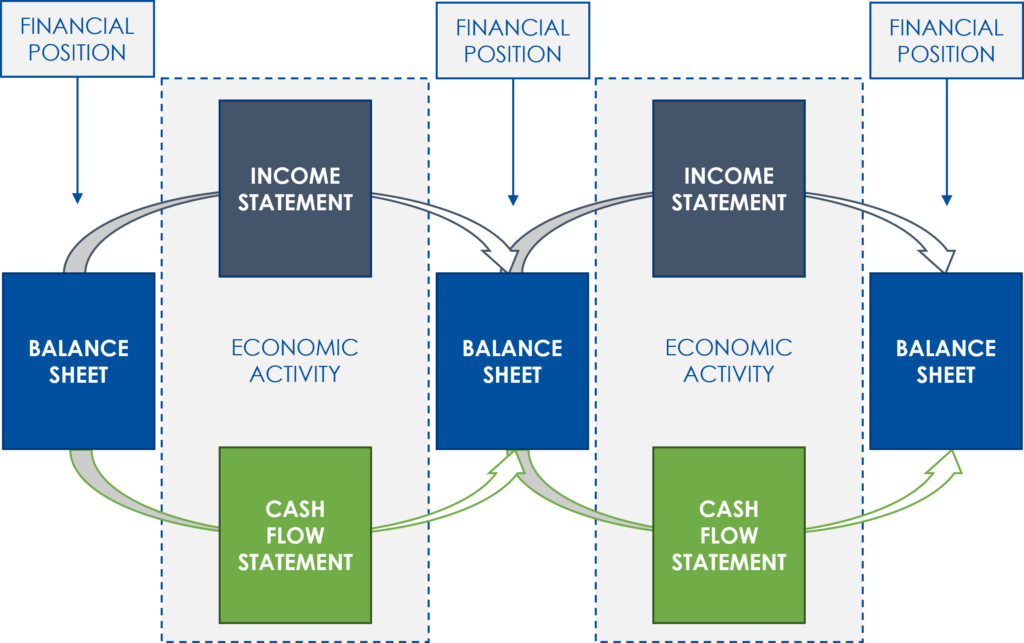

The beautiful thing about accounting and the three-statement models it helps inform is that they create a closed system. What affects the income statement also affects the balance sheet, and any change on the balance sheet must be captured by the cash flow statement. If you understand these relationships, then you will also know how cash moves through a business. Ultimately, and certainly as an investor, that is the goal.

PDF notes available in draft format for a limited time: The Accounting Equation_DRAFT_20221012

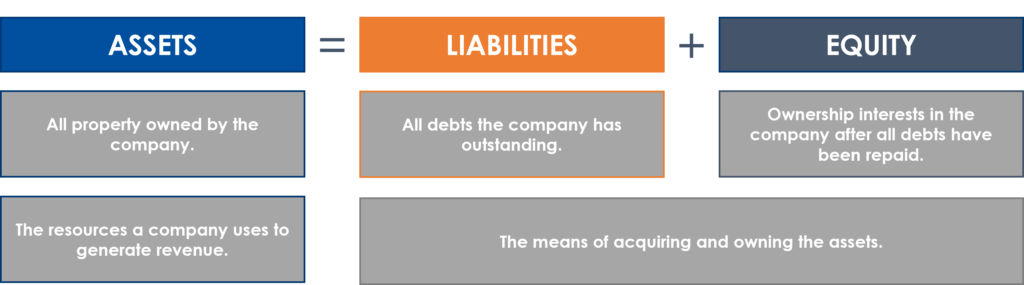

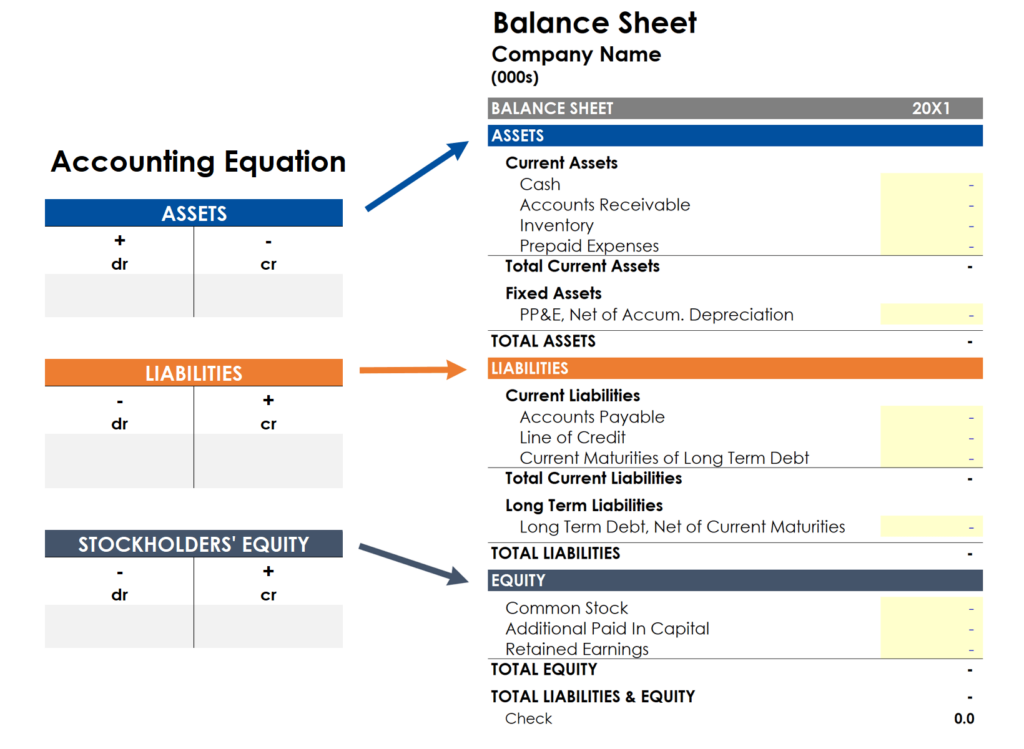

The accounting equation is the first concept you need to master to build on this skill set. Per the image below, the accounting equation states that the value of a company’s assets is equal to the sum of the company’s liabilities and equity.

More precisely, a company uses assets to generate revenue; this is everything that the company owns. Liabilities and equity represent the means of acquiring and owning the assets. So, on the left-hand side of the equation (assets) you have everything the business owns and on the right-hand side of the equation you have everything the company owes.

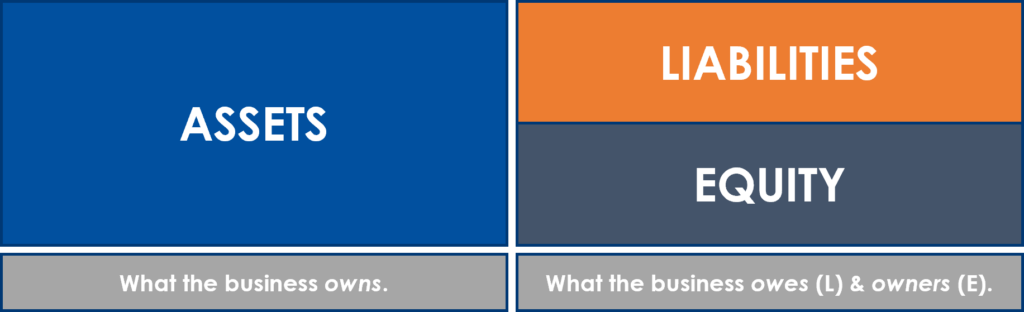

I find visuals help with abstract concepts, and in that regard repositioning the colored rectangles such that the “Assets” rectangle is the size of both the “Liabilities” and “Equity” rectangles can help visual learners with the relationship between all three.

Double-Entry Bookkeeping System

Most companies maintain the accounting equation using a double-entry bookkeeping system to record financial data. Under this system, a change in one account must be matched in another account. These changes are made by debits and credits and for every entry, the sum of debits must equal the sum of credits.

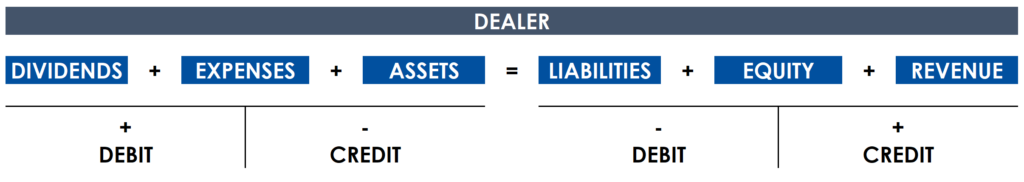

It’s important to note that here, debit and credit are not defined by their everyday usage. Here debit means left, and credit means right. Whether or not a debit or credit increases an account is indicated by these signs visible in the image below.

As you will see, on the left-hand side of the equation a debit increases an account, and on the right-hand side of the equation, a credit increases an account.

Let’s walk through a quick example where a company intends to raise $5 million by issuing debt. To record that transaction, you would credit liabilities in the amount of $5 million. This reflects the assumption of debt on the balance sheet. You would then debit assets by $5 million to reflect an increase in cash on the balance sheet (more on the balance sheet momentarily).

The Expanded Accounting Equation

This equation can be expanded to show that stockholders’ equity is equal to contributed capital plus retained earnings, and that net income is equal to revenues less expenses.

The image above can make the memorization of debit and credits intimidating. If you are ever having trouble remembering how debits and credits impact accounts, use the DEALER acronym to answer the question (see image below).

Everything on the left-hand side of the equation increases when debited and decreases when credited, and everything on the right-hand side of the equation decreases when debited and increases when credited.

Author’s Note: I had a hand-drawn image of the accounting equation (the version with debits and credits included) pinned to my cubicle for the entire time that I was an investment banking analyst. It helped me substantially on technical calls and as I thought through the three-statement model framework.

The Balance Sheet and the Accounting Equation

The balance sheet is a formal presentation of the accounting equation. Consider the image below. The three primary components of the balance sheet are assets, liabilities, and stockholders’ equity.

If you understand all of the above, then you are well on your way to understanding the three-statement model framework. In a future post we will explore the balance sheet in greater detail, and with that foundation in place we can move on to the income statement and cash flow statement. Ultimately the goal is to develop a mental model that allows you to understand how any transaction will impact each of the three financial statements.