Occasionally the Wall Street Journal tests Burton Malkiel’s hypothesis that a chimpanzee picking stocks at random should perform as well as human professionals. The results always generate laughs and some humility for the homo sapiens involved, as the chimp usually holds its own and then some.

But now, we as investors face something a bit more threatening than blindfolded, dart-throwing simians—generative artificial intelligence. How will this new technology disrupt the investing game? Will it relegate humans to the sidelines? Or can we use it to make ourselves more astute, efficient and successful at buying and building businesses?

This post will explore these questions, with a particular focus on how AI will change the day-to-day process of private equity investing. It wraps up a three-part series that began with How to Invest in AI and continued with How AI is Changing Business. Let’s Begin.

AI Offers a Four-Way Path to Improvement

In the public investing world, AI is making a huge splash. Stock portfolios selected and managed by ChatGPT are already being tested, and at least some have beaten benchmarks over limited time periods. Furthermore, academic studies have suggested that ChatGPT may be better than some traditional methods at predicting stock price movements from news headlines (Can ChatGPT Forecast Stock Price Movements? Return Predictability and Large Language Models by Alejandro Lopez-Lira, Yuehua Tang :: SSRN). As “robo-advisors” become increasingly user friendly and conversant, flesh-and-blood retail investment advisors and even large, sophisticated institutional investors in public markets are likely to find their business models disrupted.

But private investment markets are a different matter. In the private investing world, data is less plentiful and not as freely available, and deal flow is more restricted, with brokers and other gatekeepers often limiting the reach of deal processes. However, that doesn’t mean big changes aren’t still on the horizon in private markets. With that in mind, I’ve outlined four critical areas where AI is primed to streamline workflows and make PE firms better able to find and invest in businesses with superior return potential.

1. Target Identification

Private equity is all about moving deals through the sourcing funnel (Private Equity Deal Sourcing Process | A Simple Model), and the first step is identifying deal targets. Data on private firms may not be as plentiful as that on public firms, but it still exists. And generative AI can comb through it with a degree of human-like discernment that we have not seen from automated tools before. A private equity firm can set up criteria based on industry, size, geography, business maturity, management structure, or any other characteristic of interest and very quickly populate a list of potential candidates for acquisition.

And dealmakers are already leveraging this power with great success. After watching his grandfather shutter his real estate business due to lack of a viable succession plan, Shunsaku Sagami developed an AI algorithm that uses private data to identify businesses with owners who are likely to retire soon (Japan’s Aging Population Helps This Young Founder Approach Billionaire Status – Bloomberg). His firm, M&A Research Institute Holdings, connects these businesses with buyers and brokers the deals for a fee. After several years of rapid growth, M&A Research Institute Holdings now has over 160 employees and has catapulted Sagami’s net worth to nearly $1 billion.

This AI-fueled approach could save private equity professionals significant time in identifying investable businesses. We are still nowhere close to the point of putting a bot in charge of funds and telling it to go find and execute deals. Significant human judgment and oversight is still obviously needed to decide whether a given target is worth pursuing and to what degree within the context of a firm’s overall strategy. But AI can be a terrific aid in winnowing down and prioritizing a universe of targets, as well as uncovering targets that might have evaded human dealmakers or non-AI screens. AI can even draft easily customizable outreach materials for communicating with existing owners.

But there is one very important fact to keep in mind when leveraging AI for deal sourcing: as with anything computer-related, the outputs are only as good as the inputs. If the input data an AI algorithm works from is incomplete or inaccurate (as data can be, especially when coming from the Internet), the recommendations the algorithm makes will carry that bias, leading to skewed or incomplete answers. This is something that private equity firms will have to be very careful about as they adopt AI. Human oversight and sanity checks will be critical at every step of the process, from evaluating the algorithm to recommending adjustments.

2. Diligence

Generative AI is the greatest speed-reader ever. It can process millions of web pages almost instantaneously, summarizing key points relevant to the question at hand in highly readable synopses. In terms of private equity diligence, this can be game changing for quickly researching a target firm or industry and summarizing the findings for human review, giving human dealmakers more time to focus on higher-level questions and analysis, rather than data crunching.

AI can even generate financial models. Why devote human resources to at least the most basic parts of intricate spreadsheet model construction when ChatGPT (or a growing number of similar Excel tools) can translate plain English into correct spreadsheet formula syntax? For example, one of the largest banks in Argentina, ICBC Argentina, once did its budgeting and forecasting using over 100 linked spreadsheets. During the process, employees often worked until 2am and on weekends. But after purchasing a planning and analysis tool with AI from IBM, time spent on some processes was cut by one-half or more (Industrial and Commercial Bank of China Argentina (ICBC) case study | IBM). AI algorithms also show significant promise in taking large volumes of historical data and running simulations to help decide which input scenarios are most relevant to help predict the trajectory of a given target or industry.

