Insights

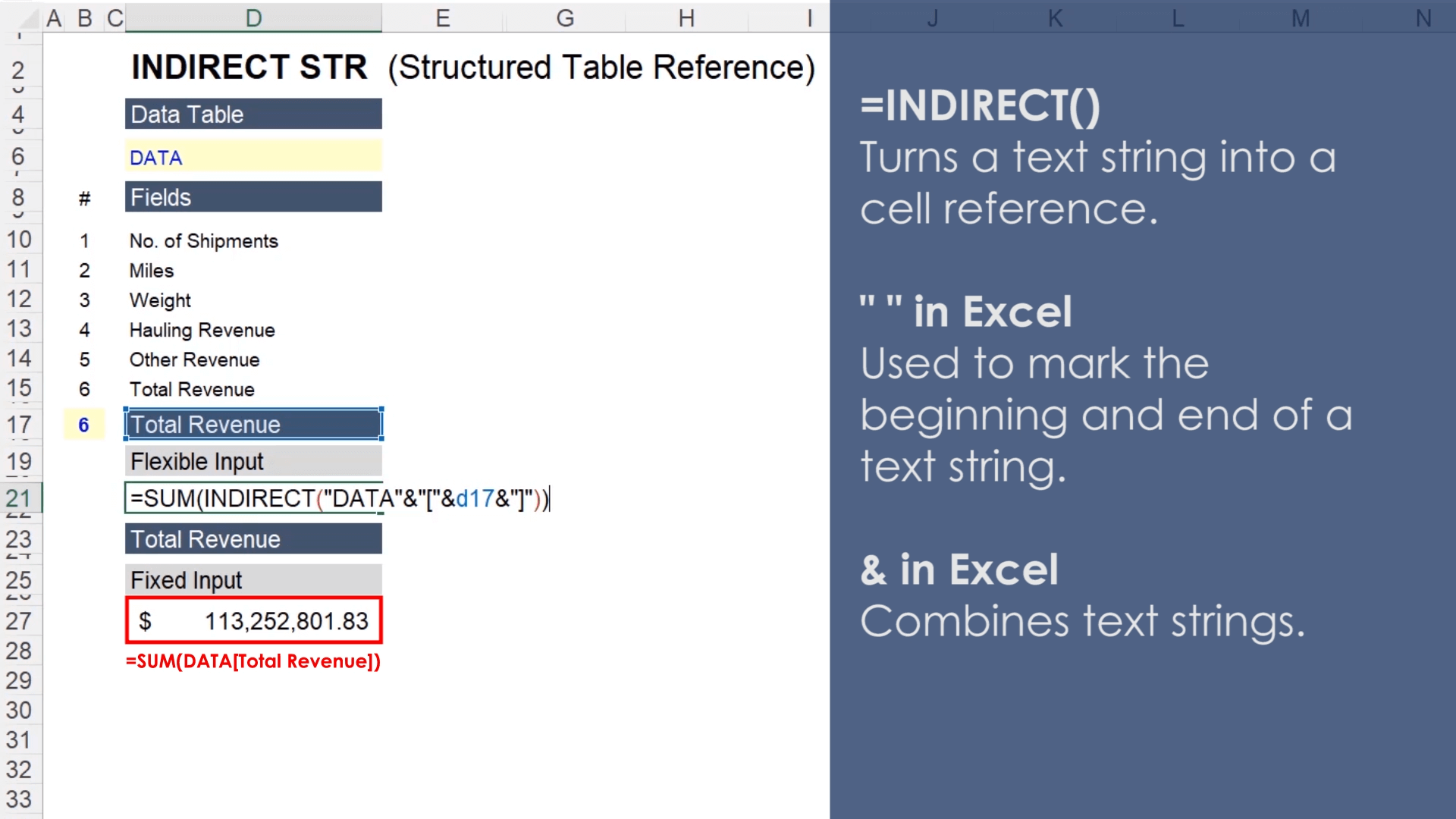

Dynamic Excel Table

In this video we are going to learn how to use the =INDIRECT function to create flexible inputs for dynamic Excel Table formulas.

The Money Illusion

I have had a surprising number of people admit that they disproportionately hold cash because investments make them uncomfortable. Ironically, whether or not you choose to invest doesn’t matter. If you have wealth, you are invested. And cash can be comforting, for reasons outlined below. But there are reasons it shouldn’t be, for reasons (also) outlined below.

