Insights

The Stock Purchase Agreement

A stock purchase agreement is the primary transaction document for a stock acquisition. The purpose of the stock purchase agreement is to confirm the price paid for the securities sought, to control risk to the degree possible and to provide a roadmap for the hold period.

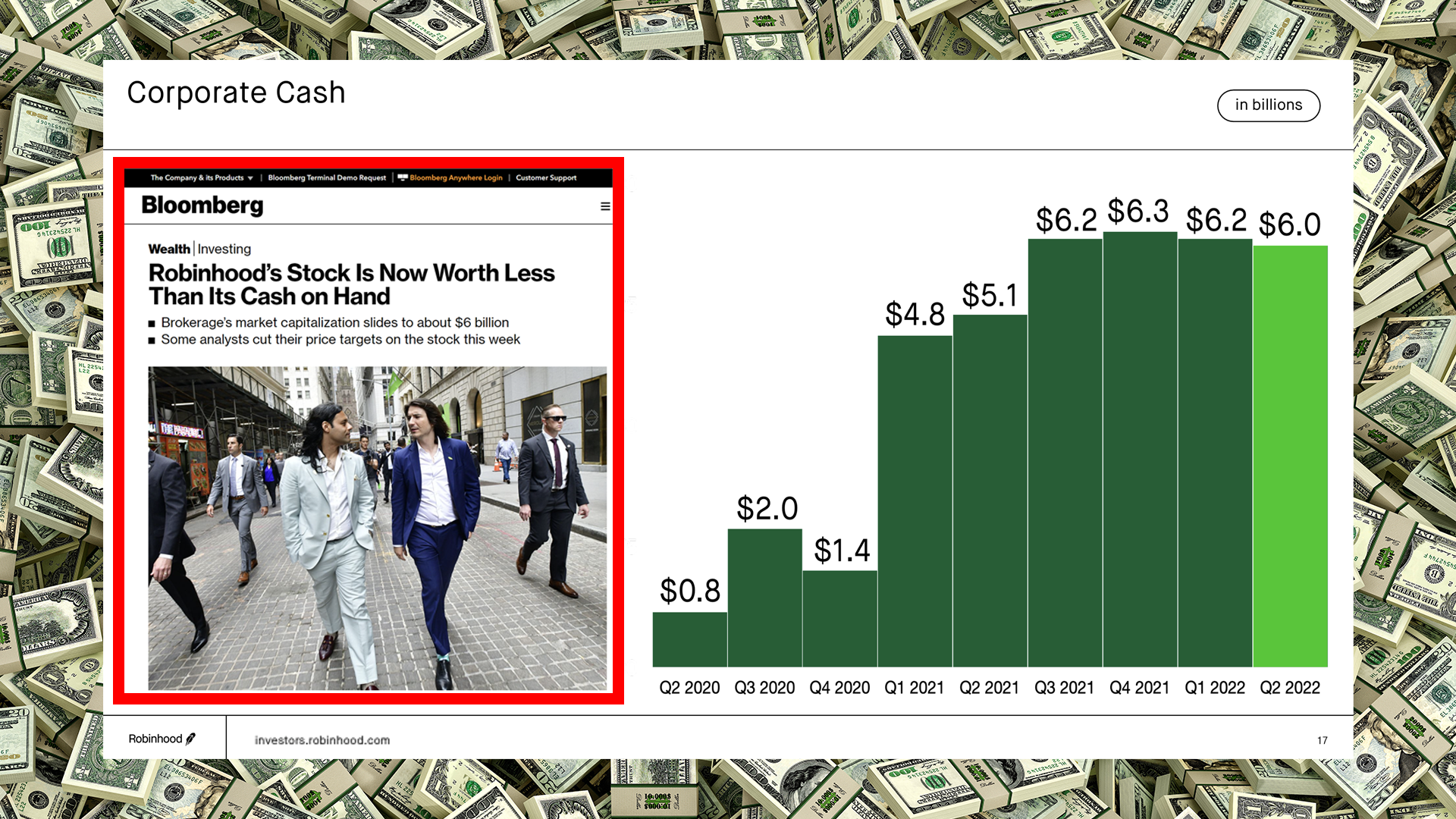

Why Not Buy Robinhood Stock?