As more companies follow this path, a natural question is whether there will be any role left for human analysts? Definitely. But some, especially those who love Excel minutia, may have to accept a promotion. Instead of coding formulas and macros, they might find themselves calibrating and validating the computer’s work, interpreting outputs and gaming alternative scenarios. There will also be more time for diligence outside of modeling, such as speaking with management and industry experts on the best assumptions and trends to incorporate into the model. AI today is hardly ready to do full LBOs, and even as algorithms take on a bigger role in the execution of spreadsheet models, a deep understanding of the financial concepts and objectives involved will be more valuable than ever to help humans prompt and evaluate this execution (Financial Modeling Courses | A Simple Model).

3. Portfolio Monitoring

In portfolio monitoring, just as in due diligence, generative AI is like having a world-class analyst and market researcher all in one (not to mention, one who doesn’t need time off!). AI can be incredibly effective at scanning and summarizing quantitative and qualitative industry trends, as well as key performance indicator (KPI) tracking and analysis, all with the aim of enabling better human decision-making. As this becomes more widespread, monitoring is likely to become not only less time-intensive for the people involved, but also more real-time, allowing companies and their investors to make better decisions faster.

These improvements should have a positive impact not only on the day-to-day work of PE investors, but also the employees of the companies they own, since AI can take over some of the (highly necessary) drudgery of KPI tracking and investor reporting. I know firsthand how much time portfolio companies spend gathering and communicating performance data to their PE owners. Cutting down on this time could make the relationship far more seamless and let management spend more time focused on running and improving the business.

