Insights

Real Estate Distribution Waterfall Example

I have been working with a friend of mine who prefers to remain anonymous and happens to be a real estate professional to develop a simple real estate distribution waterfall (I will refer to him as Dimitri for the purpose of this post). Our working relationship consists of me interrupting his day with short emails containing Excel templates and bulleted questions, which he graciously responds to with quick answers pulling from years of experience. It’s a highly iterative process that hopefully consumes little of his time.

ASM Subscriber Profiles

We are excited to announce the addition of a new feature: ASM Subscriber Profiles (see image below). Subscribers can now upload examples of their own work and share (or hide) exam results with a public page listing their accomplishments and interests. In addition to uploading unique templates or analysis, we are also encouraging subscribers to upload improvements to ASM templates available on the website. Each time a subscriber uploads an example of their own work, ASM will create a unique page for that post linking back to the subscriber’s profile. Ultimately we hope that this will help subscribers get noticed for their talent. The profile page will also track how often a subscriber’s work is downloaded and voted as helpful.

Eliminate Capital Gains Taxes in Private Equity Transactions

This post focuses on a significant tax advantage that any entrepreneur, fundless sponsor and lower-middle-market private equity practitioner should be aware of known as Qualifed Small Business Stock (QSBS). QSBS is an overlooked section of the U.S. tax code that can result in incredible tax savings on capital gains. If a transaction is structured properly, it has the potential to save shareholders millions of dollars in the event of a successful exit (sale of the company).

How to Build a Three Statement Model (Update)

I recorded the first video for this website in 2013 with a $27 microphone I purchased at Best Buy. Since that time, the technology and software used at ASM has improved significantly, and I thought it was time to update the original recording.

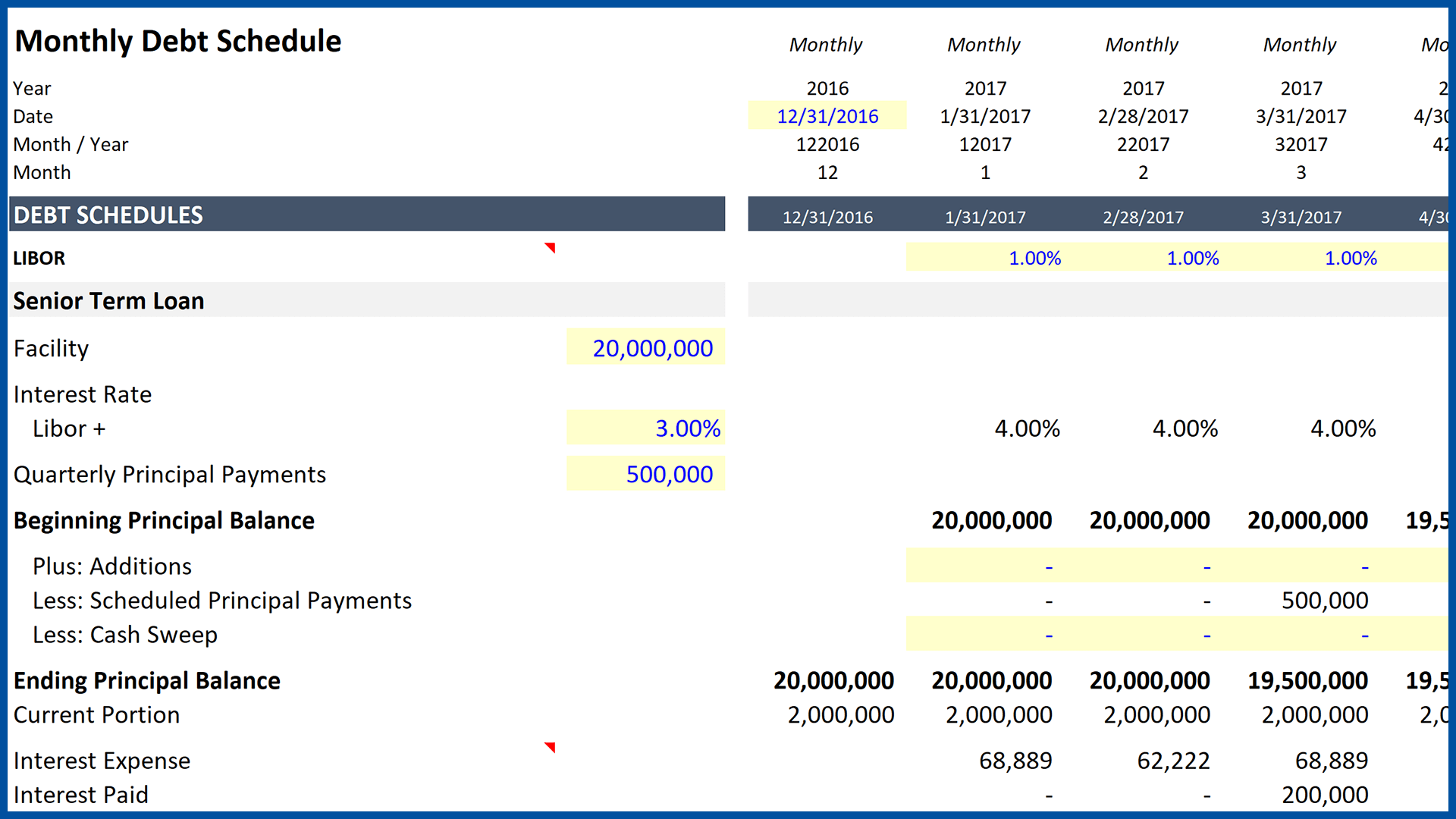

Monthly Debt Schedules Example

This post includes an Excel template with two examples (available for download at the bottom of this post). The first it labeled “Senior Term Loan,” and the second is labeled “Subordinated Notes.”