With Silicon Valley Bank having collapsed, I thought it would be a good time to discuss the money supply, how banks create money, and the danger of a bank run. We will use a simple example to demonstrate the dynamic, then apply it to the demise of Silicon Valley Bank.

Financial panic is nothing new; it’s been around for centuries. It’s the evil twin of the money expansion process that occurs in any healthy economy via bank lending. An old-fashioned example of money creation (which I read about in Niall Ferguson’s book The Ascent of Money) will drive home how money can be created by the banking system, and how it can also be destroyed. Important vocabulary is defined at the end of the post.

The Good Twin: How Banks Create Money

The example that follows is also available as a video on ASM’s YouTube channel and on TikTok. The TikTok version runs slightly longer should you want more detail. Please refer to the images that follow each of the explanations.

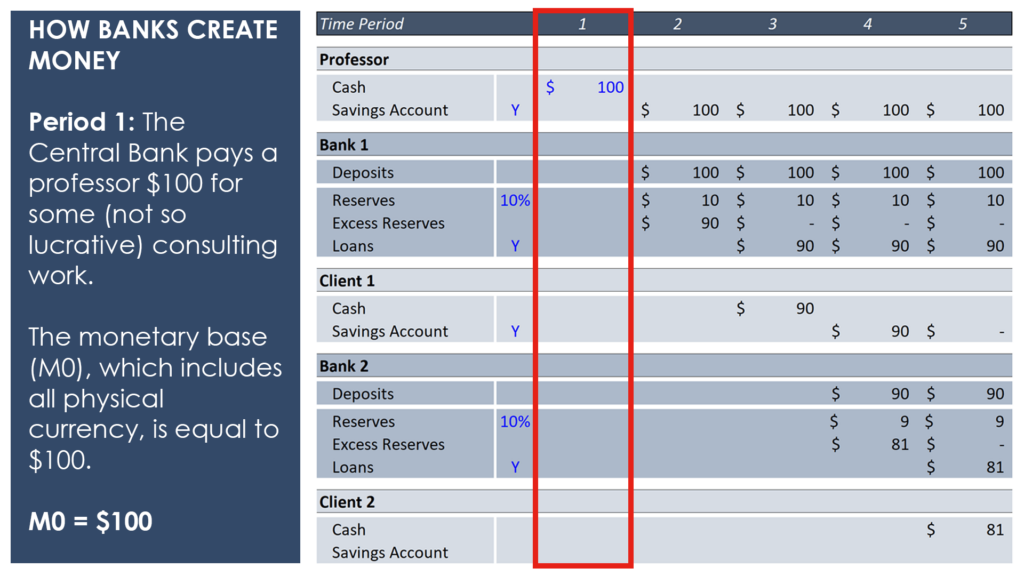

Period 1: Imagine a world without money, until one day a central bank hires a professor for some (apparently not very lucrative) consulting work. As payment, the central bank prints out $100 and gives it to the professor for his work. This economy now has a money supply of $100! The situation is shown in period 1 in the image below.

Period 2: The professor deposits the money into his personal account at a retail bank named Bank 1. This bank operates with a 10% reserve ratio. That means it will keep $10 of the $100 deposit in reserve (inside the vault or in its own account with the central bank) just in case the professor wants to withdraw cash.

The other $90 is considered excess reserves, meaning it can be loaned out or invested to earn interest for the bank. No matter how you measure it, at this point the money supply is still $100. The only change from period 1 is that the professor now has his money in the bank instead of his pocket.

