True Private Equity Experience

This course goes beyond the LBO model to explain how private equity

professionals close transactions.

This course introduces the private equity industry and explains why it is relevant to you. This course also explains how private equity works by focusing on two participants: (1) Independent Sponsors and (2) Private Equity Funds.

This course focuses on deal origination for private equity professionals. Finding attractive opportunities requires a substantial amount of work. This course will describe the deal sourcing funnel, deal sourcing strategy and the qualities of an attractive investment opportunity.

This course introduces early stage private equity due diligence. The content will explain the advantages provided by getting involved early in the process, and detail due diligence lists used for this purpose. It will also explain how private equity firms get up to speed quickly on a new industry, and how private equity professionals work with third parties to complete due diligence.

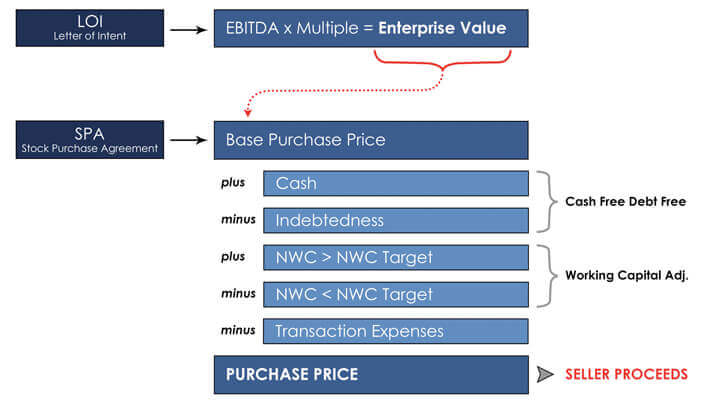

This course will walk you through all of the materials provided and documentation required to secure a transaction under letter of intent. The courses also focus on bidding strategies and price discovery tips used by private equity professionals.

The course focuses on the letter of intent, which is one of the most important documents as it relates to the process of closing a transaction. While it may be a non-binding document, which means that technically most of it can be renegotiated, the reason it is so critical is that the terms put forth by a buyer or seller for the contemplated transaction will be revisited for the entirety of the process until the acquisition closes. Attempts to “re-trade” the LOI can cause a deal to fall apart.

This course covers multiple topics essential to closing a transaction. The lessons start with a focus on advanced due diligence, which focus on the amount of additional detail required to confirm the private equity firm’s assumptions. Next the series transitions to a focus on working capital analysis and the working capital adjustment. The series also touches on transaction structure and begins to define the purchase agreement.

This course introduces the Stock Purchase Agreement (SPA). A stock purchase agreement is the primary transaction document for a stock acquisition. In most control private equity transactions this is the document that will require the most negotiation.

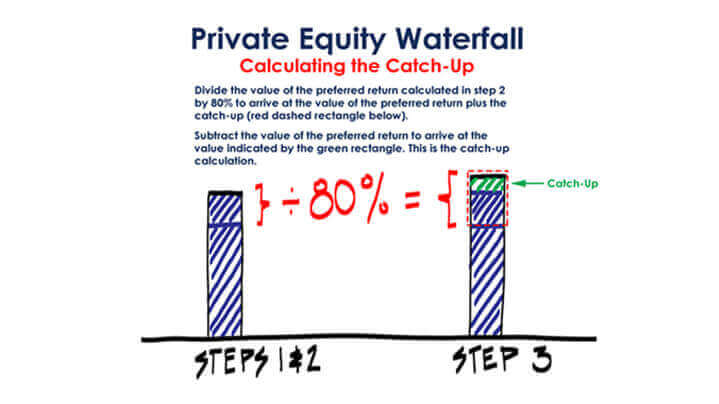

Visual Explanations

ASM content is heavily focused on visual aids to make difficult, otherwise abstract concepts, easy to comprehend.

Advanced Content

The Private Equity Curriculum covers everything from sourcing transactions to the LBO model to negotiating the Purchase Agreement.

Created by Industry Professionals

This course was created by Peter Lynch as part of a

content creation initiative with Katten.