Insights

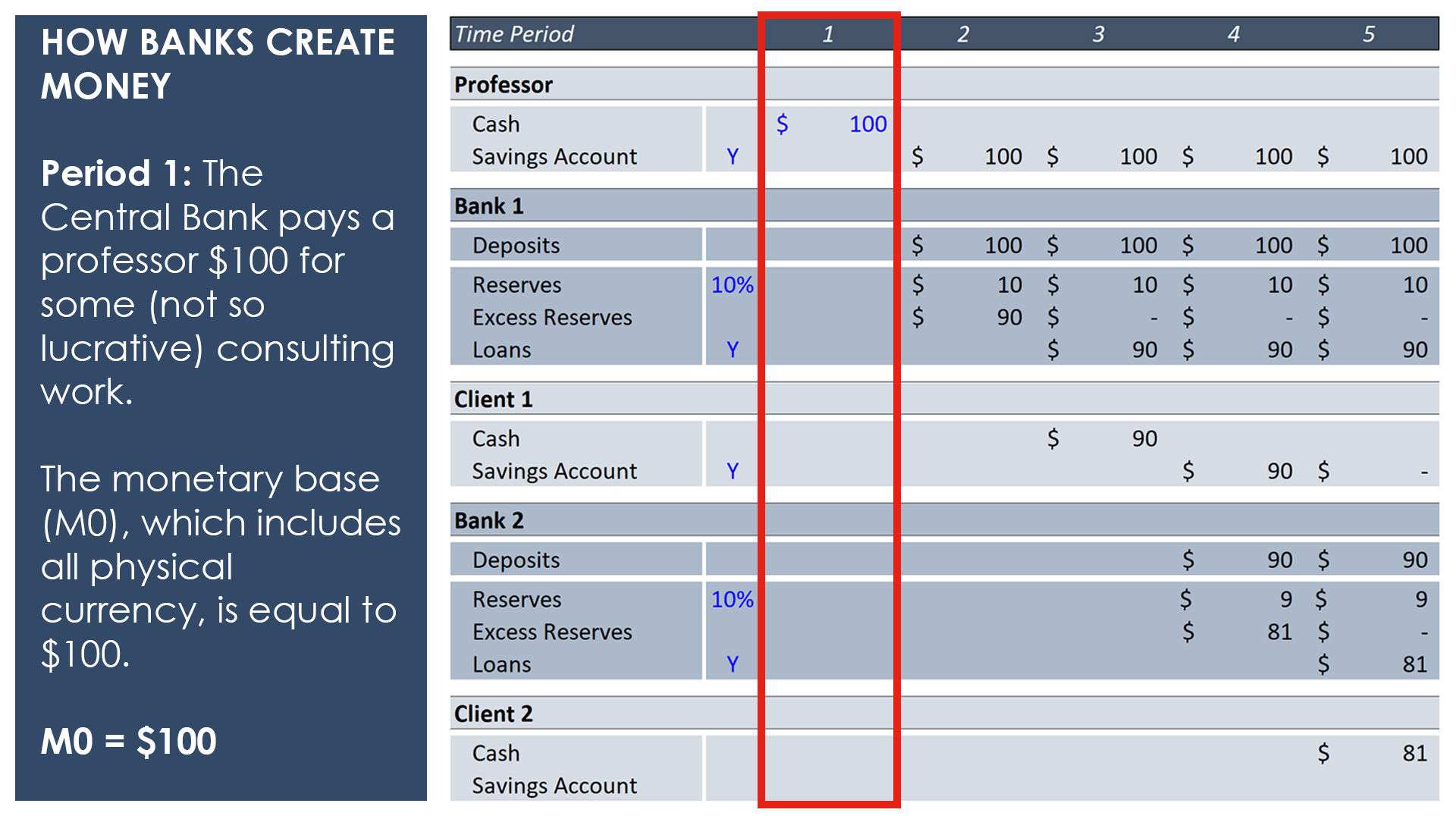

How Do Banks Create Money?

With Silicon Valley Bank having collapsed, I thought it would be a good time to discuss the money supply, how banks create money, and the danger of a bank run. We will use a simple example to demonstrate the dynamic, then apply it to the demise of Silicon Valley Bank.

Breaking into Private Equity with a Nontraditional Background

How do you break into private equity with a nontraditional background (e.g., without any investment banking experience)? I get this question a lot via email. This post focuses on the three things I tell people to focus on as part of the process.

