Insights

Private Equity: Adding Value at Scale

How private equity firm Vista Equity Partners and founder Robert Smith add value to the firm’s portfolio at a massive scale.

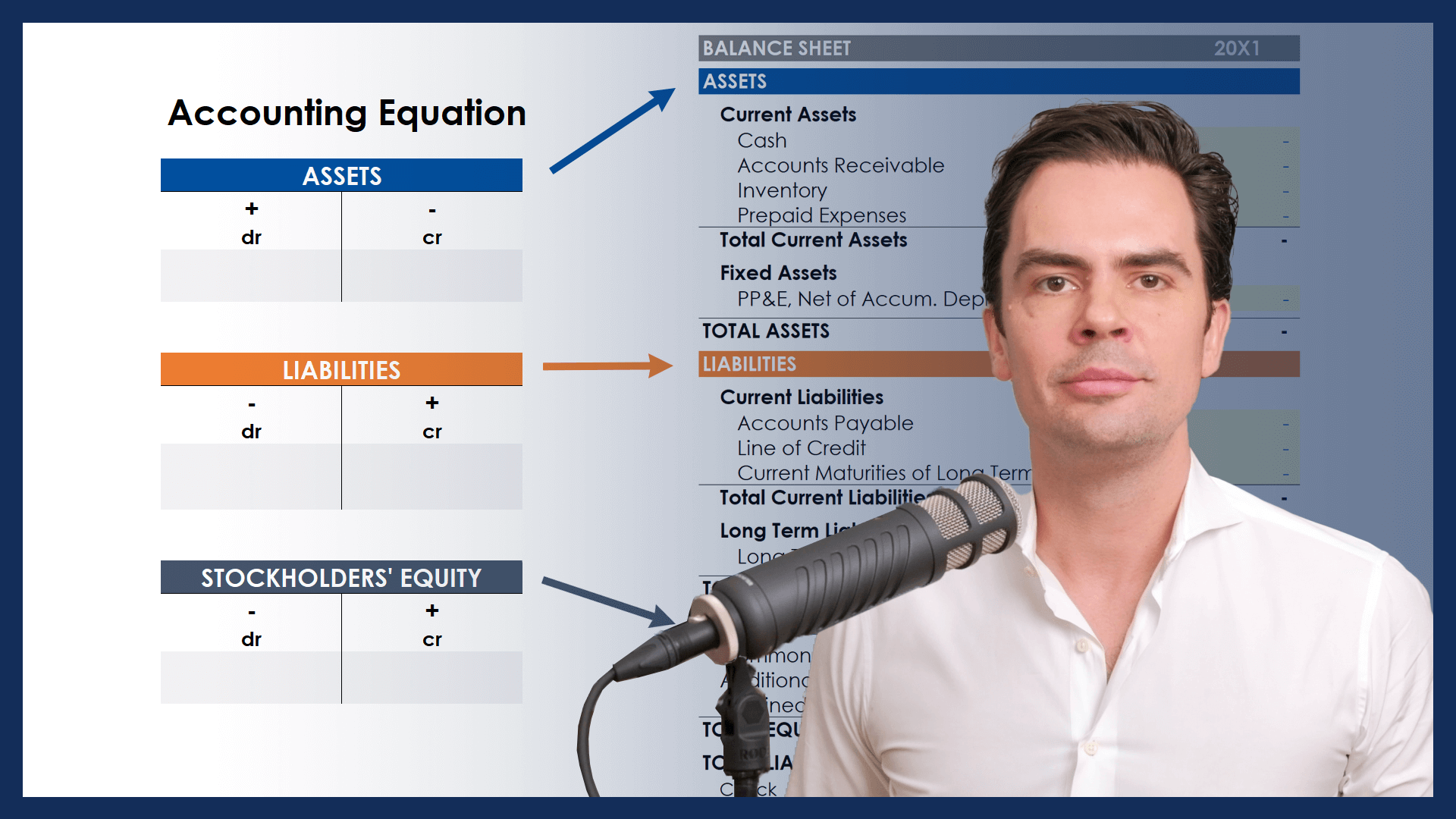

The Accounting Equation

The accounting equation is the first concept you need to master to understand how cash is created and consumed by a business.

Creating Content and Feedback

Help ASM create better financial instruction. This video is the first update to the Financial Statements Video Series.

