Insights

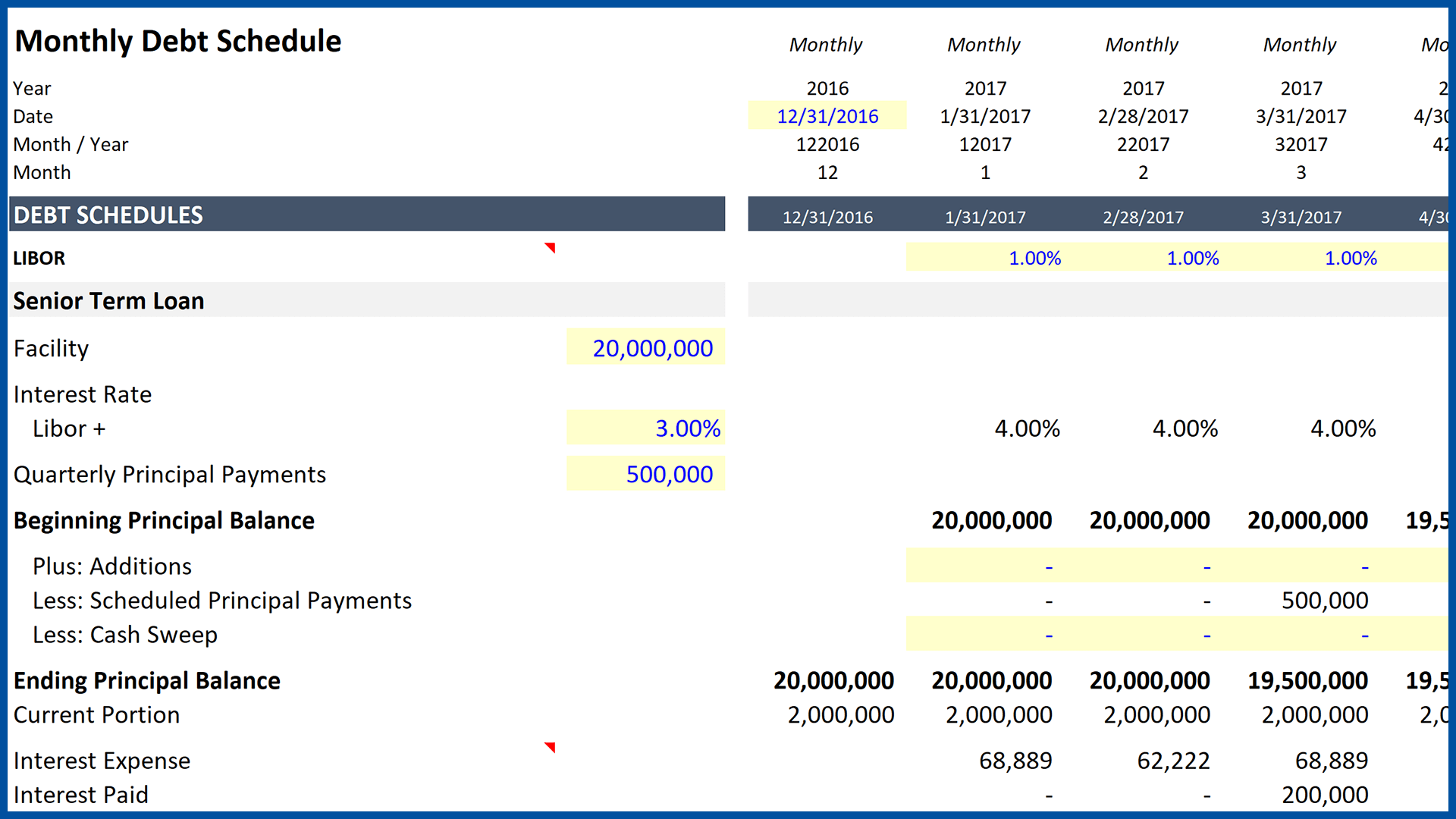

Excel: =MOD() to Calculate Quarterly Interest Payments

One of the challenges you will encounter building monthly debt schedules is the need to calculate and show interest expense in each month, and then reflect the payment of interest at the end of the quarter. This video provides a helpful approach.

Excel Trick: Sum a Specific Number of Cells

This video explains how the =SUM and =OFFSET functions can be combined to write a formula that will sum a specific number of cells. This is especially useful when you are working with monthly data, and showing quarterly and annual periods in a financial model. The video also explains why using the =SUM formula for this purpose can lead to errors.

Independent Sponsor Economics

Before discussing the economics, I thought a definition of a fundless sponsor would be helpful. An article in The Economist provided an excellent example: “The typical search-fund principals are MBA graduates from an elite American university, who raise $400,000 or so of “walking around money” from investors, who purchase a stake in the fund for about $40,000 a share. The fund searches for a high-growth, high-margin target, valued at $5m-20m. The fledgling businessmen then hold a second round of acquisition financing, as well as raising debt. Their tenure as bosses lasts until they sell out.” [1]

Excel Trick: SumProduct & Double Minus ("--")

I recently received an email asking if I was aware of a formula that could validate the information in two columns, and return the summed value for all matches. This is easier to grasp in context, which makes the video helpful. I was, admittedly, slightly long-winded in explaining the purpose of the formula. To avoid this lengthy explanation, skip to the two-minute mark once you understand the objective.

The IRR Formula Explained

The IRR formula made (very) simple. This post will show you the math behind an IRR calculation to make the concept easy to grasp.