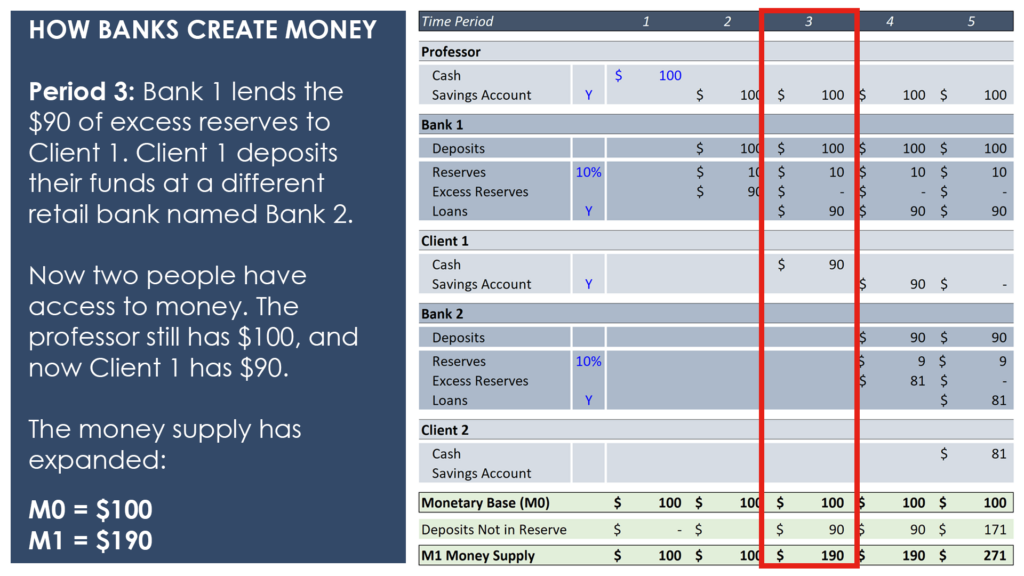

Period 3: Bank 1 lends the $90 of excess reserves to Mrs. Franco (“Client 1” in the image), who wants to fix up her house, but has not yet hired a contractor. In the interim, she deposits her funds at a different retail bank named Bank 2.

Something interesting has happened with this second deposit. Before, the professor was the only person in the economy with any money. Now there are two. The professor still has $100 in his account, and now Mrs. Franco has $90 in hers. If we define money supply M1 as not only currency but demand deposits (checking and savings accounts), then M1=$190. But if we define the monetary base as M0 (only the existing physical currency in the economy), then M0=$100, the same as before. The central bank hasn’t printed any new currency.

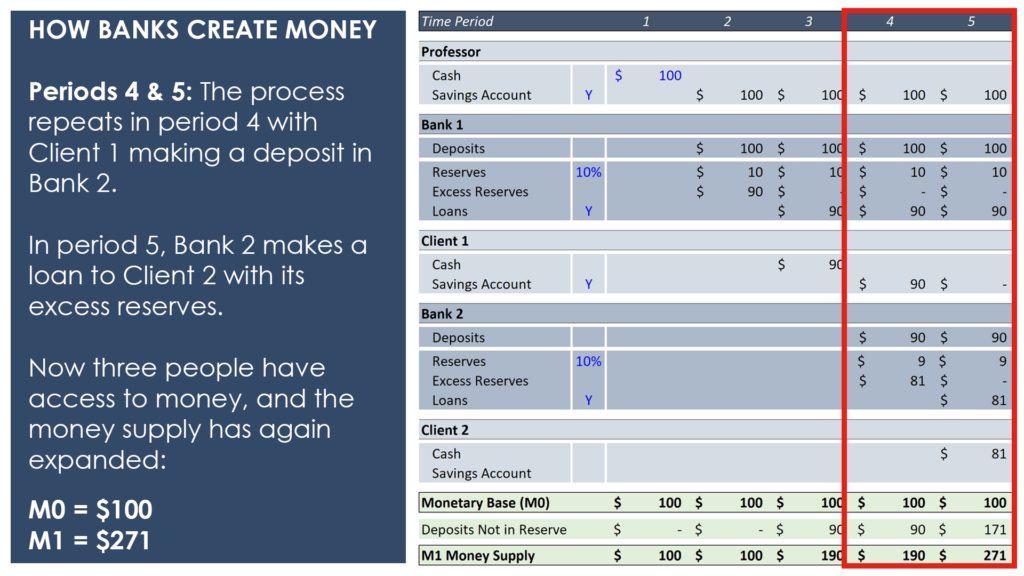

Period 4: After Mrs. Franco’s deposit, Bank 2 has $81 (90% of $90) in excess reserves.

