A private equity roll-up is the process of acquiring and merging multiple smaller businesses in the same industry into one larger consolidated company. This strategy is attractive because the market generally rewards scale with a higher valuation. More specifically, the market is generally willing to pay a higher multiple of EBITDA to acquire a larger business. This means that the sponsor (i.e., private equity firm or independent sponsor) behind the roll-up is likely to benefit from multiple arbitrage at exit.

There are additional benefits to roll-ups including economies of scale and cross-selling, but multiple arbitrage is one of the strongest value drivers. So, this post and the associated workbook will focus exclusively on value creation via multiple arbitrage. If you would like to follow along, please download the Excel workbook. Download: Private Equity Roll Up_Multiple Arbitrage_ASM (image below)

To initiate a roll-up strategy, many sponsors will first identify an ideal “platform” company with an excellent management team. This platform is generally purchased at a higher multiple of EBITDA than the smaller businesses that follow. But once an add-on acquisition has been successfully integrated, the combined platform’s earnings are valued at the higher multiple (multiple arbitrage). If that sounds a little abstract, the example that follows should provide clarity.

Private Equity Roll-Up Example: Four Acquisitions

In this post and the associated video (shorter version on TikTok), we are going to explore how this process works by looking at four acquisitions, including a platform and three add-on acquisitions. Most roll-ups take time. A private equity firm will identify an attractive platform and then source add-on acquisition targets to create scale over the course of the hold period. To emphasize the value creation realized with multiple arbitrage, we are going to assume that all four transactions take place in chronological order on a single day. This allows us to eliminate variables like interest expense and debt amortization, which makes it easier to focus on the benefits of multiple expansion.

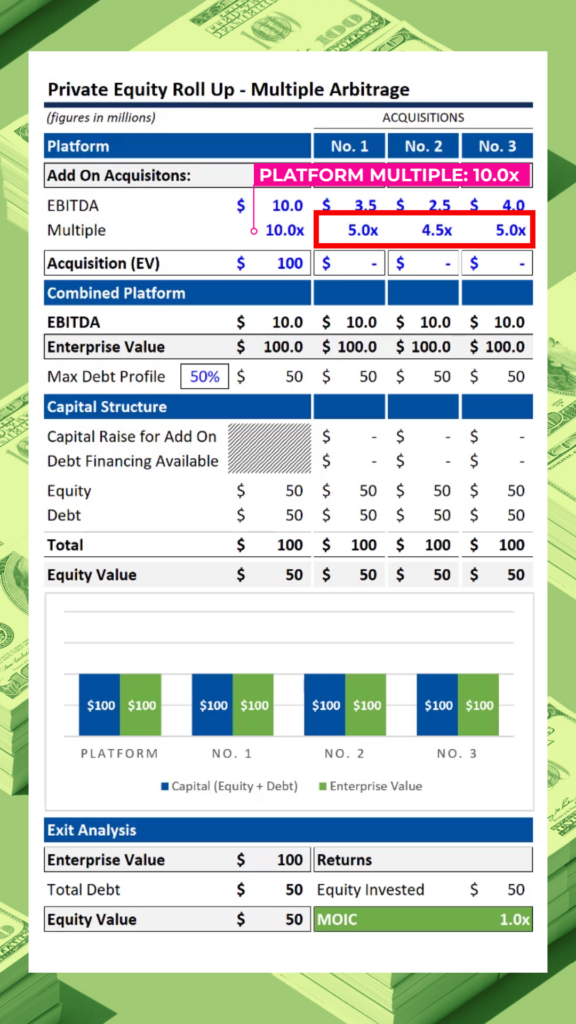

In the image visible below, you will see the four acquisitions required to complete this roll up, but the figures running through the model in this image only include the platform acquisition. For the platform we have a $10 million EBITDA business which was acquired for 10.0x EBITDA for a purchase price of $100 million. The three add-on acquisitions identified sum to an additional $10 million of EBTIDA, but the average EBTIDA multiple for the add-ons drops to less than half the multiple required to close on the platform (red rectangle in the image below).

