Insights

WSJ: Fireside Chat with Carlie Munger

I had to share this fantastic Q&A with Charlie Munger from The Wall Street Journal. I included a few of my favorite answers below, but I would suggest just following this LINK for the full article.

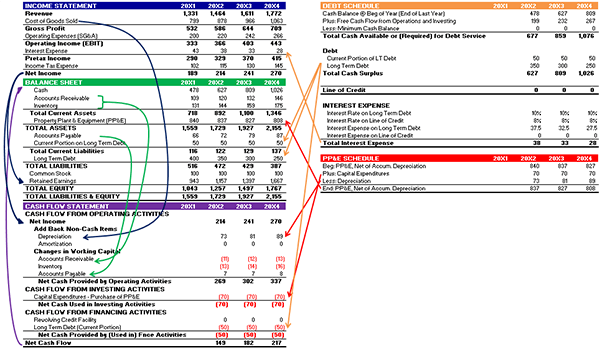

How to Integrate Financial Statements - Video Update

I recently decided to rerecord the video titled “Overview of the Process” in the Integrating Financial Statements series. This is in an effort to reduce the amount of material posted where I sound like a robot (unfortunately I still sound a bit like a robot…).

Burger King CEO by 32

Those interested in investing or cheeseburgers (and I would hope that covers everybody) should read this article about Burger King. It covers the rise of Andrew Schwartz from analyst at Credit Suisse First Boston to CEO of Burger King by age 32, and the drastic changes made at the company since he assumed the role. The approach taken by Schwartz has been an unprecedented departure from the industry norm. Fortunately Wall Street is a fan.

Cost of Corruption

It’s always helpful to see new vocabularly in different context. And even more so if it’s interesting… Below you will find mention of the p/e ratio as it relates to valuation in international markets and corrupt government practice.

Why the Cash Flow Statement Matters

The cash flow statement doesn’t always get the attention it deserves. If you think about valuation metrics most frequently cited in the press or analyst reports, most pull from the income statement: price-earnings ratio (P/E ratio), earnings per share (EPS), multiples of EBITDA, multiples of revenue, etc. This might encourage anyone new to valuation or financial modeling to spend a disproportionate amount of time examining the income statement.