To better understand how the working capital adjustment works in a control private equity transaction, we first need to distinguish between the accounting definition of working capital and the definition of working capital for the purposes of a transaction. An accounting definition follows:

Working capital, also known as net working capital (NWC), is the difference between a company’s current assets, such as cash, accounts receivable (customers’ unpaid bills) and inventories of raw materials and finished goods, and its current liabilities, such as accounts payable. [1]

In a transaction, the working capital adjustment revolves around a calculation of working capital that both parties must agree to. The primary differences are summarized in the bullets that follow and addressed in greater detail below.

- Cash is Excluded: Whereas the accounting definition includes all working capital accounts, here cash accounts are excluded from the working capital calculation.

- Not all Accounts are Included: Both the seller and buyer will need to agree on which current accounts should be included for the purposes of the working capital calculation. It should not be assumed that all current assets and current liabilities will be included.

- Certain Balances Can be Excluded: Beyond the decision to include any individual line items, the buyer and seller may agree to include or exclude only a certain amount of any particular account. We will elaborate on this later.

- Working Capital Must be “Normalized:” Finally, the seller and buyer will need to agree to a “normalized level of working capital.” A common example would be to take the average last twelve months of each working capital account included in the calculation.

Cash is Excluded: Most control equity transactions are structured on a cash free, debt free basis. This means that the Seller is entitled to the cash on the balance sheet, and that the Seller is responsible for debts owed by the company. This is also why certain debt balances are listed as accounts that are not included. (For more detail please see the course titled Cash Free Debt Free Transactions, which is part of the Letter of Intent course).

Not all Accounts are Included: As it relates to what is not included, the buyer and seller can agree to anything both parties find fair. That said, a list of common examples follows:

- Accrued Tax Liabilities (Tax is handled separately in the purchase agreement.)

- Accounts Related to Ongoing Litigation Cost

- Lines of Credit

- Notes Payable

- Current Portion of LT Debt

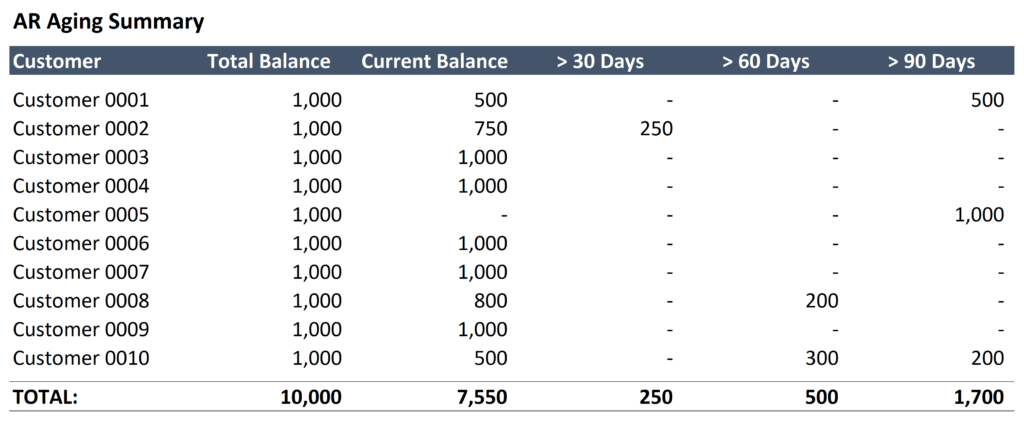

Certain Balances Can be Excluded: The most common examples of excluded balances relate to accounts receivable, accounts payable and inventory. For accounts receivable and accounts payable, this generally relates to extended accounts. More precisely, a buyer may want to omit all accounts receivable balances aged 90 days or more to avoid the risk that those customers do not end up paying (see image below). Common examples follow:

- Obsolete Inventory

- Accounts Receivable Balances Over XX Days (90 Days is Common)

- Accounts Payable Balances Considered an Obligation of the Seller

By way of example and per the image below, if the buyer and seller agreed to exclude AR balances over 90 days, the working capital calculation would include a value of $8.3 million ($10 million – $1.7 million) for accounts receivable.

Working Capital Must be “Normalized:” How you work towards a normalized level of working capital will vary from one transaction to the next, but the variables that most frequently influence this calculation are the company’s rate of growth and exposure to seasonality. The process required to normalize working capital will be addressed in a future post.

[1] Source: Investopedia (https://www.investopedia.com/terms/w/workingcapital.asp)