Insights

The Nuts and Bolts of SBA 7(a) Loans

How to secure an SBA loan to buy a small business. An introductory guide to how SBA loans work and how to get one.

Let Uncle Sam Leverage Your LBO: A Quick Guide to SBA Loans

A quick guide to SBA loans for private equity Transactions in the lower middle market. Learn the advantages of SBA financing.

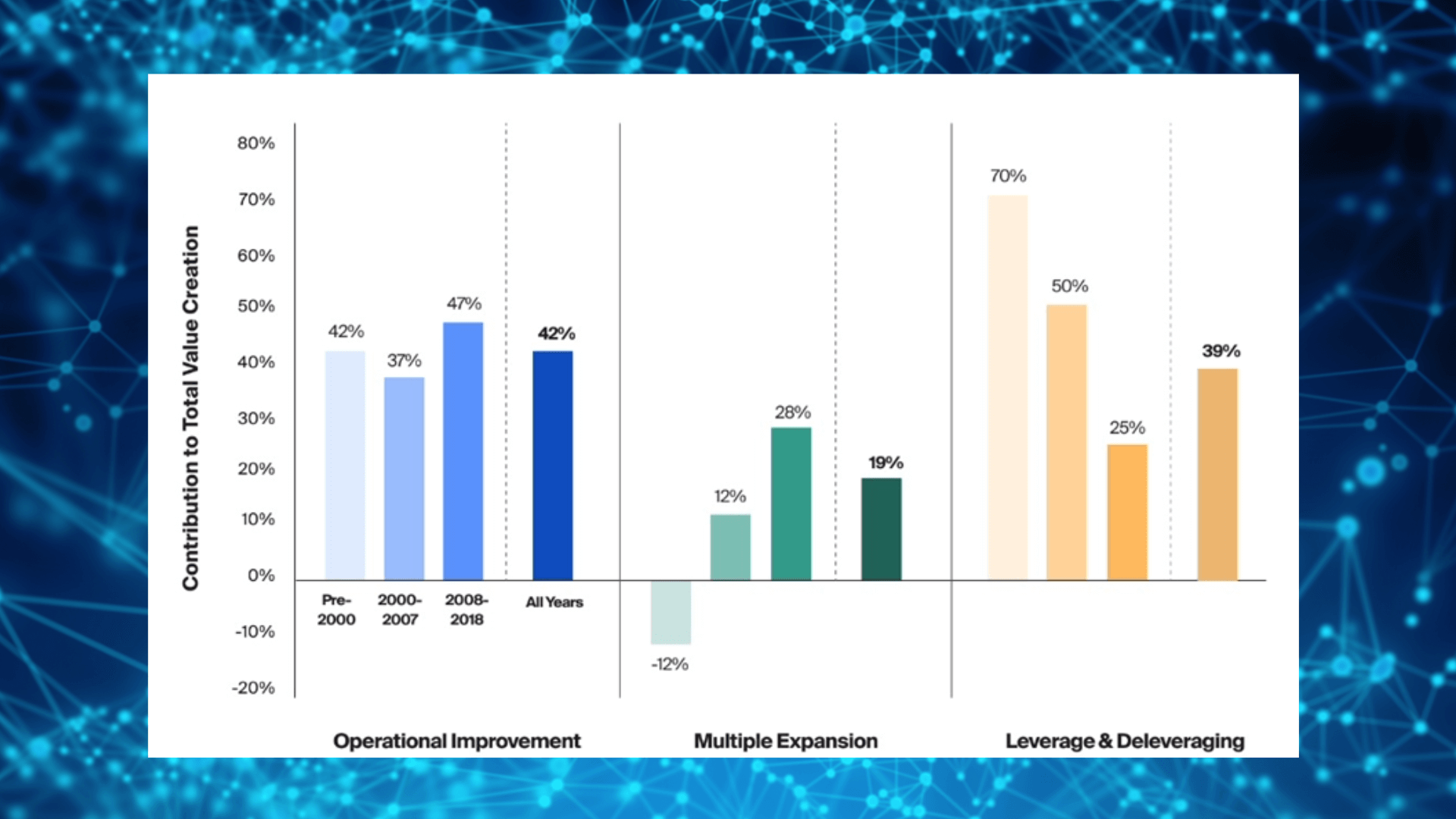

How Private Equity Firms Generate Returns

How private equity firms generate ROI over time. This post explores three primary value drivers in LBOs.

