In this post we will use a simple example to highlight the primary value drivers in an LBO model. Before we explore the value drivers themselves, we will walk through an LBO model stripped down to its simplest components. This should facilitate an understanding of the mechanics behind the template we will use. Download Template: Simple LBO Mechanics_Value Drivers Template

Building the Simple LBO Template: The first example builds the template using a $100M transaction as context. This template excludes interest expense to keep the math simple, but the second video example updates the template to include interest expense and more clearly defines the value drivers.

Primary Value Drivers in an LBO Model: In this video we update the template for interest expense, and then walk through each of the value drivers. I received A LOT of comments about inputs when this video was posted to TikTok, so this video also addresses the significance of inputs (“garbage in garbage out” as they say).

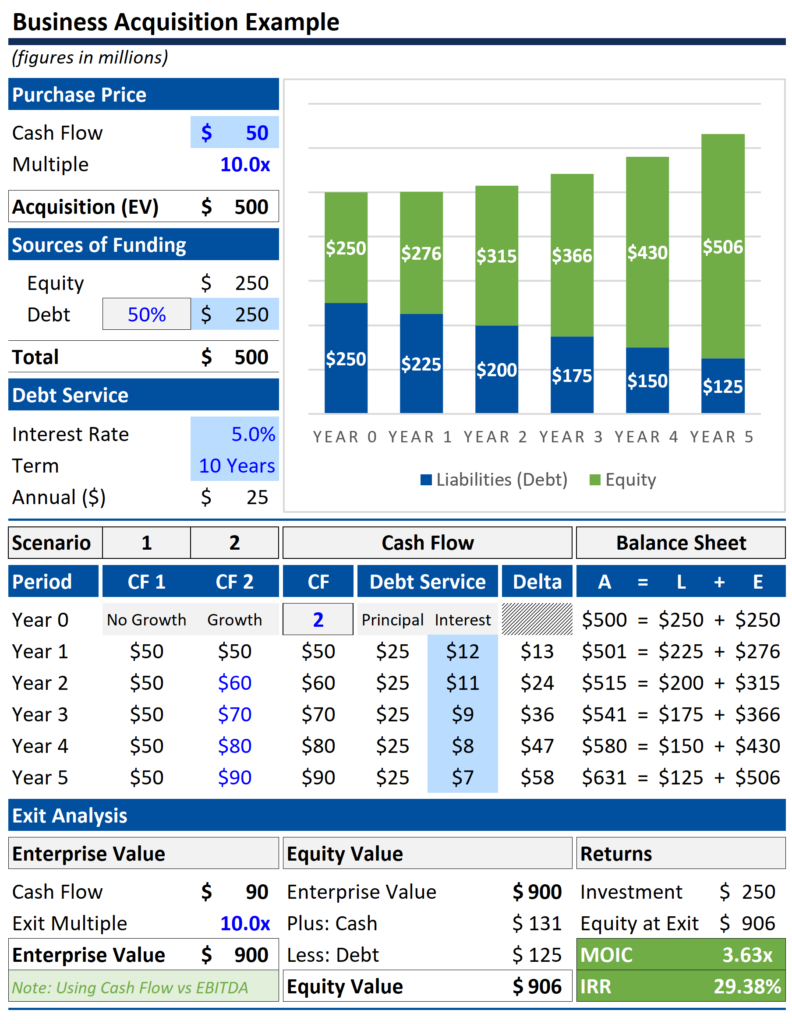

As the video demonstrates, the primary value drivers relate to how the business is acquired (both the entry multiple and capitalization), how the cash flow of the business grows throughout the hold period, and the exit multiple achieved when the business is sold. We have included a little more detail on each of these topics below.

Purchase Price (Entry Multiple):

If you can find a bargain opportunity, it makes success much easier. What you pay for a business is the ultimate advantage if you find an attractive entry multiple. Competition makes this difficult, but occasionally a buyer finds an overlooked asset.

Capital Structure:

Private equity firms acquire companies with a combination of debt and equity. Return profiles benefit from higher leverage multiples (debt measured as a multiple of EBITDA), but increased leverage also creates risk. A big part of the underwriting process is to confirm that the company acquired can comfortably manage the debt load and associated interest and principal payments. On a live transaction, the private equity firm will create a projection to confirm that the company can comfortably manage debt service payments in a timely fashion (this is a big focus of the LBO model building process).

If you would like to see a more robust example that includes detailed financial statements please see the LBO Case Study available on ASM.

Cash Flow Improvements and Growth:

As the market grows ever more competitive, a private equity firm’s ability to scale a company becomes all the more important. If you can substantially improve operations and efficiency (increase profitability on existing revenue) or scale the company well beyond the growth it was achieving at the time of acquisition, it will substantially improve the return profile of the business. It is also likely that the market will reward the seller with a higher multiple at exit, which further improves returns (more on this topic below).

Exit Multiple:

An increase over the entry multiple at exit is known as multiple arbitrage. Multiple arbitrage generally occurs because the company’s financial performance significantly outperformed what the market thought it was capable of when it was acquired. The logic is simple, if at the time of acquisition a company was growing X% per year and at exit it was achieving annual growth of 2X%, its highly likely that the next buyer will place a higher multiple on the earnings of that business. (Note: A higher exit multiple has such a strong impact on valuation that it is generally frowned upon to include it as an assumption in an LBO model unless the multiple expansion has strong support at close.)

Beyond growth, the market will also reward scale with a higher multiple, which is why a roll up strategy can be attractive. A roll up involves buying a collection of small businesses and combining them in an effort to sell the new combined entity at a significantly higher multiple.

Finally, macro trends can also benefit the exit multiple. Low interest rates, for example, makes it easier for a company to manage debt service (the payment of interest and principal) on higher debt profiles.

Learn more about private equity transactions with ASM’s Private Equity Training course. The Private Equity Training course at ASimpleModel.com was developed by industry professionals. The content below goes beyond the LBO model to explain how private equity professionals source, structure and close transactions.