightness of Private Loan Covenants

This post explores debt covenants in credit agreements before and after the Great Financial Crisis, and the emergence of cov-lite agreements.

How Business Owners Choose Buyers

Attractive firms can field dozens of acquisition inquiries and choose from multiple competing offers when they decide to sell. What do those firms look for in a buyer, and why do they choose one offer over others? If you want to successfully acquire businesses, you should know the answers to these questions.

Challenges Forecasting Private Equity Returns

Why professionals struggle to accurately forecast private equity returns for transactions the deal team is focused on.

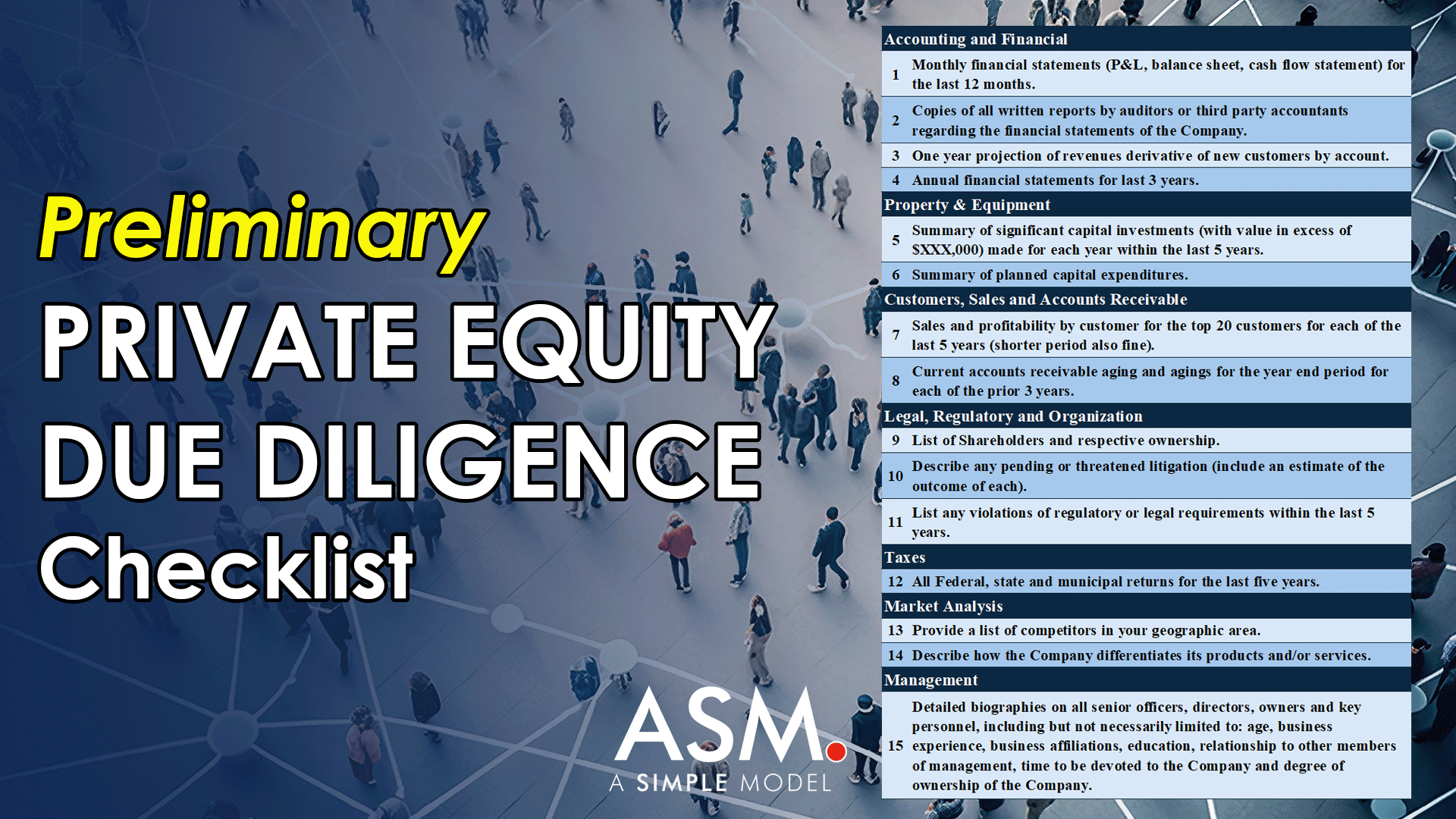

Buying a Business: Your Minimum Due Diligence Checklist

In the private equity world, due diligence is a crucial part of evaluating a company for a potential acquisition. But to the business owner it can be an invasive and uncomfortable process. For situations like these, I developed a streamlined due diligence checklist. Click on the post to learn more.