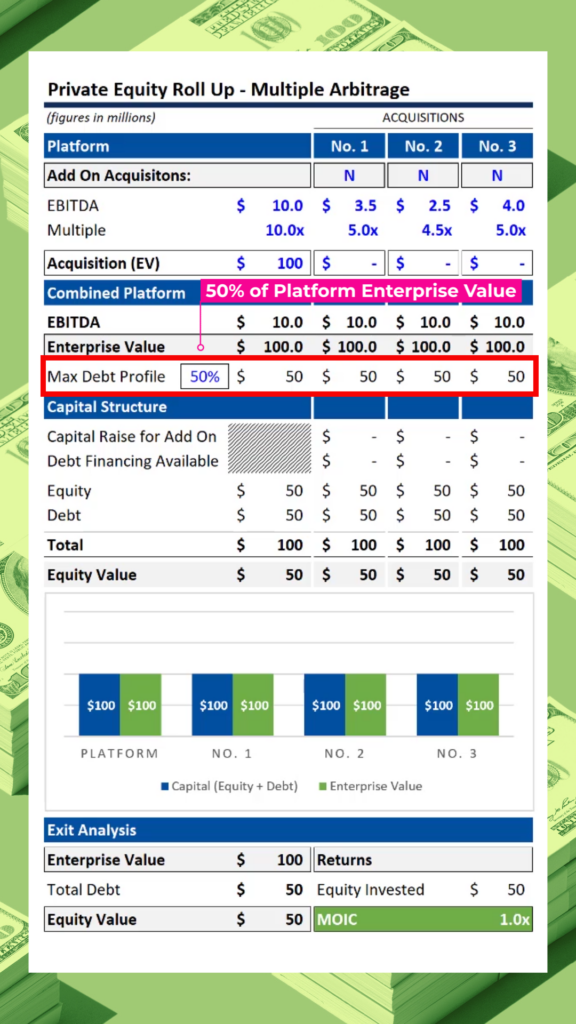

One of the additional incredible benefits of a roll-up business model initiated with a healthy platform company, is that the combined scale allows the sponsor to make acquisitions with debt. In our financial model, we have included a “Max Debt Profile” equal to 50% of the combined platform’s enterprise value (see image below).

