The working capital adjustment requires that the buyer and seller exchange working capital estimates and calculations. In financial models everything takes place automatically, but in the real world a structured process must be in place. In this article we will explore this sequence. Each of the steps listed below is listed in chronological order.

Establish Target Working Capital

The first step is to establish what is known as “Target Working Capital” or “Estimated Working Capital.” It is common to have the seller deliver an estimate of working capital leading up to the closing to arrive at a better approximation of working capital prior to making the Post-Closing Adjustment. This is delivered in advance of the close, and both the buyer and seller must agree that this sum is the best estimate of working capital on the date of the transaction.

While it is impossible to predict the future, a more accurate estimate will reduce the amount of the post-closing adjustment for net working capital (as we will see below).

Transaction Closes

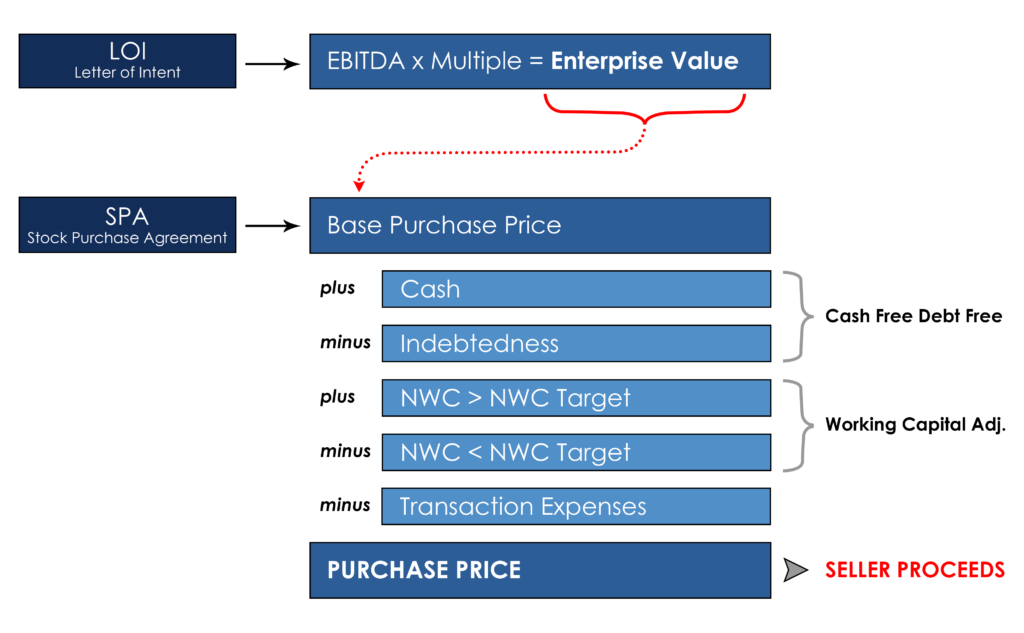

On the closing date of the transaction, the buyer will pay the seller an initial purchase price, which is subject to an adjustment for working capital (note: additional adjustments can be included, but this post will focus solely on the working capital adjustment). The initial purchase price will include an estimate for working capital for the closing date (Target Working Capital). The image that follows demonstrates how purchase price is adjusted for the amount by which Target Working Capital (“NWC Target” in the image) is greater than or less than working capital on the date of the transaction (“NWC” in the image).

Delivery of Closing Statement

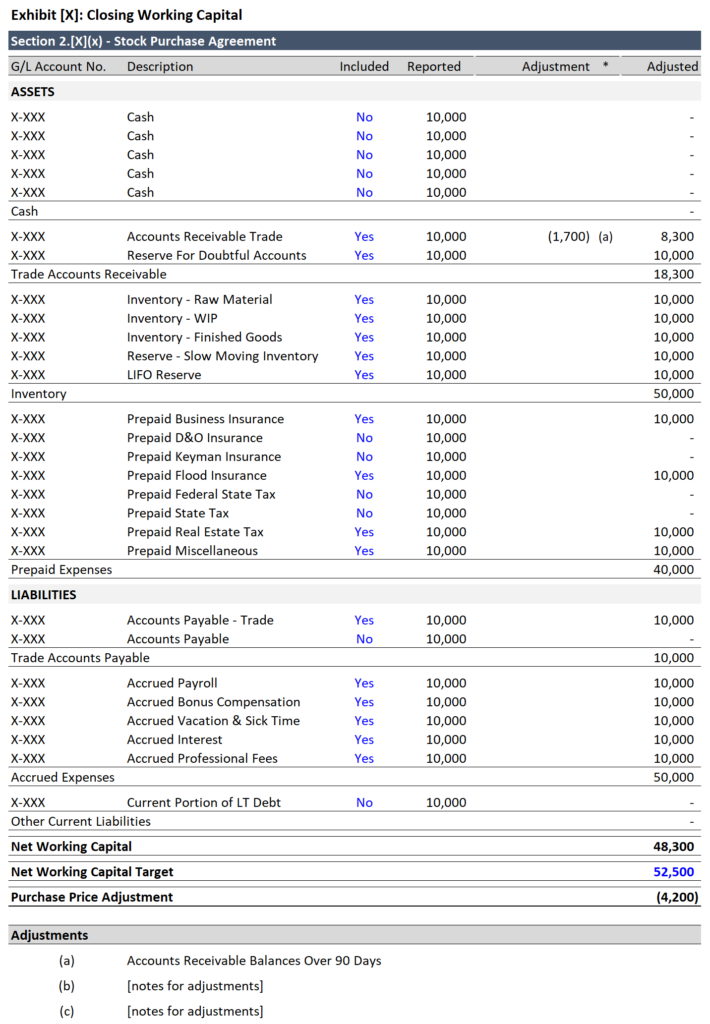

Between 60 and 120 days after the closing date, the buyer will then deliver a statement to the seller with the buyer’s calculation of working capital (Final Working Capital). Per the image below, this is generally delivered with a detailed working capital calculation. The schedule will include all working capital accounts, a column indicating whether or not the account should be included and any adjustments made to each account. It is also common to include the rationale for each adjustment (bottom of the schedule).

Review Period

After receipt of the Closing Statement, the seller shall have approximately 30 (number of days can vary from one agreement to the next) calendar days (the “Review Period”) to review the Closing Statement. If the seller disputes the Closing Statement, the seller shall notify the buyer in writing of their objections in reasonable detail prior to the expiration of the Review Period, together with a description of the basis for, and dollar amount of, the disputed Closing Statement.

Post-Closing Adjustment

Once all parties agree that the calculation is accurate, then an adjustment will be made as follows.

- If the Final Working Capital is greater than the Target Working Capital (Excess Amount), then Buyer shall pay directly to Sellers an amount equal to the Excess Amount, and Buyer and Sellers shall promptly deliver a joint written instruction letter to the Escrow Agent to release all funds in the Working Capital Escrow Account to Sellers.

- If the Final Working Capital is less than the Target Working Capital (Shortfall Amount), then Buyer and Sellers shall deliver a joint written instruction letter to the Escrow Agent to release an amount equal to the Shortfall Amount from the Working Capital Escrow Account to Buyer.

This final step concludes the process. If the calculation is correct, this mechanism in the stock purchase agreement helps make both parties whole for the amount of working capital carried by the business on the date of the transaction.

Related Videos: