Goodwill is an intangible asset that is created in a business combination. When one company acquires another company, the value in excess of the target company’s net assets is recorded as goodwill. We’re going to dive in on this vocab word because ASM is heavily focused on transactions, which makes understanding goodwill important.

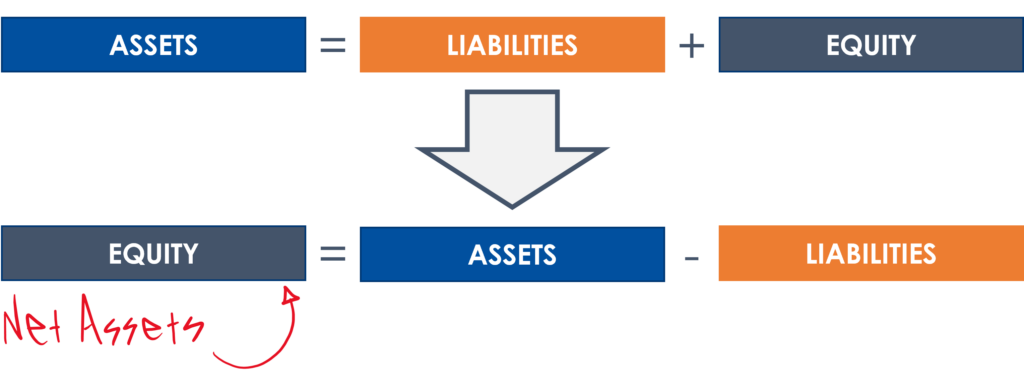

It follows that to better understand this accounting concept, we need to understand the definition of net assets, which is simply the value of a company’s assets minus its liabilities. This is also known as a company’s book value. If we rearrange the accounting equation (assets = liabilities + shareholders’ equity), you will notice that the value of a company’s assets minus the value of its liabilities is also equal to shareholders’ equity.

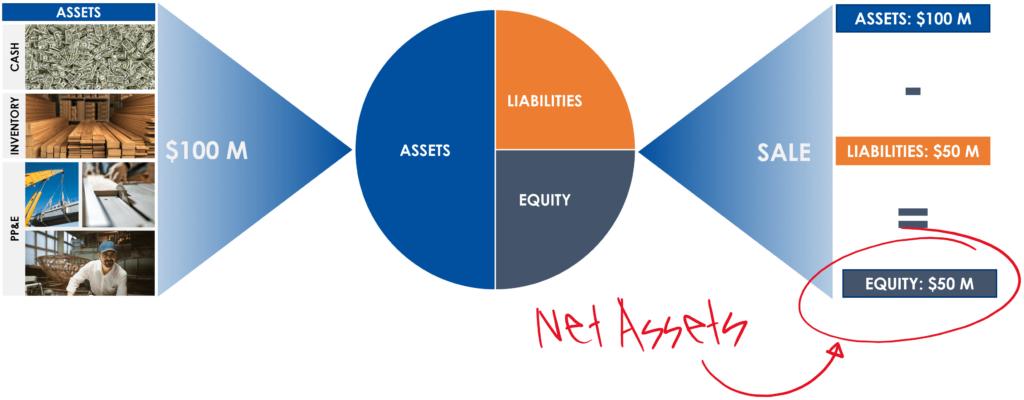

Goodwill is defined as the “value in excess of the target company’s net assets,” but I think it helps to first visualize a transaction where no goodwill is recorded. So, imagine selling a company’s assets. In other words, imagine liquidating a company.

We are going to assume that you own a manufacturing business with $100 million in assets. In theory, you, as the sole shareholder, would receive the value of the assets sold minus the value of the company’s liabilities. With assets of $100 million dollars and liabilities of $50 million dollars, that leaves you with $50 million per the image below. In this scenario, we don’t record any goodwill because we did not exceed the value of the company’s net assets.

But why would you liquidate a company if it’s generating a bunch of cash? Let’s assume that your manufacturing business prints cash to the tune of $20 million per year (glorious), and let’s further assume that you receive an offer to sell your business for 10x cash flow. How is goodwill calculated in this scenario?

In this instance your company, is selling for a 10x multiple of $20 million dollars in cash flow for a purchase price of $200 million. If you subtract net assets of $50 million dollars, then the business acquiring your company will record goodwill in the amount of $150 million dollars.

Another way to think about this is that you sold your business for 4.0x times book value. Which means your business must be doing something clever. It means you have created something more valuable than the assets you use to generate revenue. If it wasn’t true, your competition could easily emulate your success by buying similar assets at a fraction of the purchase price.

Learn more about financial statement analysis with the Introduction to Financial Statements course available at ASM. If you are interested in learning about transactions, please see the Private Equity Training curriculum.