Introduction to Excel Tables

Excel Tables help organize your data and they are packed with useful features that facilitate analyzing information. In this lesson we will start with a small subset of data to demonstrate how Excel Tables function.

Data Analysis in Excel: Spotting Red Flags

The value of data analysis in Excel when working in private equity. Sometimes you need to look beyond the LBO model.

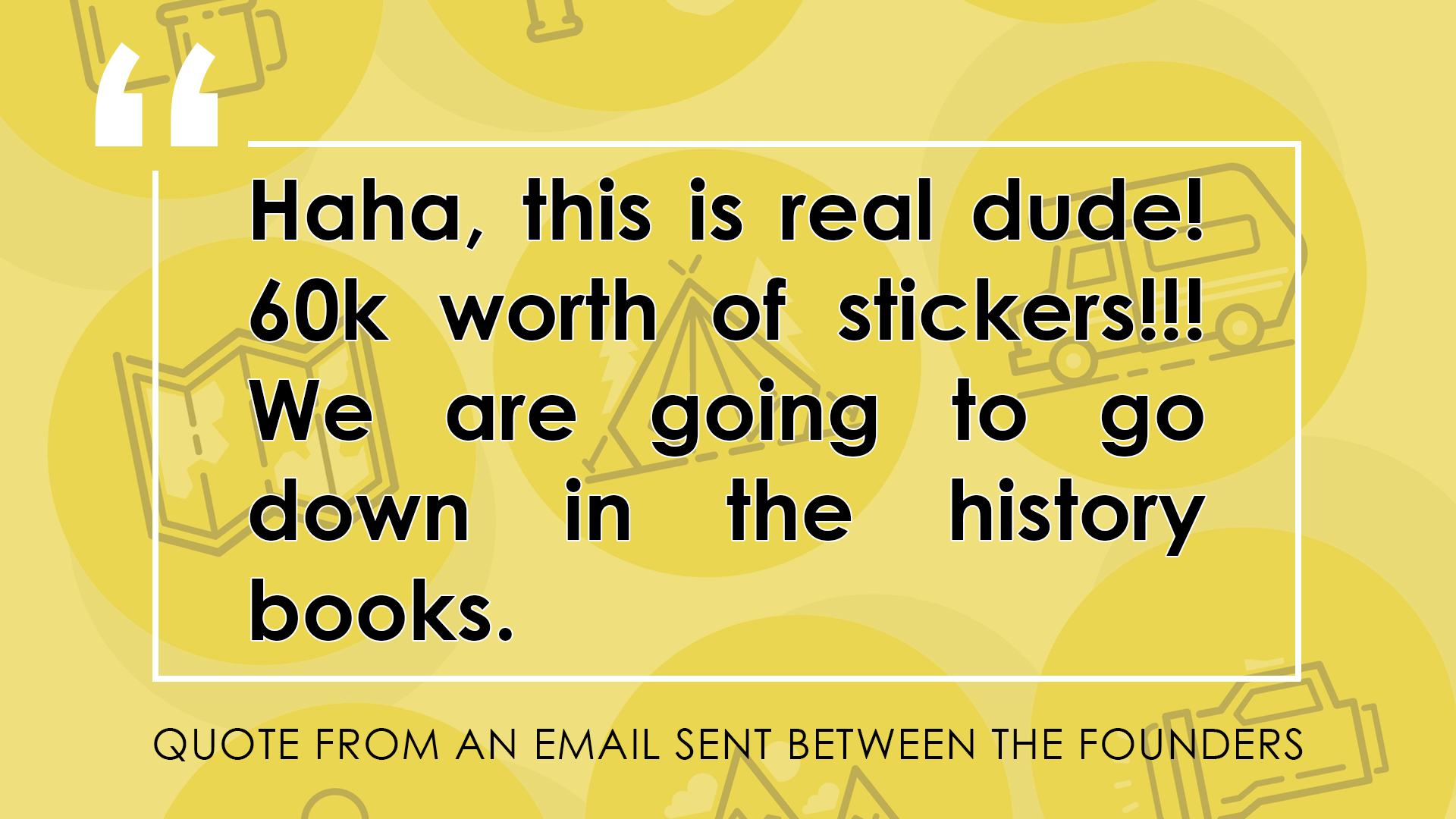

Earnout Manipulation: $4 Million of Stickers

An example of an earnout as a cautionary tale. This story is a great example of why earnouts need to be carefully structured.