Insights

Become a Financial Modeling Expert

Starting out as a novice, the challenge in becoming an expert in any field is knowing what will be relevant to your career. As it relates to financial modeling, this challenge is amplified by the scope of all that falls under “finance.” As any field grows the talented practitioners become increasingly specialized.

How to Learn

If you are looking to build a new skill set or become excellent in any field, I would encourage you to read this article. I spent a few years reading about the science of learning, and my only regret is that I did not have this information sooner.

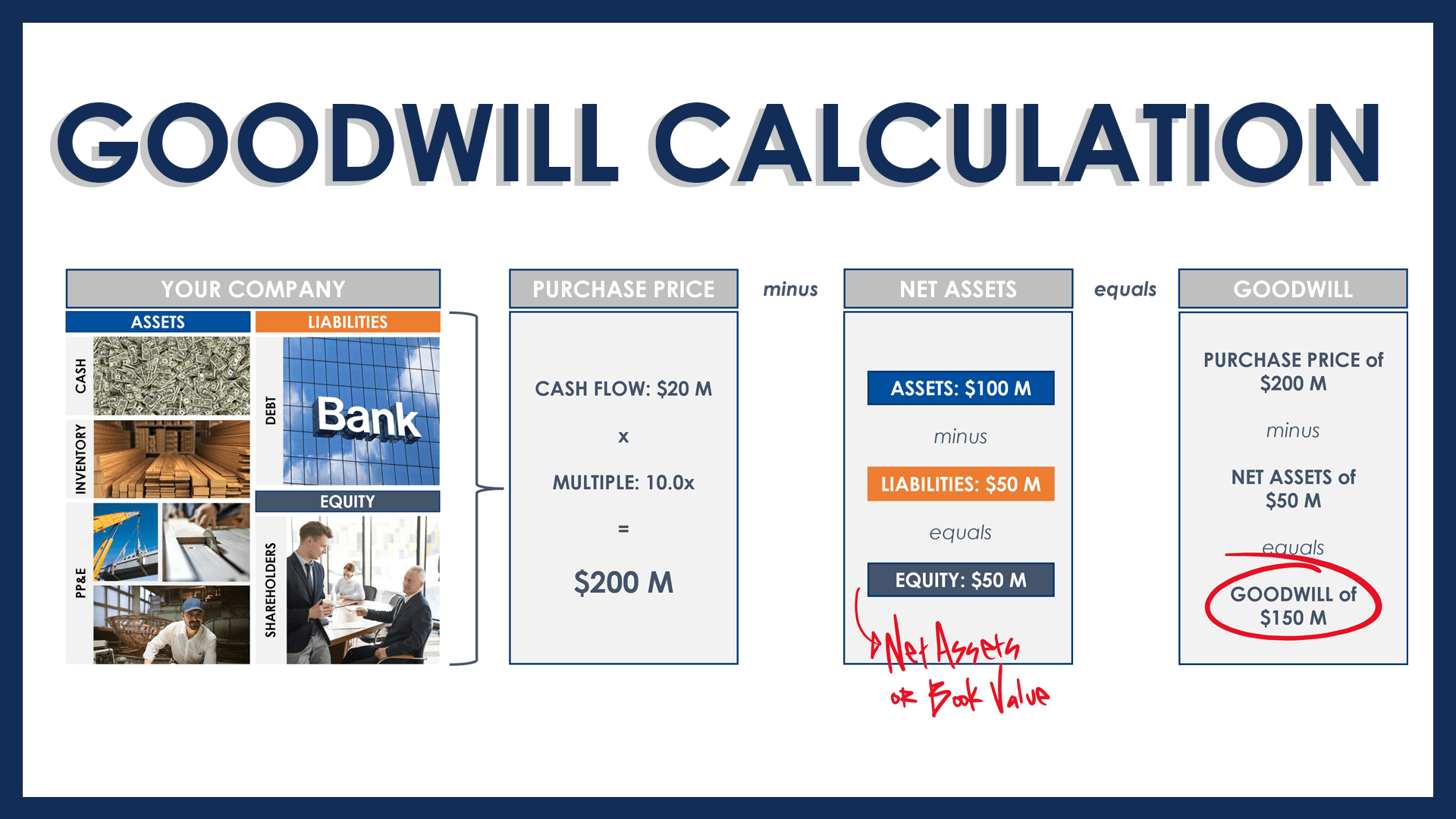

What is Goodwill (Accounting)?