Become a Financial Modeling Expert

Starting out as a novice, the challenge in becoming an expert in any field is knowing what will be relevant to your career. As it relates to financial modeling, this challenge is amplified by the scope of all that falls under “finance.” As any field grows the talented practitioners become increasingly specialized.

How to Learn

If you are looking to build a new skill set or become excellent in any field, I would encourage you to read this article. I spent a few years reading about the science of learning, and my only regret is that I did not have this information sooner.

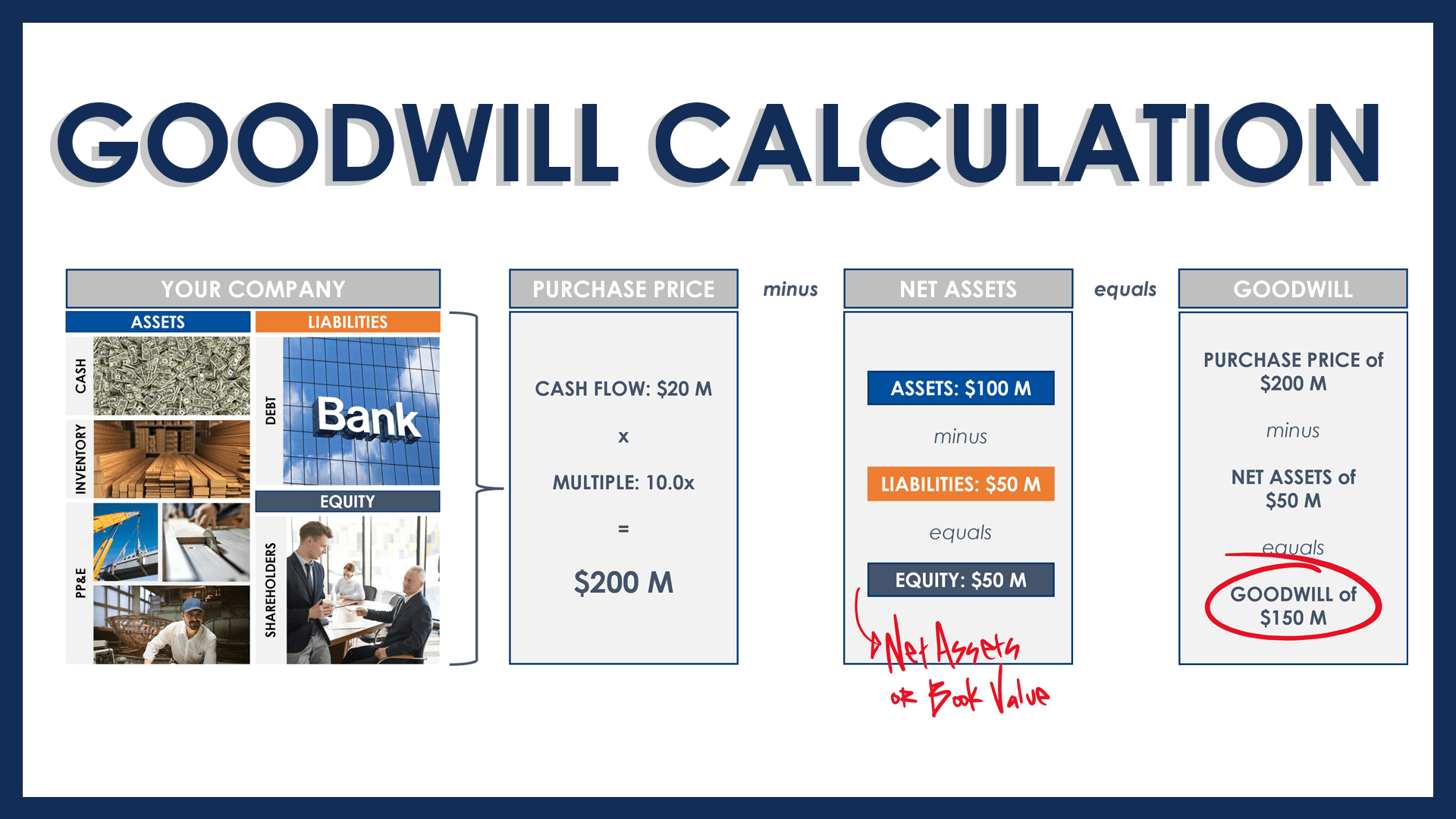

What is Goodwill (Accounting)?

Goodwill is an intangible asset that is created in a business combination. When one company acquires another company, the value in excess of the target company’s net assets is recorded as goodwill. We’re going to dive in on this vocab word because ASM is heavily focused on transactions, which makes understanding goodwill important.