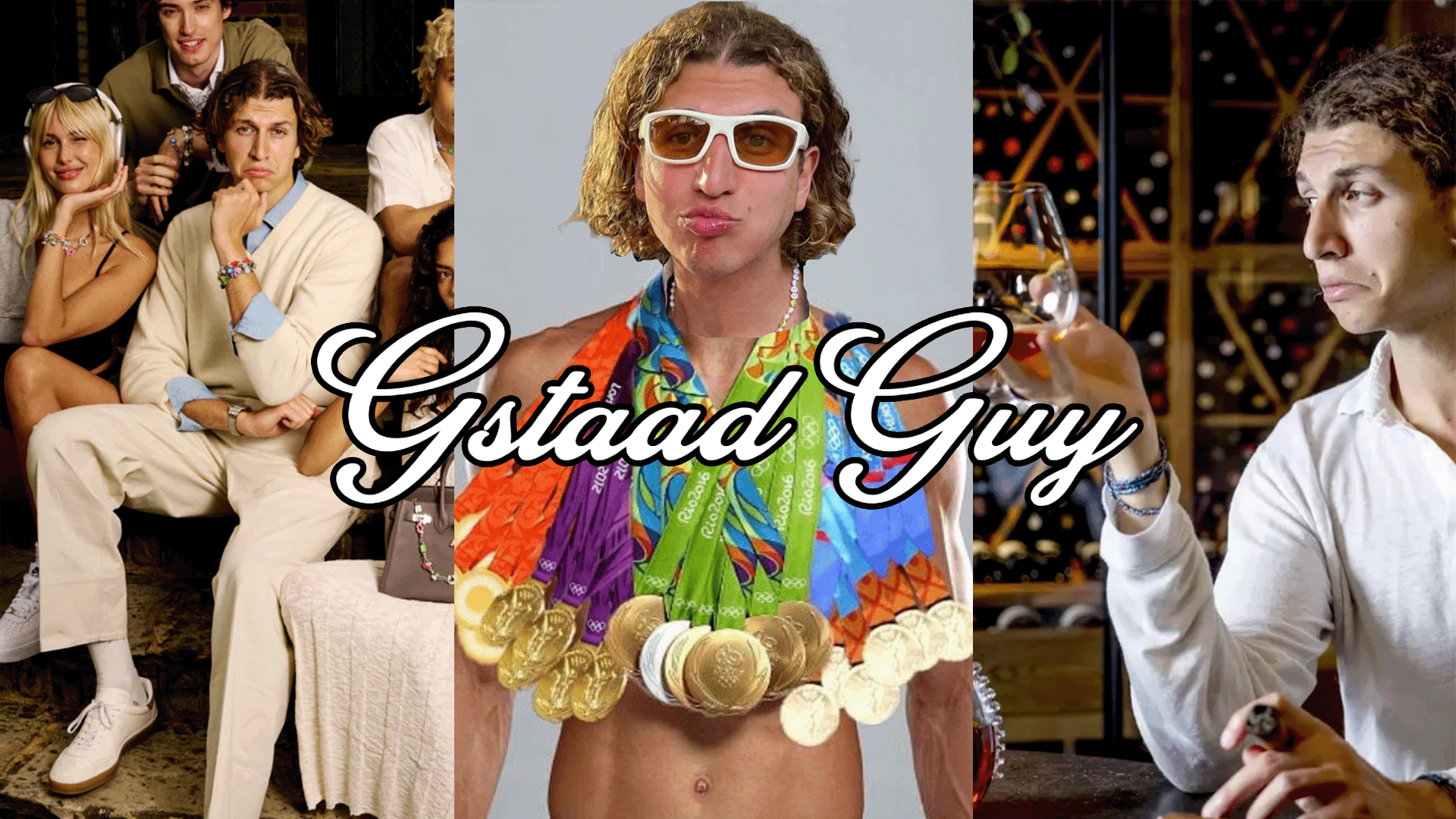

Why is “Gstaad Guy” Fantastique?

Who is Gstaad Guy and what can we learn from him? How did he turn his “small” following into multiple businesses?