Period 5: Bank 2 loans the $81 to a guy named Joplin (“Client 2” in the image) who wants to buy some drums. But he holds onto the cash while he explores the acoustic quality of alternative drum kits. There are now three people in the economy who have M1 money, defined as either currency or a demand deposit. And the sum of their money is $271 ($100 + $90 + $81). But there is still only $100 of actual currency in existence. Printing $100 of hard physical currency has led to $271 circulating in the economy thanks to fractional reserve banking!

How Does a Bank Fail? An Evil Twin Appears

Do you see a potential problem developing in our scenario? What if depositors demand more of their money in the form of cash than the actual amount of currency can supply?

Imagine the professor returns to Bank 1. He wants to buy more books, and he demands his entire $100 balance instantly. To get the professor’s cash for him, Bank 1 will have to call in the $90 loan it made to Mrs. Franco. But Bank 2 has already loaned most of this money to Joplin. So that loan will have to be called in. The money creation process is now going in reverse. M1 may shrink all the way back to the $100 monetary base (unless, of course, the central bank decides to crank up the printing press to keep everyone happy, but that is another story).

Why did Silicon Valley Bank Fail?

Unfortunately, the problem we just discussed periodically plays out in the real world. We’ve just seen it happen with the collapse of Silicon Valley Bank. According to the Wall Street Journal, this bank’s fall began with its rapid rise. Between 2020 and 2022, deposits at the bank more than tripled, from $55 billion to $165 billion!

Suddenly awash in money, rather than focusing on making loans the bank put much of it into long-term government bonds and mortgage-backed securities. As interest rates rose, these lost value, and the bank’s executives failed to recognize the burgeoning problem quickly enough. As the Journal article alleges, “Risk management seemed to be an afterthought.” To satisfy customer demands for withdrawals, the bank was forced to begin selling its holdings at a loss. As word of this spread, especially through Twitter, even more depositors demanded their money. The snowball became too big to stop, and government regulators had to take over. If the government hadn’t done this, a lot of people would have lost a lot of money. And the fallout might have spread like wildfire.

What is Fractional Reserve Banking?

In fractional reserve banking, banks must keep a fraction of the funds deposited by their customers in reserve (either physically at the bank or on account with the Federal Reserve). This fraction, known as the reserve ratio, is determined by the central bank or regulatory authority. Banks can then lend out the rest to earn a profit on the spread between the interest rate they pay depositors and the one they charge borrowers. An old joke says that bankers operate on the 3-6-3 rule. Pay depositors 3%, charge borrowers 6%, and be on the golf course by 3 pm! Regardless, this system enables banks to create money, literally increasing the supply of funds available in the economy. But it also exposes banks to the risk of a bank run if depositors try to withdraw their funds en masse.

What are Required Reserves?

Required reserves are the minimum amount of money that a bank must have on hand to meet the requirements of the central bank. Balances greater than this are considered excess reserves, and can be loaned out (or invested) in an effort to earn a profit for the bank.

What is the Money Supply?

Generally speaking, the money supply is the total value of all cash and cash equivalents (such as checking accounts) in the economy at a point in time. It can be measured in different ways, as the next paragraph shows.

What is the Difference between M0 (the Monetary Base) and M1?

M0 and M1 are both measures of the money supply, but they differ in the types of assets they include. M0, the monetary base, is the narrowest measure. It includes only physical currency (notes and coins) in circulation and reserves held by commercial banks at the central bank. M1, on the other hand, is a broader measure that includes everything in M0 plus demand deposits in commercial banks. Demand deposits are funds that depositors can withdraw on demand using checks or debit cards.

An economy built on fractional reserve banking (in which part of a bank’s deposits are kept in reserve and the rest loaned out or invested), only works as long as depositors don’t demand too much of their cash at once. But this is exactly what people do when they get scared. They retreat to cash. That, very simply, is the danger of a bank run.