Insights

How a Balance Sheet Balances

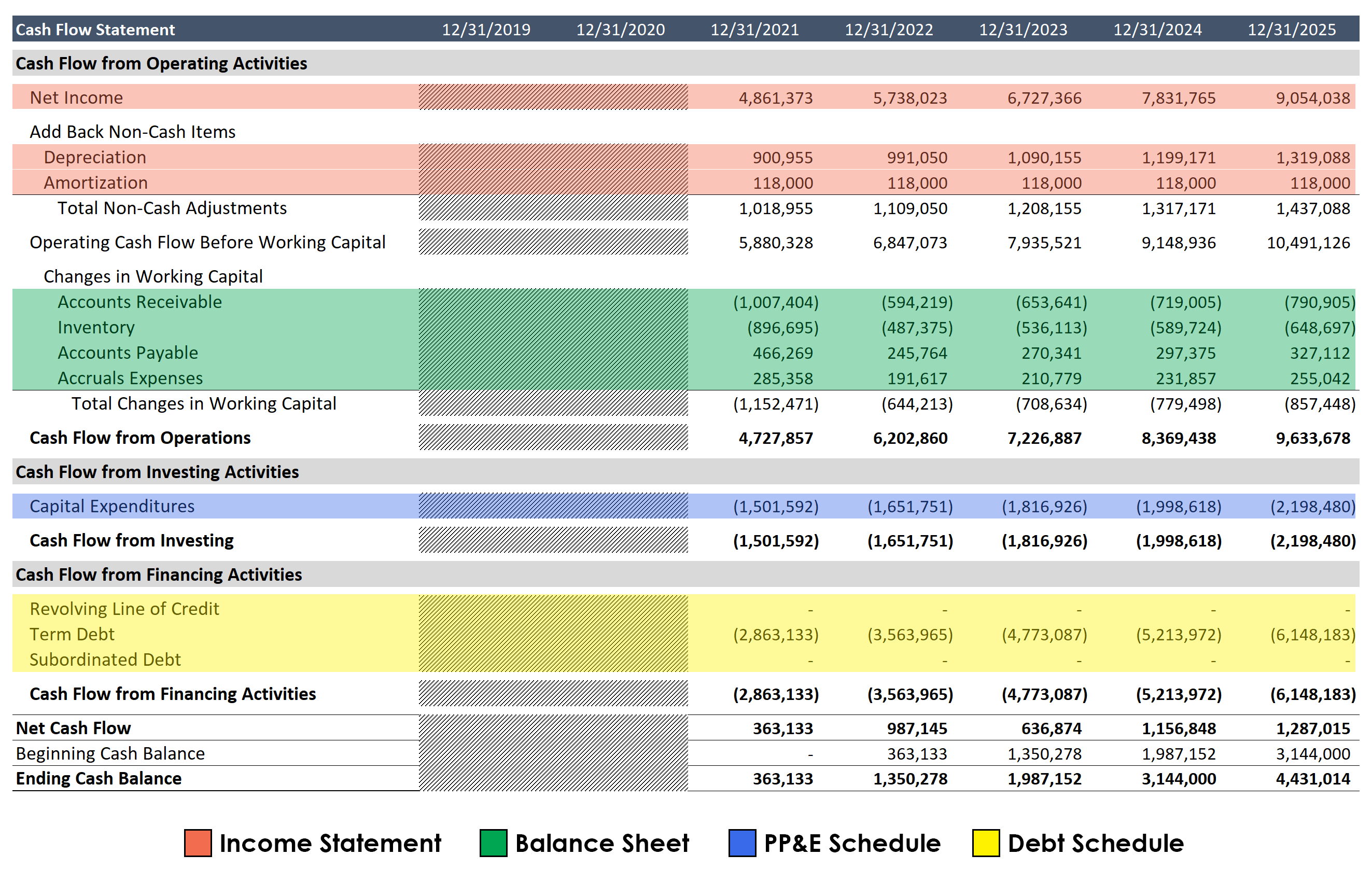

An unbalanced balance sheet in a three-statement financial model can be a nightmare if you don’t understand the mechanics that would otherwise result in a balanced balance sheet. In this post we will explore how the cash flow statement balances a three-statement model, and we will include common errors that result in a broken model together with instructions on how to fix them.

