Exercises can help provide context for abstract concepts. In this post and the associated YouTube Short we are going to explore the balance sheet by walking through a simple example for a startup. More precisely, we will be launching a banana stand business (because “there’s always money in the banana stand”).

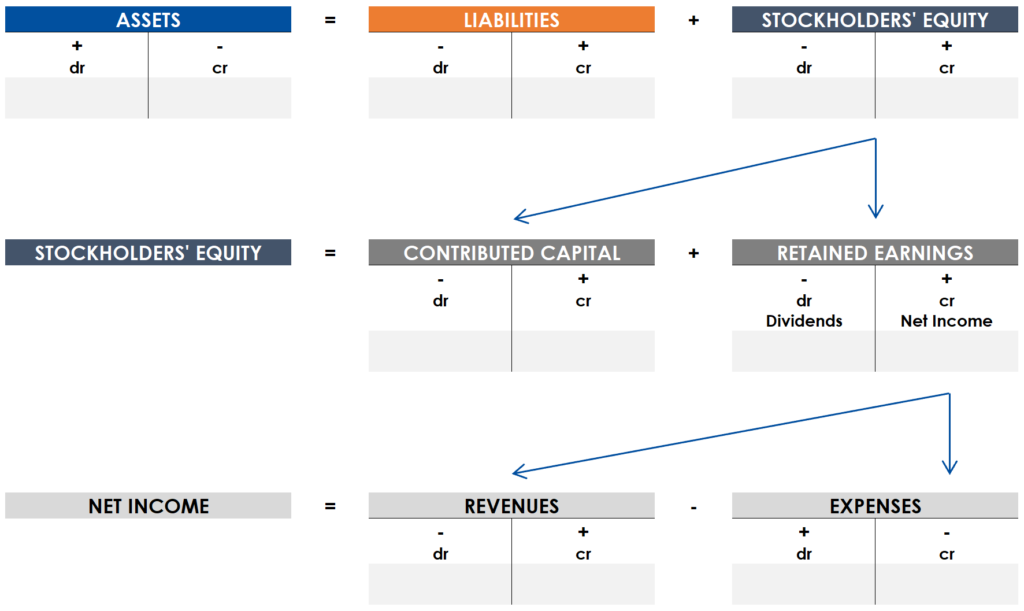

In the sequence that follows, we will start by raising the funds required to purchase a banana stand, equipment and inventory (Periods 1 – 3), and conclude with the company’s first profitable sale of chocolate bananas (Periods 4 and 5). As we work through each step, keep the accounting equation in mind (image at the bottom of this post) and notice how the balance sheet remains balanced as we progress through the sequence.

Period 1: You invest cash in the company. Cash and contributed capital both increase by the same amount.

Period 2: The company raises debt. Cash and debt both increase by the same amount.

Period 3: The company purchases a banana stand and equipment. Cash is reduced by the amount of the purchase and PP&E increases by the amount of the purchase.

Period 4: The company purchases enough inventory for 100 chocolate bananas. Cash is reduced by the amount of inventory purchased and inventory grows by the same amount.

Period 5: The company sells 100 chocolate bananas at a 50% profit. Cash increases by the amount of the sale, and because the inventory (chocolate bananas) have been sold, inventory is reduced to zero. The difference between the sale and cost of inventory (i.e., the profit made on the sale) is recorded under retained earnings.

Accounting Equation Image