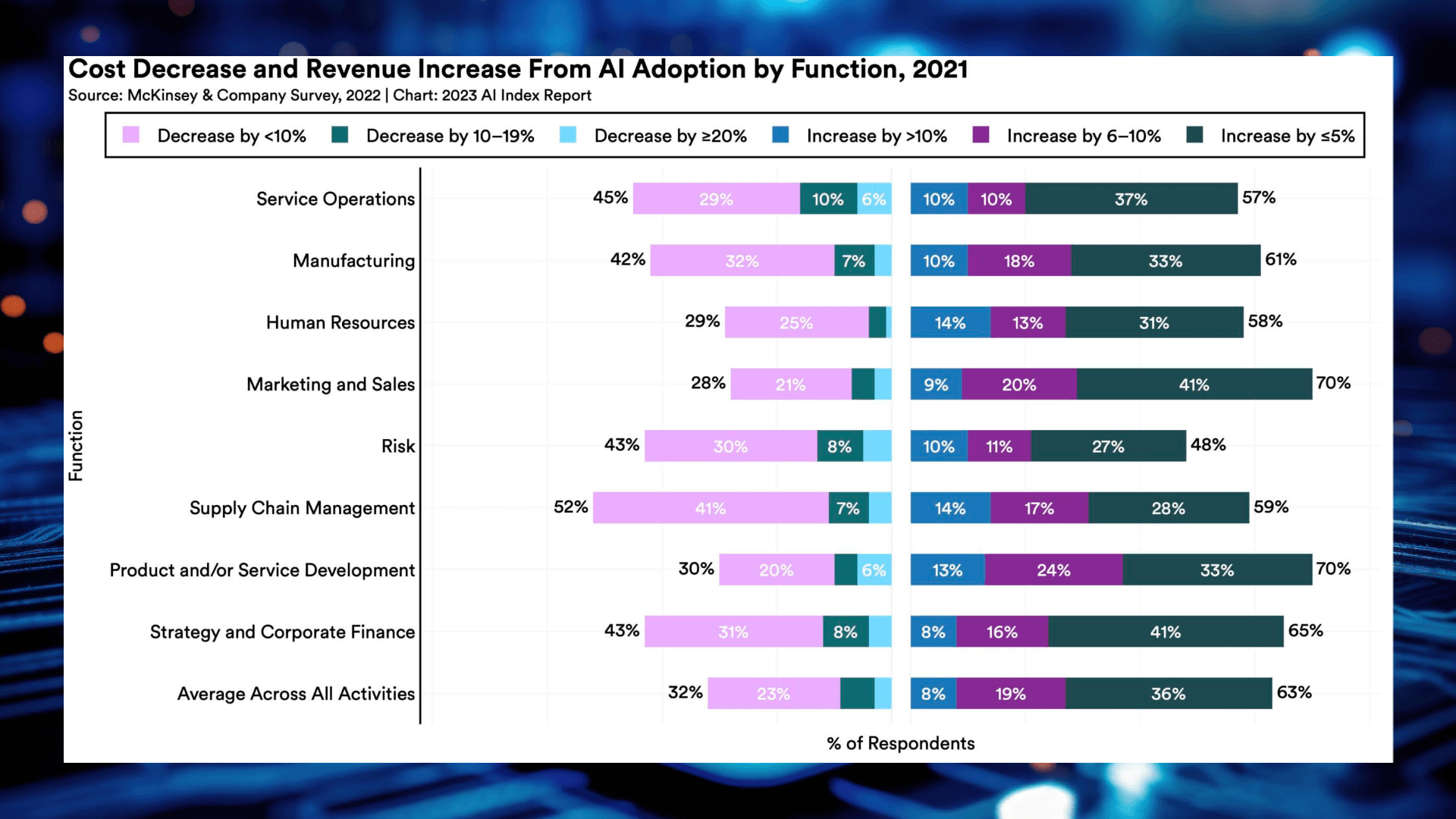

What kind of potential gains are we talking about? Figure 1 below is taken from a global survey of 1,492 businesspeople. It shows both the average revenue gains and cost savings in 2021 due to AI adoption across a variety of business functions. Many of these functions, such as operations, marketing and human resources, should see clear gains from the implementation of AI, as we discussed in the prior post. But in addition, the area of Strategy and Corporate Finance, where much of the work related to portfolio monitoring and interfacing with PE owners typically occurs, saw 65% of AI adopters reporting some level of revenue gain and 43% some level of cost reduction, typically on the order of more than 10%. And that survey is based on results achieved at least a year before the appearance of tools like ChatGPT.

Figure 1. AI is Driving Revenues Up and Costs Down Across the Board

Source: McKinsey & Company (Background Added)

4. Back-Office Processes

Private equity firms require a considerable amount of back-office activity to support the front-office mission of responsibly investing LP capital in deals with the highest return. From human resources to legal to accounting, AI can automate multiple manual, grueling and repetitive tasks to save time and money. Intelligent screening and interviewing of job candidates, drafting of joinders, LOIs and other common legal documents, and automation of ongoing LP and regulatory reporting processes are all well within the capabilities of generative AI, even today.

Private equity firm SignalFire (LINK) has radically improved the efficiency of its back office by using AI to do things such as convert term sheets—informal agreements on the aspects of a deal—into longer, more detailed and legally binding documents. SignalFire even uses AI to help create marketing content micro-targeted to specific audiences. As the technology evolves, the possibilities for this kind of automation will likely be limited only by our imaginations and our willingness to implement it effectively.

Conclusion: AI Works, But Only with Human Involvement

When it comes to generative AI, I’m an optimist. But I’m also a realist. Incorporating AI in the ways outlined above can make the work of both investors and the management teams they partner with more efficient and effective, but the transition will not always be seamless or successful. In the short term, certain types of jobs both at private equity firms and the portfolio companies they oversee will be lost or radically transformed. Proper training and security protocols will be critical to making sure employees across the board are comfortable and proficient at using AI to streamline their daily workflows, while not exposing sensitive data to AI algorithms that may leverage or spread it in unknown ways.

In the first post of this series, I acknowledged the vast spectrum of views on AI’s potential, with some people believing it will bring about a utopia and others predicting the apocalypse. I personally don’t think the eventual outcome will be anywhere close to either extreme. But one of the keys to ensuring it lands closer to the former than the latter (especially for you and your organization) is ongoing, educated human oversight. Warren Buffet cautioned investors to “never invest in a business you cannot understand.” So when it comes to AI, don’t follow trends or rush to implement expensive solutions until you are able to wrap your head completely around what they can and more importantly cannot do. Keep reading, keep learning and keep looking for opportunities to leverage AI in ways that are clear wins, whether in your daily work, the work of your portfolio companies or both.

And if you’re still trying to break into the world of private investing, the good news is that in many ways there could not be a better time (particularly if you leverage some of our past insights on the topic, such as Breaking into Private Equity with a Nontraditional Background | A Simple Model). Quickly and successfully mastering the use of new AI tools will set you apart from other aspiring dealmakers. And suggesting innovative uses for AI can be a great way to start up a conversation or get your foot in the door with existing firms. But remember, no matter the setting, AI tools are just that…tools. At the end of the day, at least for the foreseeable future, key functions of private equity investing like setting mandates, exercising investment judgment and building relationships will remain squarely in non-robotic, human hands.

Have you come across an interesting potential investment related to artificial intelligence or a novel use of the technology in private equity investing or portfolio company management? Reach out to us at info@asimplemodel.com or through one of the channels below and tell us more – we’re always looking for new opportunities and examples to incorporate as we continue the discussion around AI.

Learn more about private equity transactions with ASM’s Private Equity Training course. The Private Equity Training course at ASimpleModel.com was developed by industry professionals. The content below goes beyond the LBO model to explain how private equity professionals source, structure and close transactions.