I have had a surprising number of people admit that they disproportionately hold cash because investments make them uncomfortable. Ironically, whether or not you choose to invest doesn’t matter. If you have wealth, you are invested. And cash can be comforting, for reasons outlined below. But there are reasons it shouldn’t be, for reasons (also) outlined below.

Humans take great comfort in watching the amount of cash in their savings account grow, even if that cash is losing value daily. Enter the money illusion, defined by Henry Hazlitt in his classic economics primer, Economics in One Lesson (Buy it on Amazon):

As this is being written, in fact, printing money is the world’s biggest industry – if the product is measured in monetary terms. But the more money is turned out in this way, the more the value of any given unit of money falls. This falling value can be measured in rising prices of commodities. But as most people are so firmly in the habit of thinking of their wealth and income in terms of money, they consider themselves better off as these monetary totals rise, in spite of the fact that in terms of things they have less and buy less. [1]

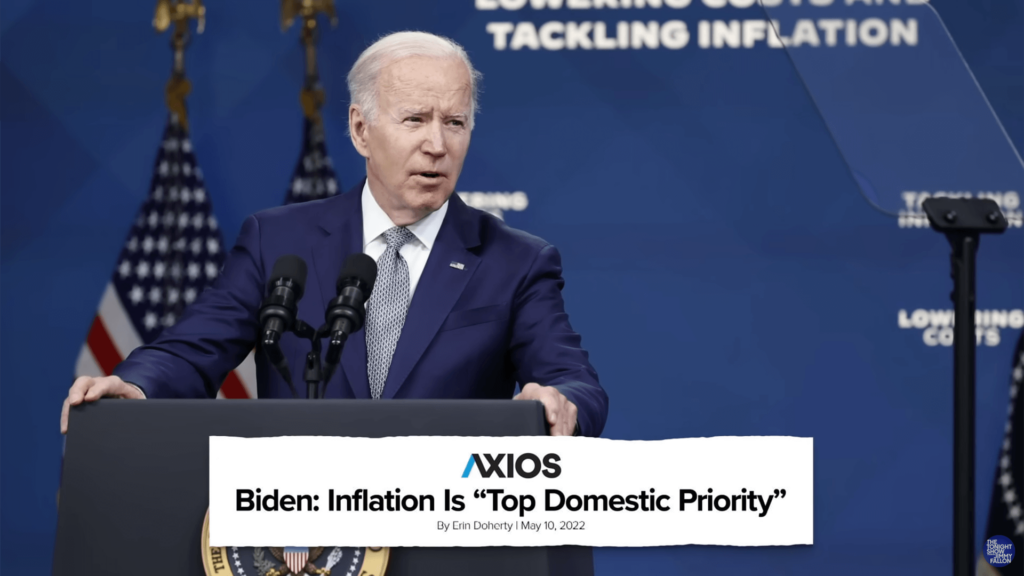

In short, you have increasingly more of something that buys you less of what you want. Inflation is responsible for the “falling value,” and even Jimmy Fallon has taken to talking about it. In response to Joe Biden’s statement that inflation is a “top domestic priority,” Fallon quipped, “…Biden knew it was time to act when the price of milk and gasoline both hit $9 / gallon.” [VIDEO LINK]

What to do now? I struggle with this question because humans have different risk appetites. Fortunately, “Intelligent Investor” columnist Jason Zweig provided a few high-level suggestions in an article titled “What to Know if You Want to Buy the Stock Market Dip”:

- “Avoid long-term bonds and bond funds, which are highly sensitive to rising rates and have lost 20% or more this year.”

- Prepare yourself for stocks to drop farther and stay down longer. “Dips can turn into dives, and recoveries won’t always be as swift as they’ve been in the past decade.”

- Make purchases automatic: “for example, buy a fixed dollar amount automatically once a month – so you won’t be tempted to give up near the bottom.”

- “Lean towards assets that can benefit from inflation.”

- “Above all, don’t take big risks to try catching up. The Fed isn’t going to bandage investors’ mistakes anymore.”

To echo the final bullet, inflation is shutting down the printing presses that elevated asset values across asset classes. An article in Barron’s highlighted how bear market duration changed in the last 35 years, and suggested the trend could reverse:

The average bear market during Warren Buffett’s career has taken about two years to get back to even, and a few have taken more than four years. But since today’s 35-year-olds graduated from college, no bounceback has taken longer than six months. The tech-heavy Nasdaq 100 Index has had a positive return every year since 2008. [2]

It’s impossible to say how long a downturn will last, and things can certainly get worse from here, but if you are sitting in cash, keep the money illusion in mind. It may encourage you to explore your own investing style. And remember, volatility creates opportunity.

[1] Henry Hazlitt | Economics in One Lesson | p. 26

[2] Jack Hough | “Don’t Panic. It’s Time to Be Bold and Buy Stocks.” | Barron’s | 5/13/2022

Note: As an Amazon Associate I earn from qualifying purchases. For a collection of investing-related books, click here to view the ASM Amazon Storefront.