Why not buy Robinhood stock? Why not buy any stock when the company is trading close to the value of the cash it has on the balance sheet?

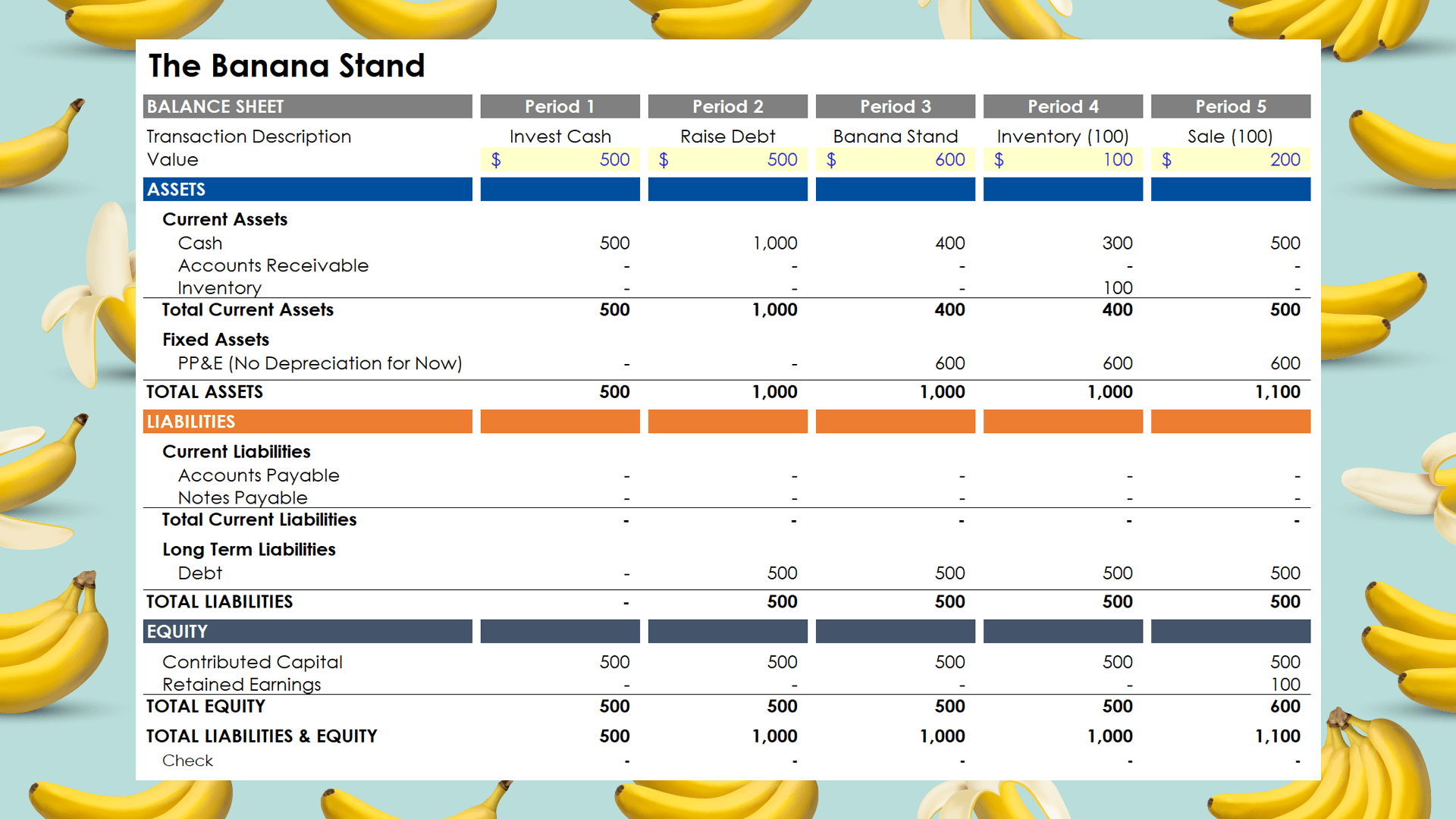

Building a Balance Sheet for a Startup

Exercises can help provide context for abstract concepts. In this post and the associated YouTube Short we are going to explore the balance sheet by walking through a simple example for a startup. More precisely, we will be launching a banana stand business (because “there’s always money in the banana stand”).