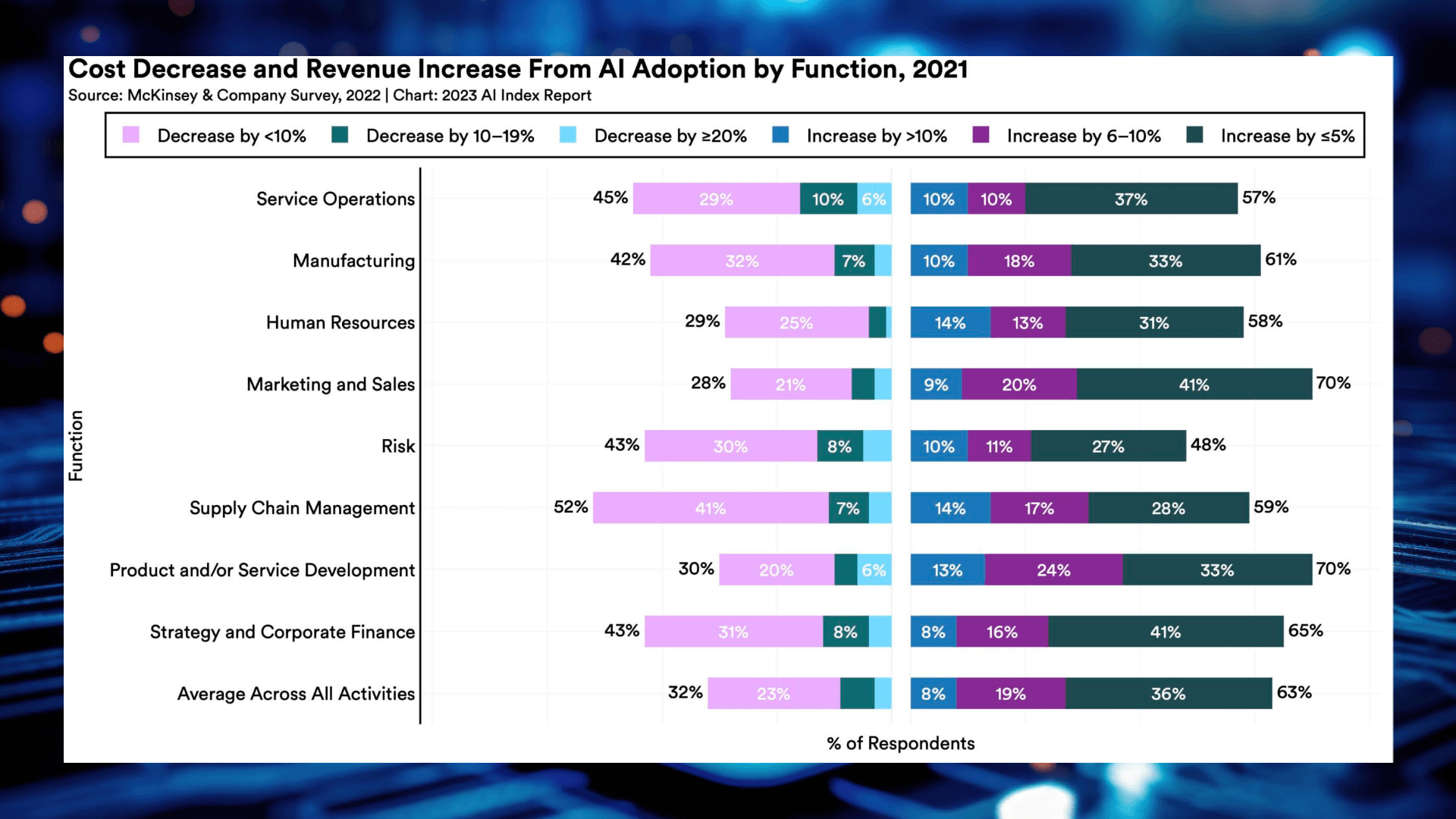

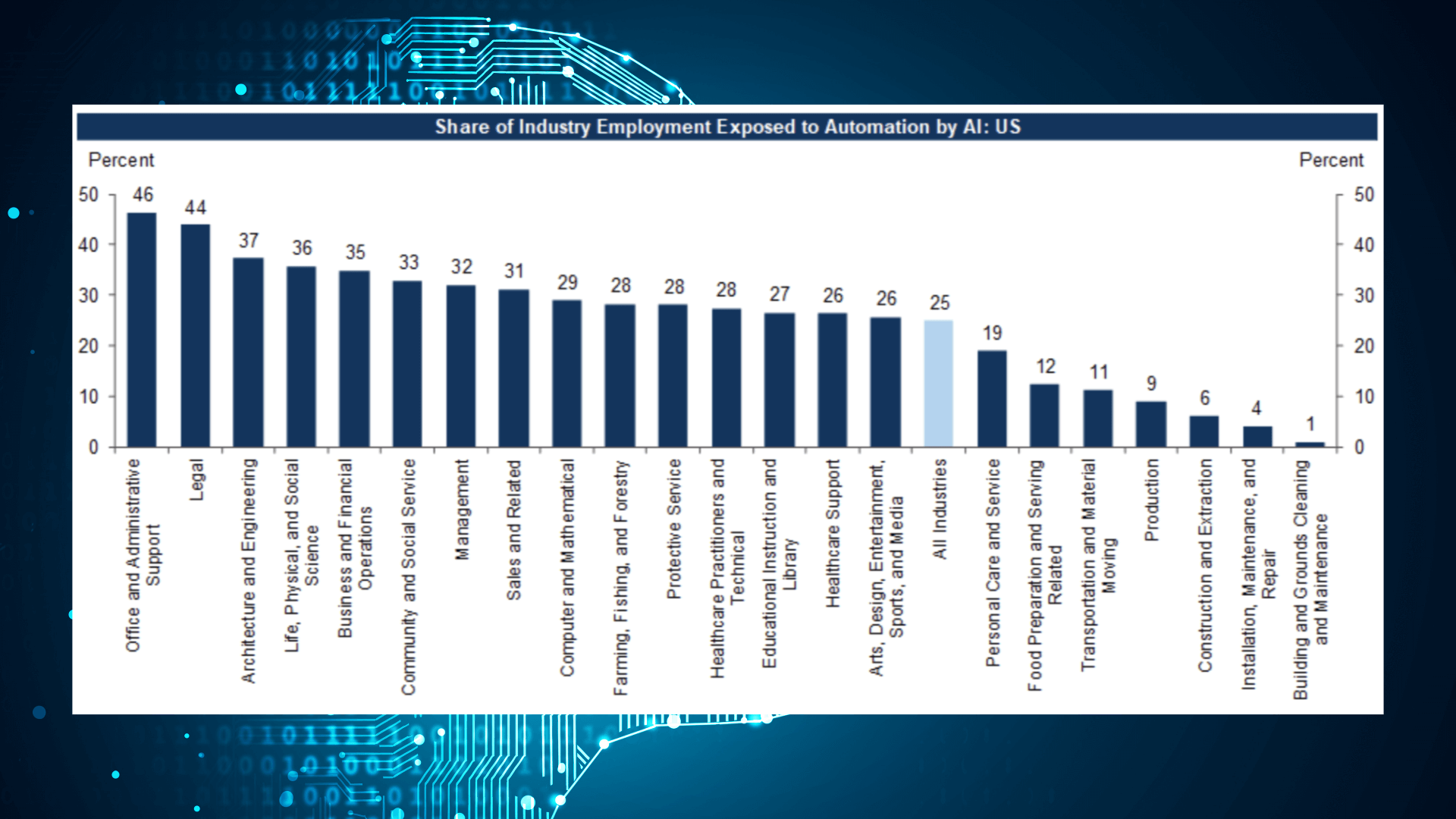

How AI Can Improve the Investing Process

This post will explore how AI will change the day-to-day process of private equity investing. It wraps up a three-part series that began with How to Invest in AI and continued with How AI is Changing Business.

How AI Is Changing Businesses

What artificial intelligence means for private equity portfolio companies. How should private equity firms react to AI?