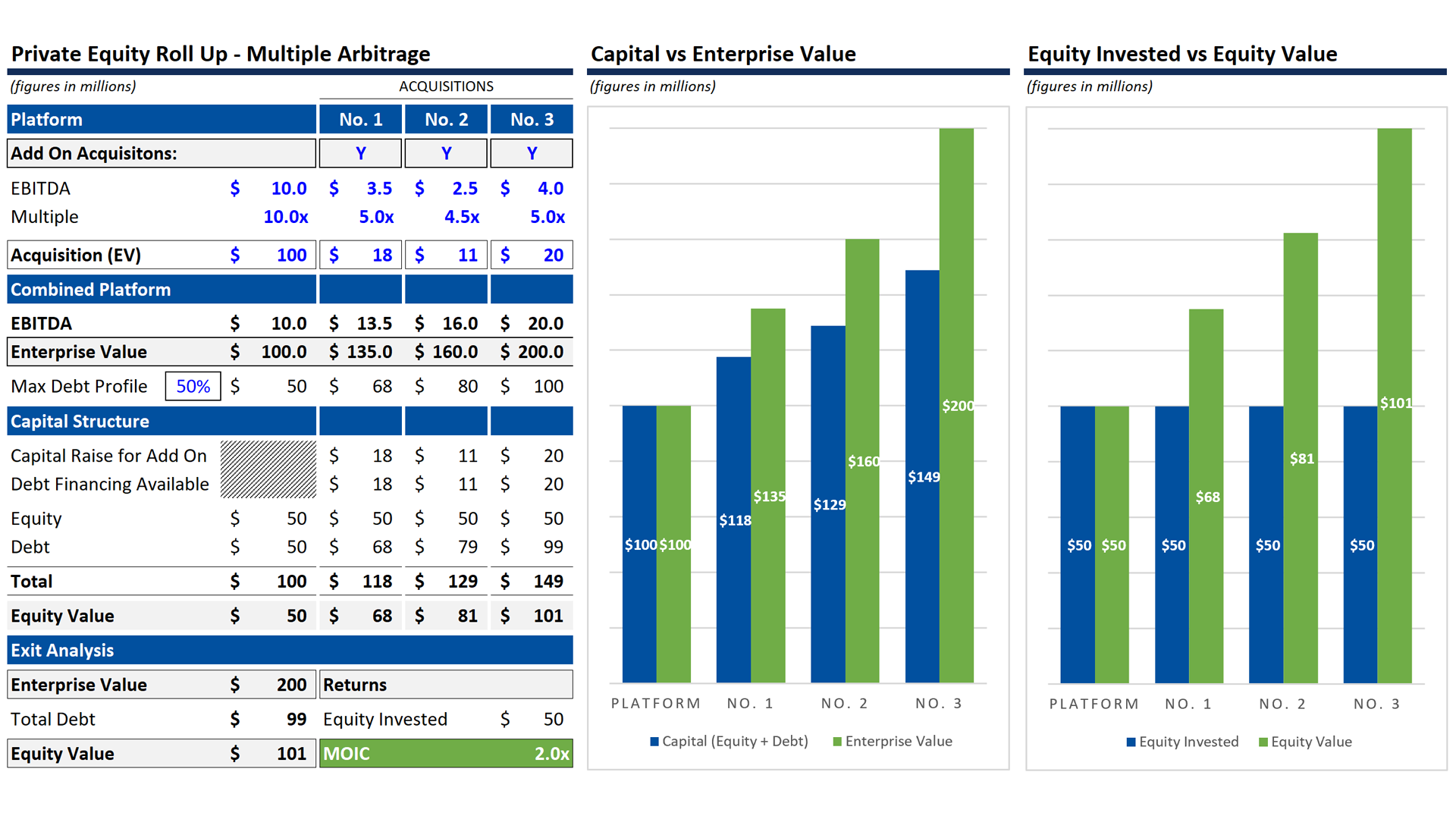

Examples of Multiple Arbitrage in Private Equity

Examples of multiple arbitrage in private equity. Multiple arbitrage creates value at exit by selling a company at a higher multiple.

Private Equity Roll Up

Private equity roll-up strategy is attractive largely because of the value creation achieved with multiple arbitrage. With a roll up strategy, the sponsor (private equity firm or independent sponsor) sets out to acquire and merge multiple smaller businesses into one larger consolidated company.