Insights

Private Equity Search Step-by-Step

The goal of any search is finding a business to buy and run. But as anyone who has actually run a search can tell you, the process is much more marathon than sprint. This post provides a general overview of the day-to-day routine for most private equity searchers.

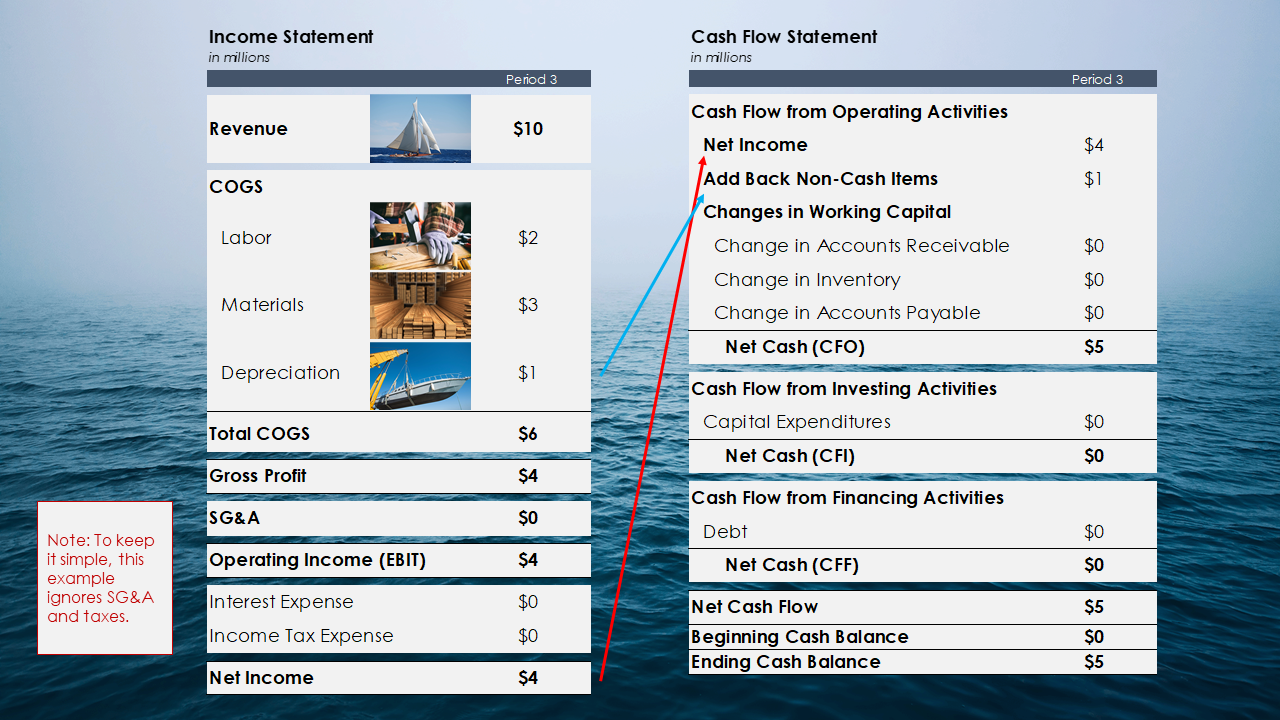

Working Capital and Cash Flow

In this post we are going to explore the relationship between profitability on the income statement and cash generated through sales by taking a closer look at working capital. I think this is one of the most important relationships to understand, because a healthy business should have the capacity to fund some of its working capital needs through profits generated via the sale of its goods and services.

Negotiating Equity in a Private Equity Transaction

Equity compensation is an incredible way to build wealth. This post provides four steps to help you negotiate an equity position without any private equity experience.

Why Is Specialization Taking the Private Equity World by Storm?

The role of specialization in private equity. Research indicates that that PE funds that classify as “niche” achieved an average IRR of 38%, while mainstream PE funds achieved 18%.

Private Equity Stock Options Primer

What do you need to know about private equity stock options agreements? This post provides an introduction to the topic.