Insights

How to Become a CFO

Interested in the CFO role? I recently interviewed two talented individuals on what it takes to join the c-suite. Amazingly, under their leadership, both of the companies these two CFOs worked for grew from double digit millions of revenue to well over $1 billion of revenue. One company grew organically and the other largely via acquisition, which provides for two interesting perspectives.

Private Equity Fund Structure: GP and Management Company

Why does a private equity fund have both a general partner and a management company?

EBITDA Exit Multiple

An EBITDA multiple is, very simply, a company’s enterprise value (EV) divided by its EBITDA at a given time (EV / EBITDA); conversely, EV can be calculated by multiplying EBITDA by the EBITDA multiple. This metric has long been used as short-hand approach to a company’s valuation, and you will frequently hear individual deals or entire industries referred to as “an [X] times deal” or “an [X] times industry,” with X being a multiple of EBITDA.

Projecting the Cash Flow Statement

This video explains how to project the cash flow statement in an LBO model built in Excel. The sequence required to project each line item is identical to the sequence laid out in the Integrating Financial Statements video series (which is focused on a three-statement model) and the LBO video series, so we will not explore that in detail. Instead this video will provide shortcuts to move through the process faster when you are working with new financial statements, and visuals to help communicate how the income statement and balance sheet link to the cash flow statement.

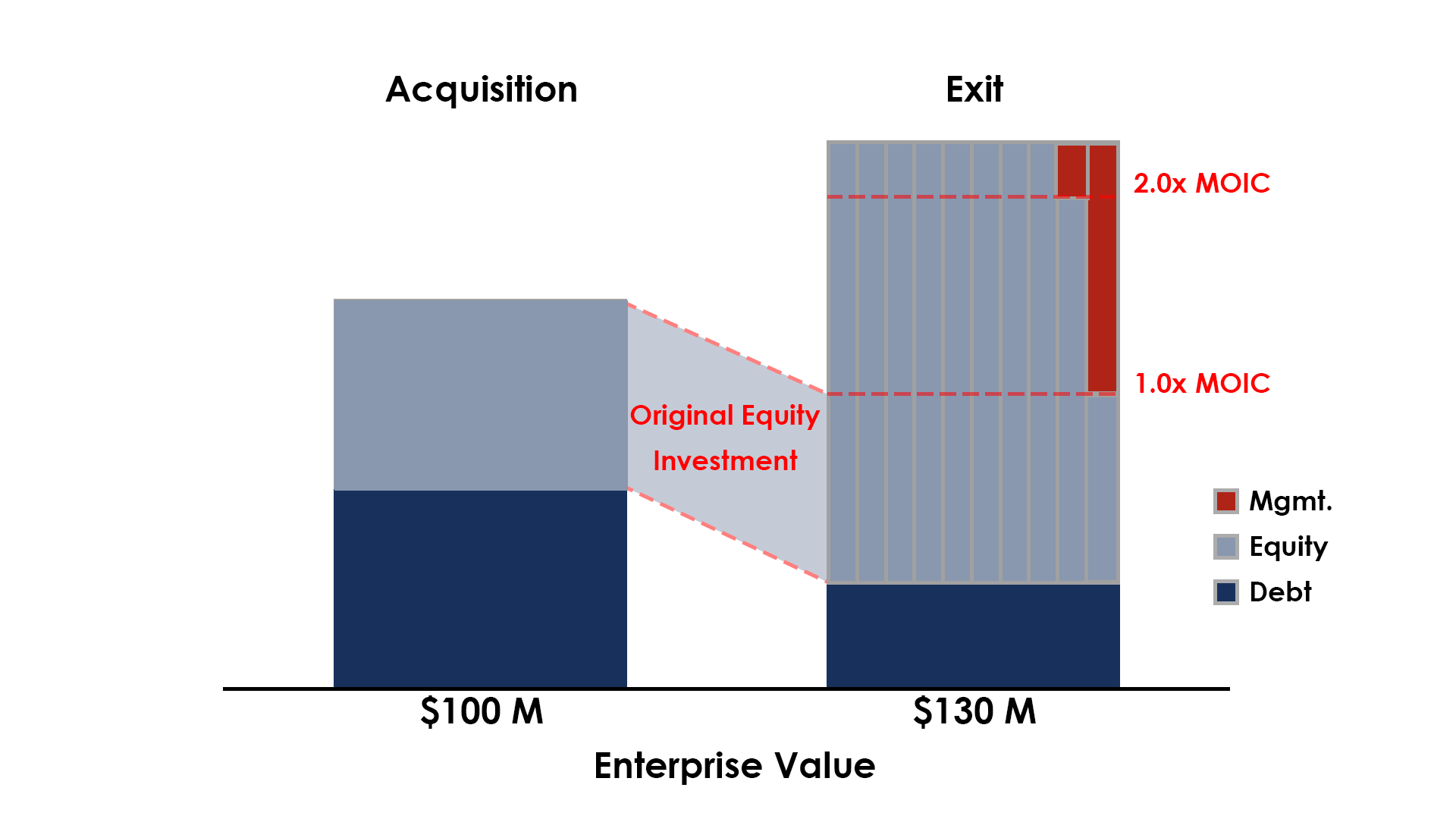

Incentive Equity Compensation

Incentive equity compensation helps align investors with the management team running the business. In every control private equity transaction, it is one of the most important variables to get right. This post will explain how equity compensation generally works with visuals that should help cement these concepts.