Goodwill is an intangible asset that is created in a business combination. When one company acquires another company, the value in excess of the target company’s net assets is recorded as goodwill. We’re going to dive in on this vocab word because ASM is heavily focused on transactions, which makes understanding goodwill important.

Private Equity: Adding Value at Scale

How private equity firm Vista Equity Partners and founder Robert Smith add value to the firm’s portfolio at a massive scale.

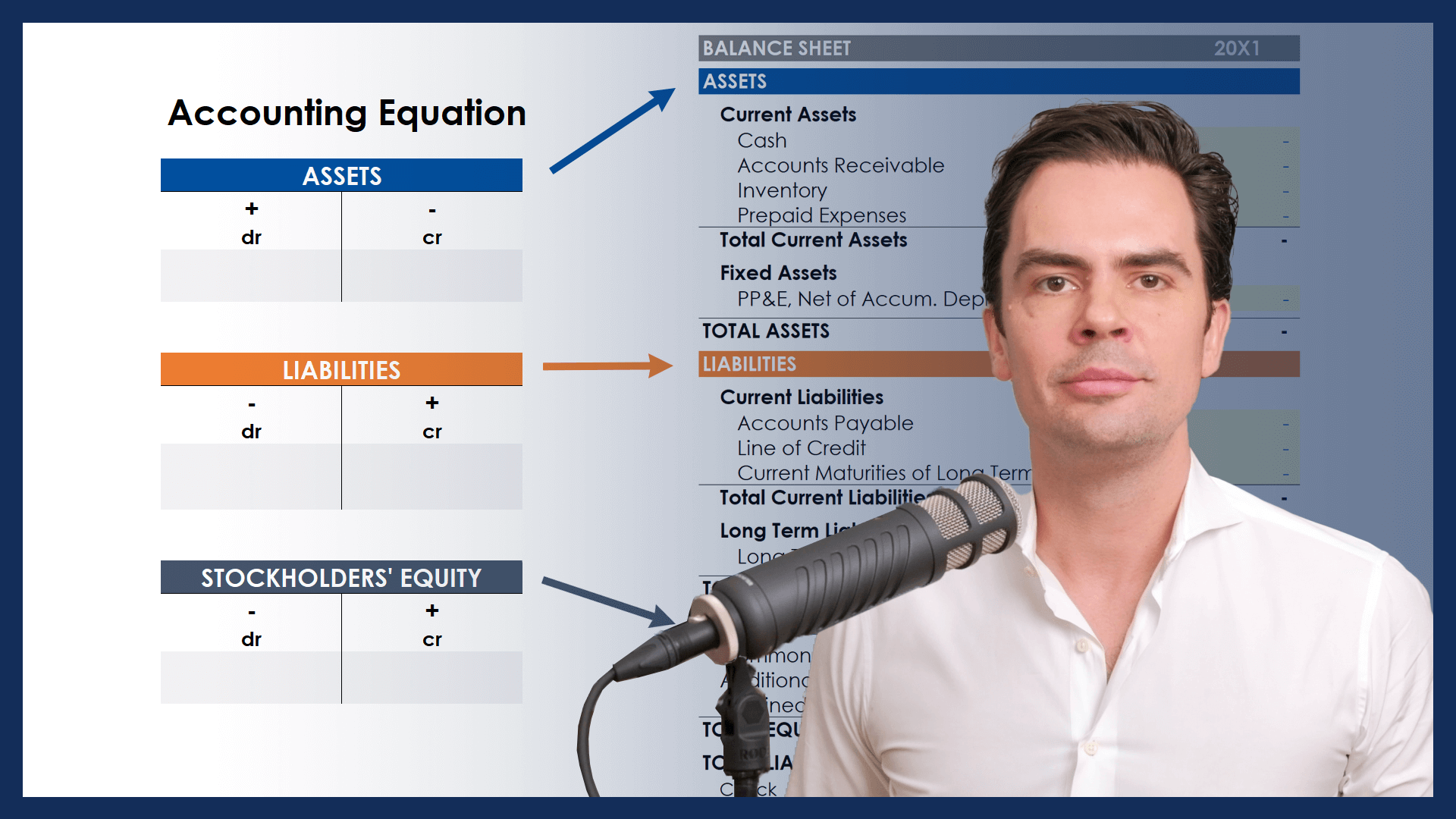

The Accounting Equation

The accounting equation is the first concept you need to master to understand how cash is created and consumed by a business.