Insights

The Private Credit Business Development Role

My friend Ryan Mullins joined Elm Park Capital (EPC), a private credit fund, in March of 2016 tasked with the objective of developing a dedicated business development role. As Mullins points out in this ASM interview, this was not common practice at the time. Investment firms in the lower middle market and middle market did not typically have dedicated sourcing roles, but the market was growing far more competitive.

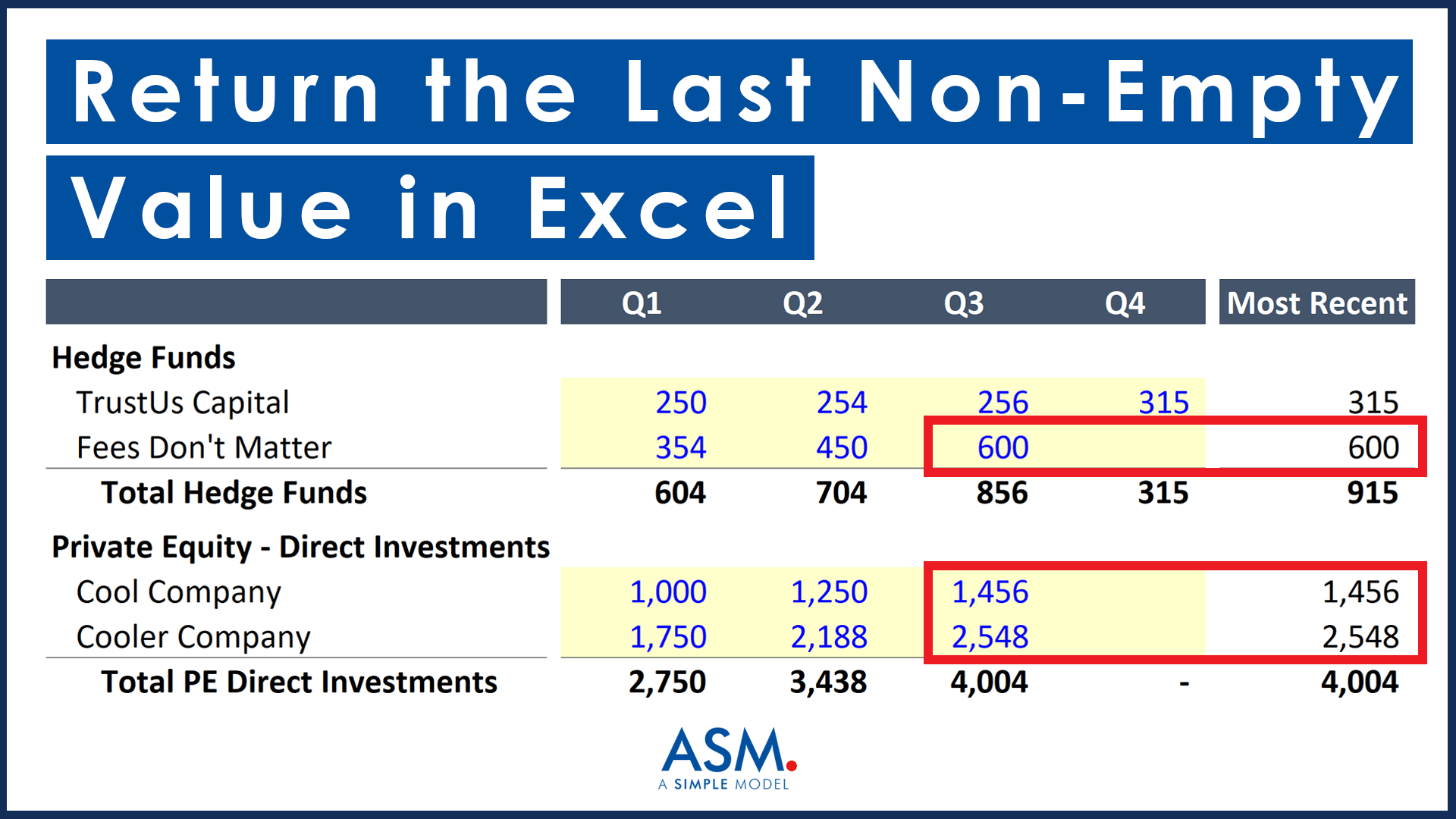

Return the Last Non-Empty Value in a Row or Column in Excel

Get the last non-empty cell value in a row or column in Excel. This post includes a video and Excel template for download.

Apple's Metaverse Advantage: Tech & Luxury

Recent headlines about Apple’s market cap crossing the three-trillion dollar threshold and the race for the metaverse caused me to think back to a comment Scott Galloway made in his book The Four. Compared against Facebook, Google and Amazon, he wrote that Apple stood “alone as a luxury brand.”

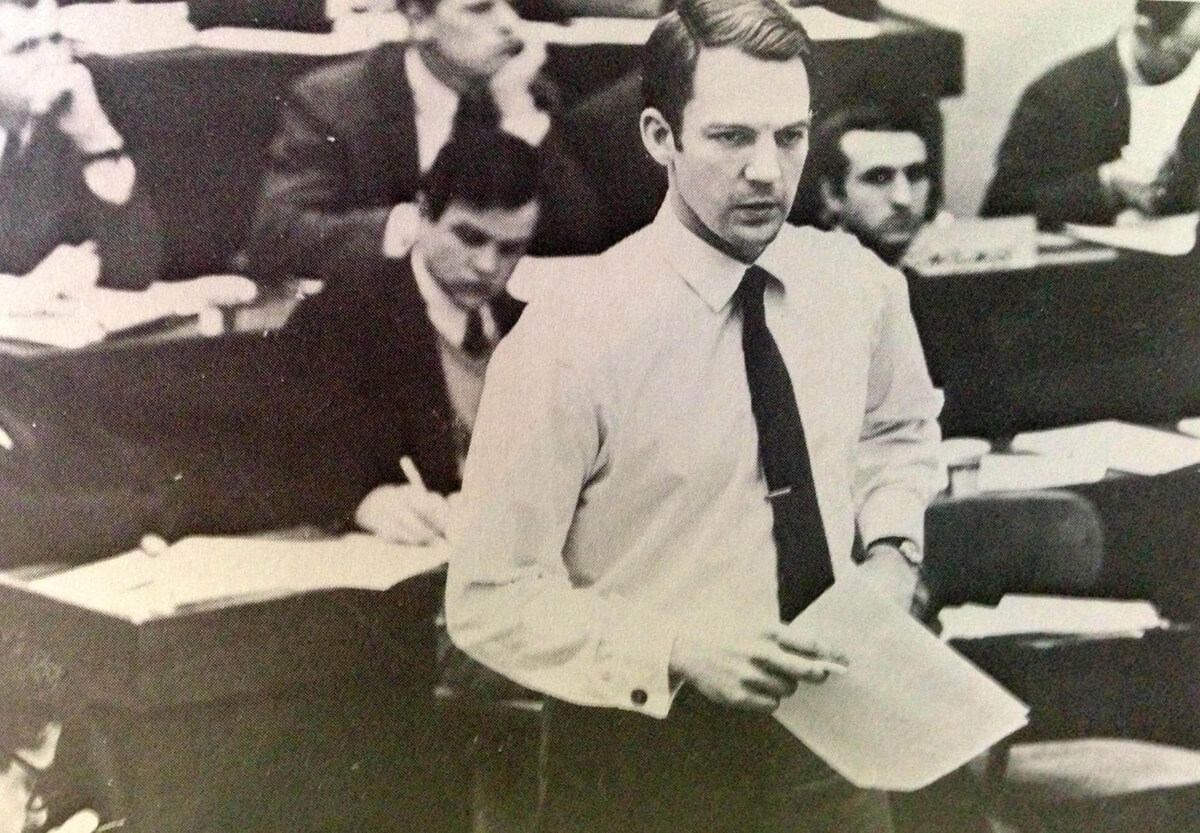

What My Father Taught Me About Teaching

My father passed away peacefully on December 30th. The photo is from a time before I knew him, taken when he was 27 years old as a professor at the Harvard Business School. I chose it because he thought that one of the best things you can do in life is to help people learn and grow.