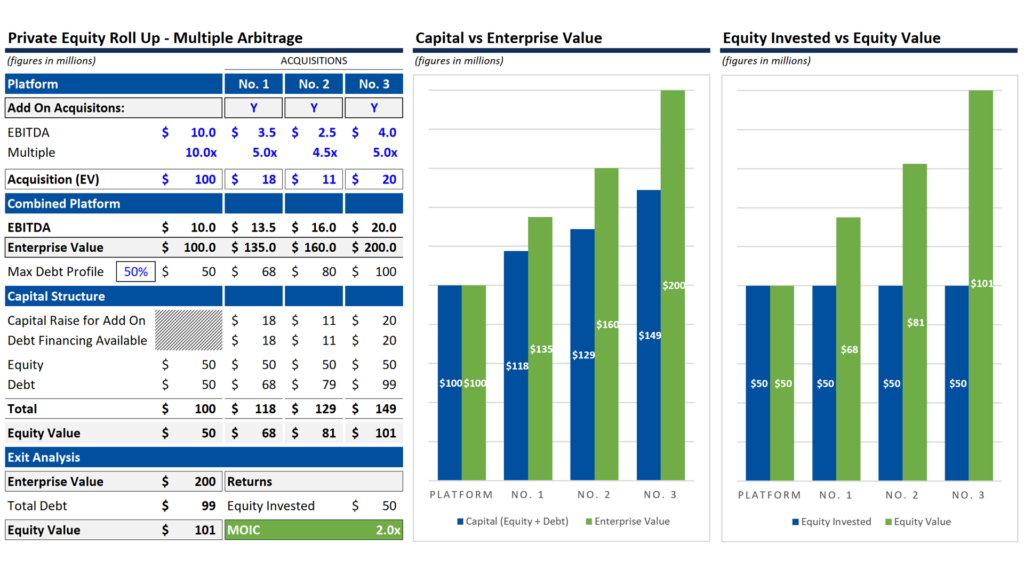

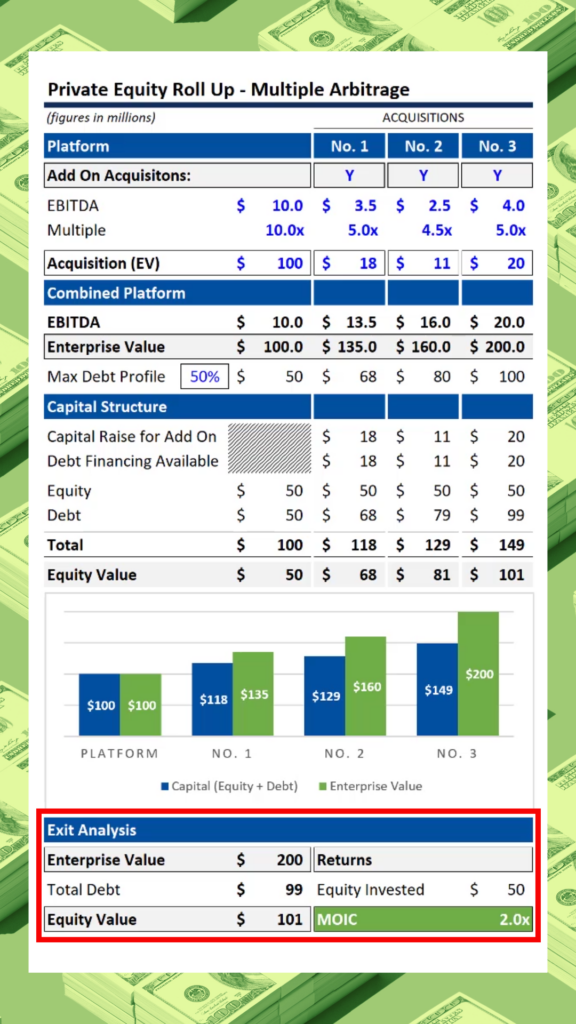

Once the add-on acquisitions are flowing through the model (see image below), it becomes easy to see how the availability of leverage under the combined platform enhances returns. With the initial investment, the capital invested is equal to the platform’s enterprise value. Once you start making acquisitions at lower multiples of EBITDA, the combined platform’s enterprise value, which is calculated with an EBITDA multiple of 10.0x, quickly exceeds the sum total of capital invested (including both equity and debt).

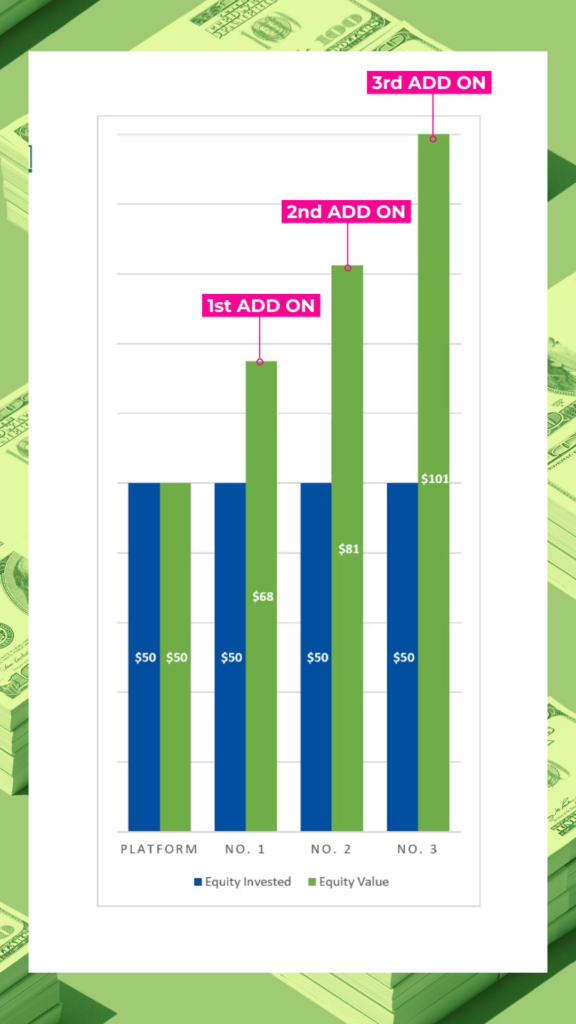

The benefit is further magnified if you look at equity invested and compare it to the combined platform’s equity value. Since the combined platform’s scale makes it possible to close each of the three add-on acquisitions with debt financing, this strategy generates a return of 2.0x by only taking advantage of multiple arbitrage (note: there are additional benefits to properly executed roll ups, but this post is focused exclusively on multiple arbitrage).

This example is entirely hypothetical, but this strategy is used constantly by private equity firms and independent sponsors alike. If the numbers seem astounding to you, please check out the links that follow (it might blow your mind).

Learn more about private equity transactions with ASM’s Private Equity Training course. The Private Equity Training course at ASimpleModel.com was developed by industry professionals. The content goes beyond the LBO model to explain how private equity professionals source, structure and close transactions.

Private Equity Roll-Up Success Stories: