If you want to succeed, it helps to specialize. The most recent Global Private Equity Report released by Bain & Company explains how sector-focused private equity firms are gaining an edge over the classic buyout fund.

To emphasize the benefits of specialization and the expertise required to be effective, the report states that choosing to operate in the fastest growing sector can be a mistake. “Bain research shows that the distribution of returns within a given sector is actually considerably higher than it is between sectors.” In other words, good and bad deals can be found in any industry, outsized returns are achieved by deal teams that know precisely what they are looking for.

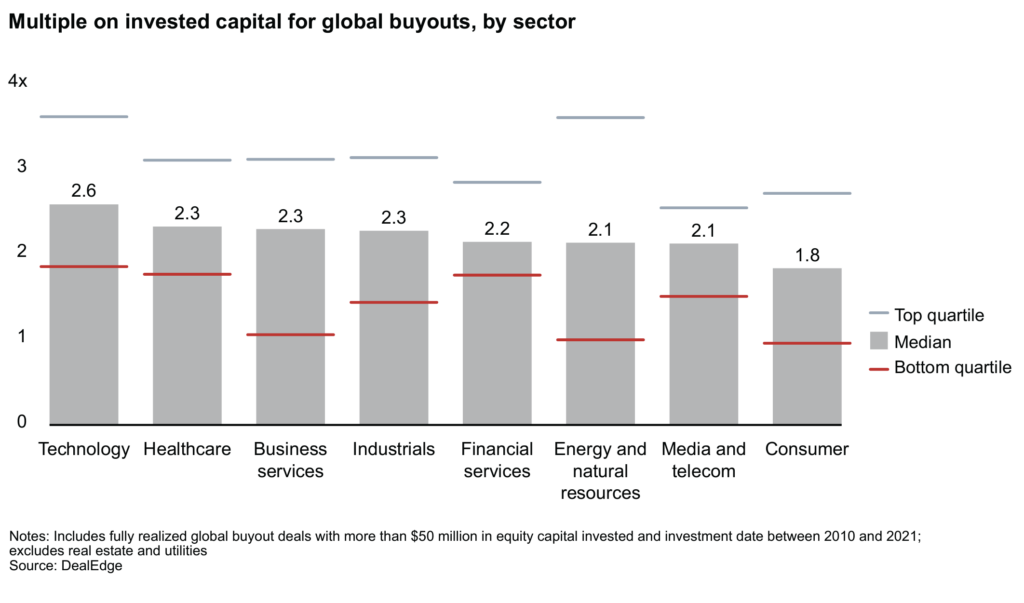

Buyouts in the broad technology sector, for instance, have produced median returns of 2.6x over the past decade, while industrial deals have returned 2.3x. Within the industrial sector itself, however, top-quartile deals produced 3.1x returns and bottom-quartile deals 1.4x. That means a good manufacturing buyout during that period far outpaced an average tech deal. (p. 59)

Global Private Equity Report 2022 | Bain & Company

But expertise alone is not sufficient. Deal flow has always been heavily dependent on the relationships of the senior partners and business development professionals, and it increases substantially for firms with a known sector focus. Escaping auctions and benefiting from exposure to more limited processes requires being recognized as one of the “top three or so firms that sellers and intermediaries turn to when looking for the likeliest buyer for a specific deal process.”

I have seen this in action. I spent a few years looking at opportunities in the fast-casual dining space, and I rarely sat through a meeting where I could breathe those words without hearing “CapitalSpring” in response. If we looked at an opportunity hard enough, eventually most industry professionals that we contacted in our due diligence processes asked if we had either been in contact with CapitalSpring or knew if they had also seen the deal. Per the website:

Since our founding in 2005 as a source of structured financing to franchisees, we’ve been focused on providing creative capital solutions to the branded restaurant industry.

Now, with $2 billion invested in more than 60 brands across North America, CapitalSpring has become one of the most active institutional investors in the restaurant sector. While our strategy has broadened and our capital base has grown, we remain exclusively dedicated to restaurant investing.

It’s a powerful reputation to have. The Bain & Co report provides additional examples, including L Catterton’s acquisition of Wellness Pet Food in 2004. The transaction was a huge success and provided a return of 7x the original investment. Success begets success, and in the years that followed L Catterton made more than a dozen additional investments in the space. The knowledge and reputation gained allowed them to further expand internationally with pet-care related investments in the UK, Brazil and China.

As software-focused firms like Thoma Bravo and Vista Equity have demonstrated, investing in a particular sector can provide significant advantages. Per the report, this increasingly extends to fund raising, sourcing transactions, portfolio oversight and outperformance. As the industry matures and competition increases, I look forward to new creative examples of specialization in this asset class (see Arctos example below).

Example: Arctos Sports Partners

Arctos Sports Partners launched in April of 2020 and raised $3 billion to invest in the professional sports industry. Per an article in the Financial Times, Arctos is now the most prolific buyer of sports stakes around the world.

Through direct and indirect investments, it now owns stakes in 16 franchises including professional baseball’s Boston Red Sox, English football’s Liverpool FC, basketball’s Golden State Warriors, and the Kings. [1]

As an example, the article cites Shaquille O’Neal’s immediate need to sell his minority interest in the Sacramento Kings. An endorsement deal with a sports betting company raised a red flag, and he was told that the NBA prohibits team owners from accepting gambling sponsorships.

That meant he would need to liquidate his minority interest in the Sacramento Kings. Instead of tapping his network of all-star friends to buy the stake, he struck a deal with Arctos Sports Partners, a relatively new private equity firm specialising in professional sports team investments. [2]

Click on the link below for a fascinating article describing how the founders of Arctos uncovered this investing niche.

Source [1] & [2]: Sara Germano and Arash Massoudi | “Why private equity newbie Arctos is making prolific bets on sport” | Financial Times | 1/6/2022 | Visit