A tsunami of money has been flooding into private equity. I find this interesting because we seem to be in the late stage of the business cycle, with a significant macroeconomic slowdown (if not an actual recession) coming soon. It raises the question: Is the PE world facing a historic opportunity or a historic threat?

Money is Flowing into Private Equity Like Never Before

According to Bain & Company, in 2022 there was a 10% falloff in the raising of private capital globally. But keep this in mind: We are still talking about a figure of $1.3 trillion. That’s more than any year on record except for 2021. And the total of the past five years ($6.4 trillion) is also a record for any five-year period on the books. It’s not even close.

During this party, new funds have both appeared faster and exited faster. Successful PE firms raise multiple funds, and the window between each raise has been getting tighter. In addition, general partners (GPs) are raising more money. In 2022 the median size increase of a fund over its predecessor fund was 50%.

A downturn could certainly change this. For one thing, GPs would likely start holding on to portfolio companies longer to wait for better exit conditions. Nonetheless, new and growing sources of PE money—such as individuals and sovereign wealth funds—means there will be no shortage of dry powder, especially once any downturn is behind us. Individual investor money coming into the PE universe—the subject of a previous post—is an especially interesting trend, from the standpoint of both PE funds and the individual investors wanting to get in on their returns.

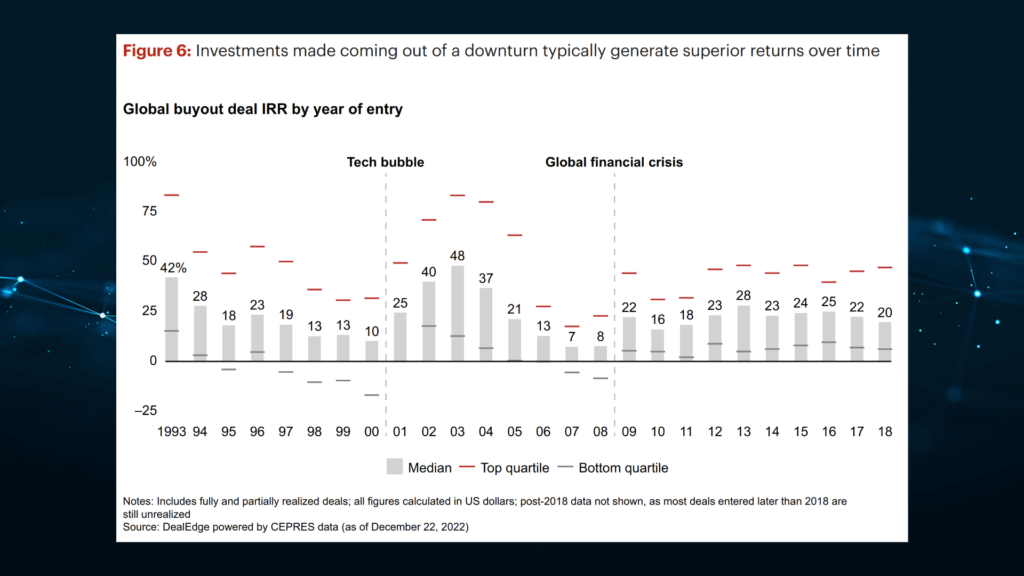

Historically, PE Funds Started Just After a Recession Outperform

Everyone knows the saying: ‘Buy when there’s blood in the street.’ Turns out it’s as true in private markets as in public. The chart below shows how lifetime returns have been especially good for funds started soon after a downturn. Returns fall off for funds started as the expansion matures and the next recession nears.

Image Source: Bain’s Global Private Equity Report 2023 (Background Added)

I find this interesting because it goes to the heart of superior investing. Think about Stephen Schwarzman. He raised Blackstone’s first fund on Thursday, October 15, 1987. Four days later was a little event known as Black Monday, when the Dow Jones Industrial Average plummeted 23%. It was the largest one-day percentage drop in the history of the index. Get this: Schwarzman called it “probably the luckiest moment in Blackstone’s history.” I doubt many investors looked at Black Monday quite this way (link to Twitter thread). But Schwarzman did, and today his firm has $991 billion under management.

Another great example is Advent International, which closed on its first $10 billion fund in the spring of 2008—the midst of the subprime mortgage meltdown. The Great Recession which followed was the worst economic downturn since the (capital D) Depression. As financing markets descended into a deep chill, Advent became the most active private equity group in the world, snapping up bargains and laying the groundwork for future outsized returns.

Conclusion

Let’s say a recession happens in the near future. How will private equity react? Expect a split between existing and new funds. Existing funds will find themselves in a situation like the one faced when the Great Recession hit. Many will remain active beyond their expected lifespan, waiting for a better exit market. As the chart below shows, in 2023 enterprise value (EV) is already down significantly relative to revenue. Going forward, returns to existing funds are likely to decline. Those with conservatively capitalized portfolio companies can ride it out (perhaps in the minority, see PE Multiples to the Moon). Those with over-levered portfolios will be in danger of becoming so-called “zombie” funds. Without a way to refinance, liquidate or raise a successor fund, they’ll be trapped in the land of the financially undead. Not a fun place.

Image Source: PitchBook Data “PE Firms Perform Financial Feats” (Background Added)

Funds born in the downturn will face a very different situation. Declining valuation related ratios will look good to them. As with Blackrock in 1987 and Advent International in 2008, the best will be positioned to turn dry powder and a down market into a winning combination. And in addition to attractive multiples, these firms will find exciting new hunting grounds for high-growth companies. Artificial Intelligence and Web3 technologies are already disrupting finance, healthcare and many other fields. In fact, as the Bain report notes, some $94 billion has already been invested in web3 technologies alone, and most of that in the last two years.

If we do see a recession in which such opportunities abound, it could be a different kind of recession, one where outcomes are more bifurcated than in the past. Will the historical advantage of having freshly raised capital in a downturn, a product of luck in many instances, be subdued by private equity’s ability to raise new funds faster? I think this time it may have more to do with specialization in general and the ability to incorporate these new frontiers (previous post: Private Equity Industry Focus and Sourcing Strategy Drives Fund Objective).

If you are choosing where to work or where to invest, be mindful of these trends. Unwinding over levered investments can be painful. Focus on firms that have industry knowledge and that know how to add value post-close.

Related: Learn more about PE EBITDA exit multiples with the video available below.

Learn more about private equity transactions with ASM’s Private Equity Training course. The Private Equity Training course at ASimpleModel.com was developed by industry professionals. The content below goes beyond the LBO model to explain how private equity professionals source, structure and close transactions.