Insights

Why Is Specialization Taking the Private Equity World by Storm?

The role of specialization in private equity. Research indicates that that PE funds that classify as “niche” achieved an average IRR of 38%, while mainstream PE funds achieved 18%.

Private Equity Stock Options Primer

What do you need to know about private equity stock options agreements? This post provides an introduction to the topic.

The Nuts and Bolts of SBA 7(a) Loans

How to secure an SBA loan to buy a small business. An introductory guide to how SBA loans work and how to get one.

Let Uncle Sam Leverage Your LBO: A Quick Guide to SBA Loans

A quick guide to SBA loans for private equity Transactions in the lower middle market. Learn the advantages of SBA financing.

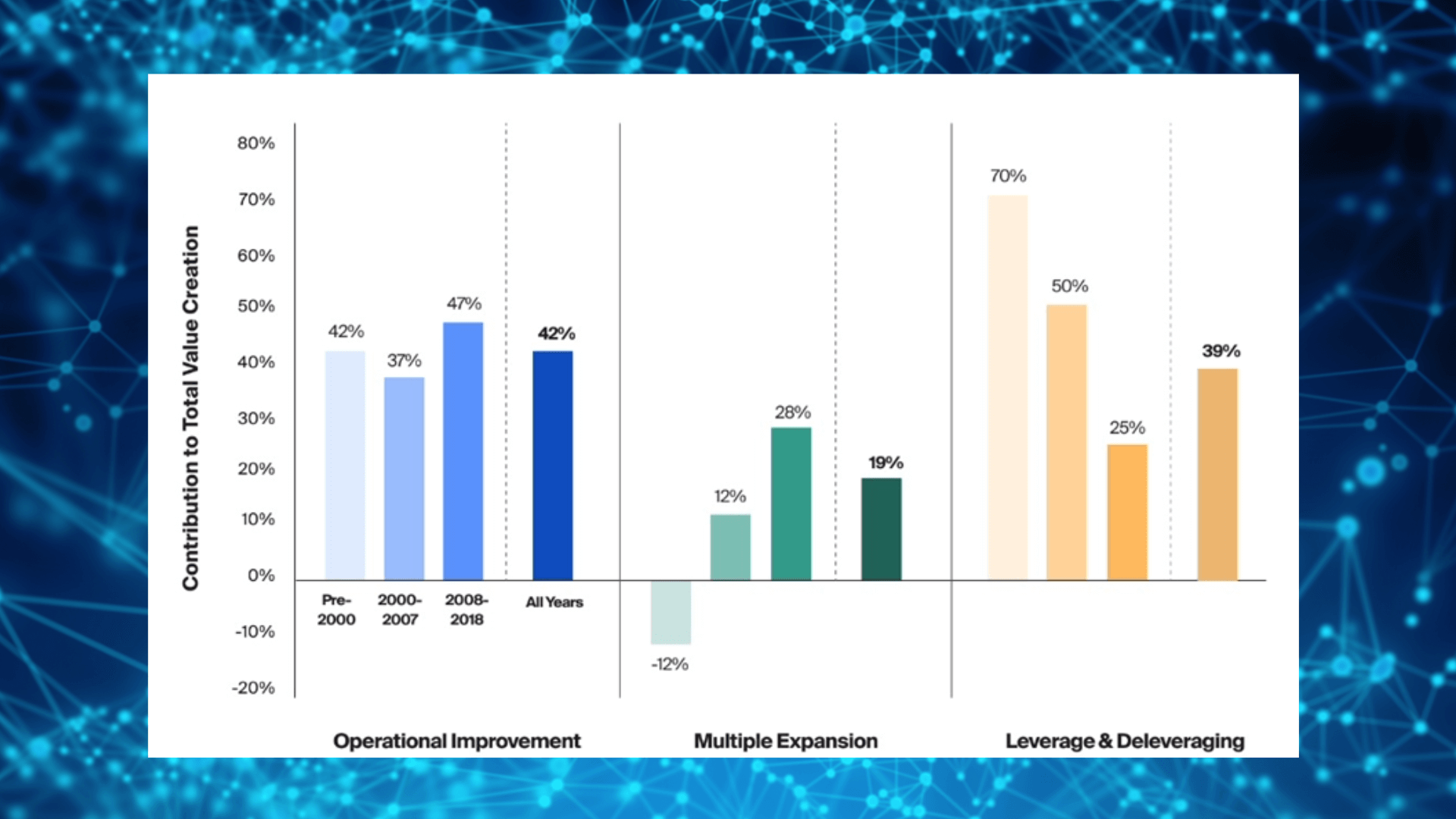

How Private Equity Firms Generate Returns

How private equity firms generate ROI over time. This post explores three primary value drivers in LBOs.