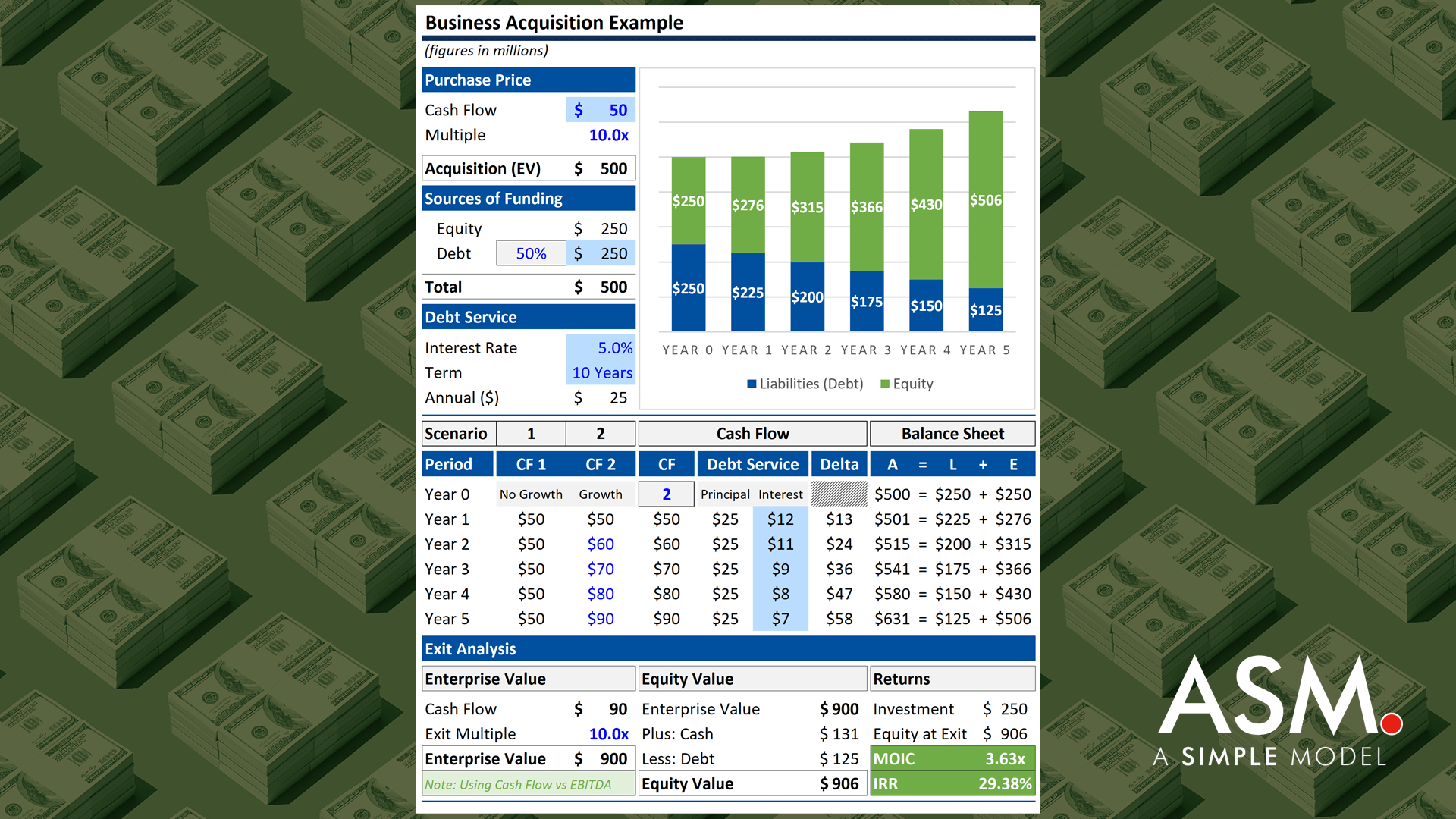

Value Drivers in an LBO Model

In this post we will use a simple example to highlight the primary value drivers in an LBO model.

Carried Interest for a $500M Private Equity Fund

How much carried interest would private equity fund managers earn on a $500 million dollar fund that triples in value? In this post we will walk through a basic distribution waterfall to explain how this calculation works.