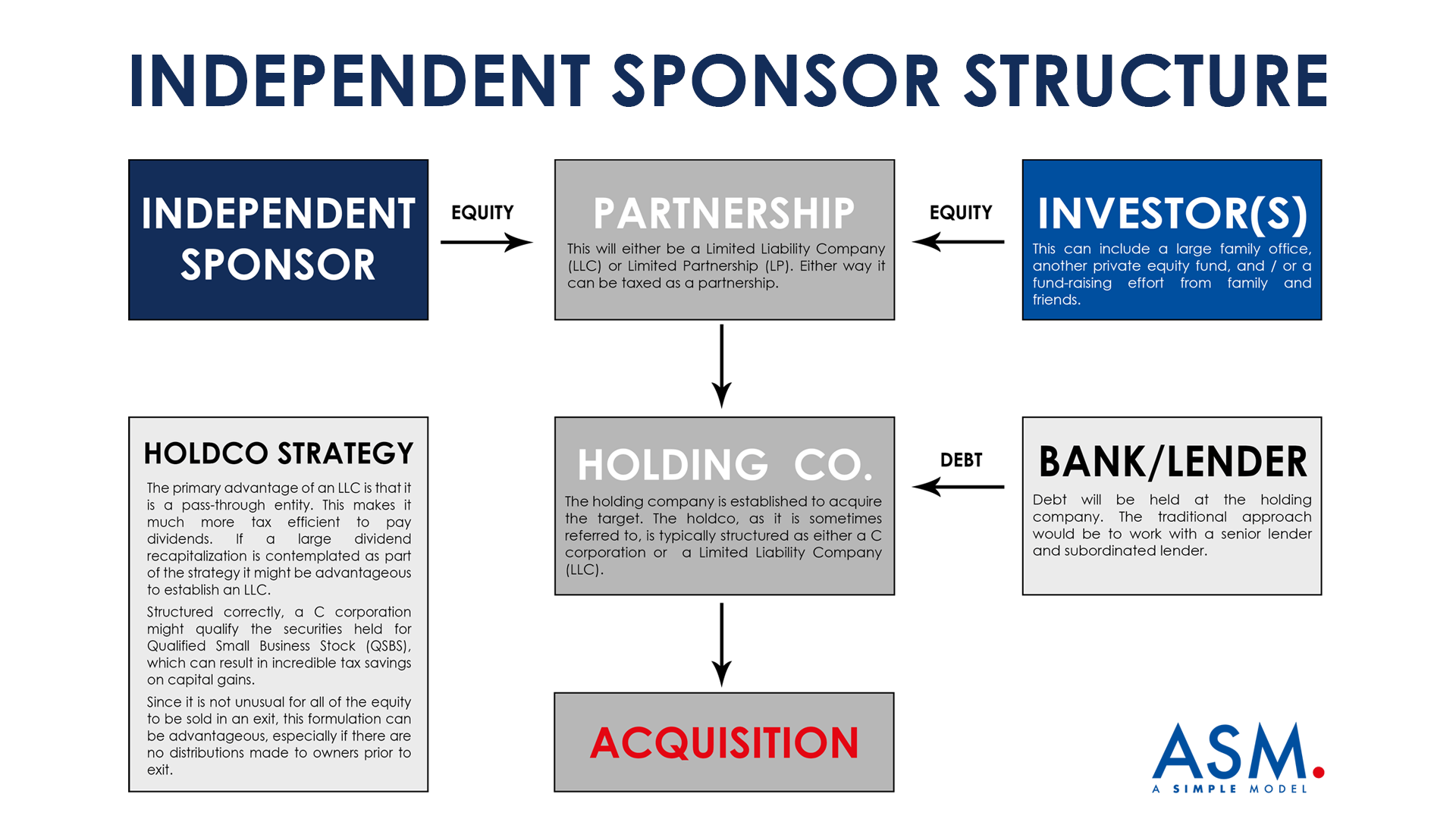

Becoming an Independent Sponsor

Last week I was lucky enough to interview Mason Barrett on his decision to set out as an independent sponsor. For those of you unfamiliar with this career track, Independent Sponsors pursue entrepreneurship through acquisition; his intention is to identify a company and raise capital to acquire it.