Adjusted EBITDA Example

Adjusted EBITDA is a very common metric that can be found in many investor presentations, which makes understanding EBITDA and acceptable adjustments to this figure important. Unfortunately EBITDA is frequently used as a proxy for cash flow. As the video featured in this post will demonstrate, it is anything but. In businesses that require heavy capital expenditures or those with heavy debt burdens, the discrepancy between EBITDA and cash is vast. Add to this the adjustments investment bankers and management teams will use to embellish or even exaggerate earnings and the metric can become meaningless.

Examples of Differentiated Products

Per Michael Porter there are two ways to compete, by charging lower prices or by developing differentiated products and offerings. In this context product differentiation is the only way to avoid a race to the bottom.

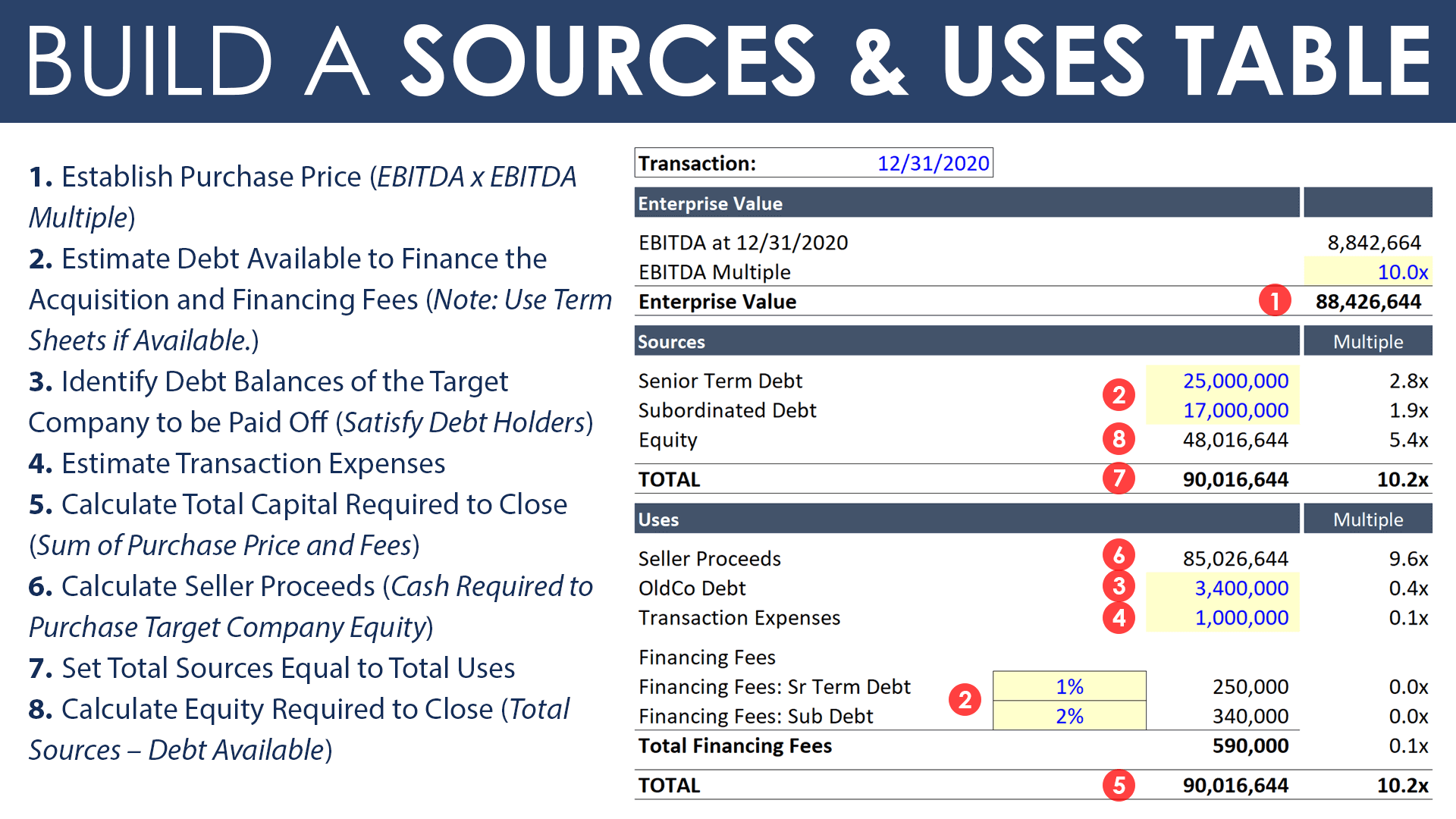

Sources and Uses

In an LBO model the sources and uses table is a convenient way to track the sources and uses of cash required to close a transaction. Building a sources and uses table can appear to be a process that is without a proper sequence, but there is definitely an order that can be followed. To understand it, let’s first explore concise definitions of the two terms. Think of sources and uses as follows:

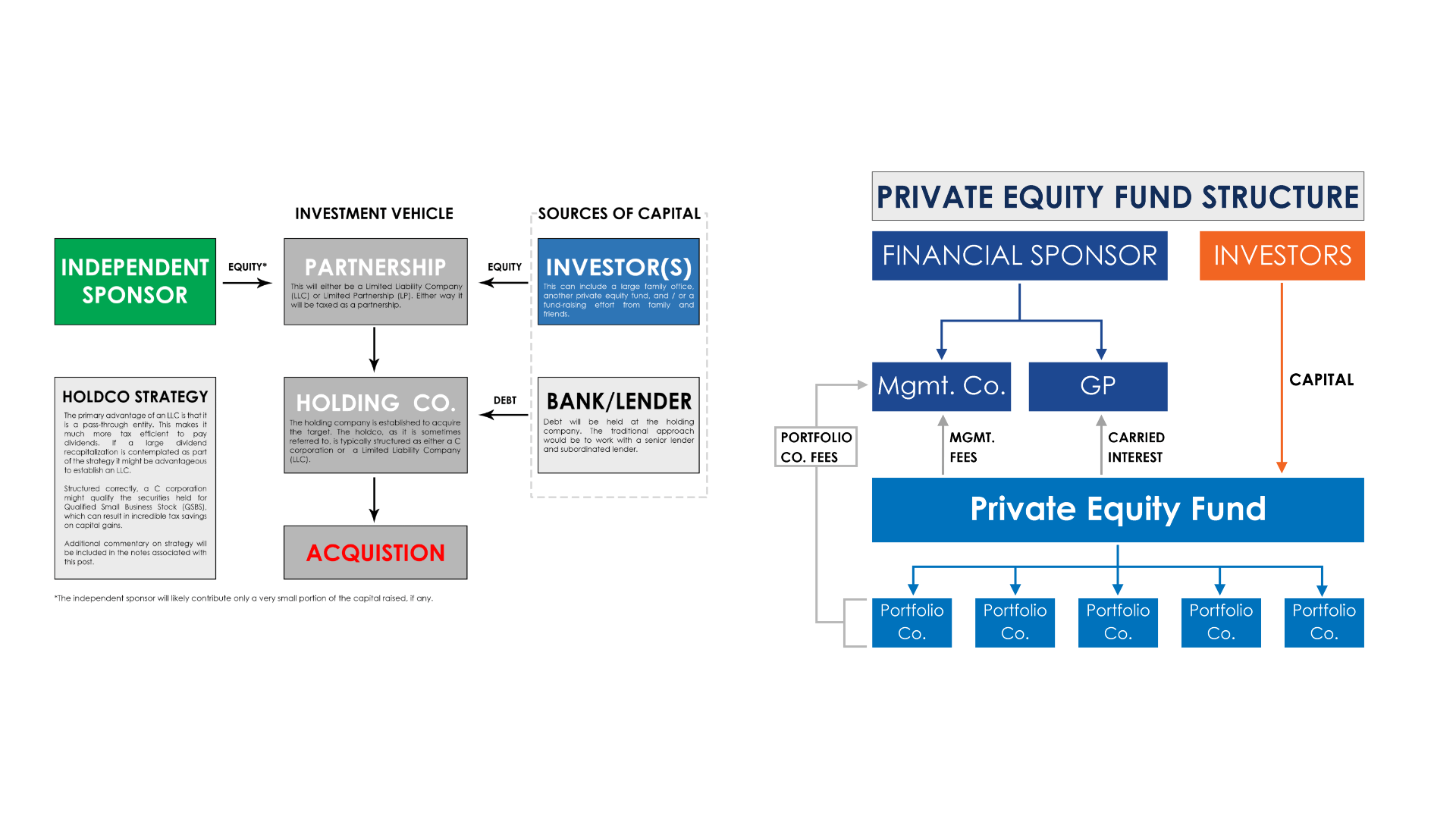

What is Private Equity: Fundless vs Funded

This video is Part 4 of an introduction to private equity. In this video you will learn more about the individuals involved in the process of sourcing, structuring and closing transactions. The video provides an introduction to the independent sponsor (aka fundless sponsor), and explains certain advantages dealmakers have over their competition. The conclusion covers a brief comparison of the independent sponsor structure and the private equity fund structure.