Insights

M&A Auction Process

In this post we will cover the M&A auction process from the buyside perspective by detailing a “standard” process for a private equity group. In any process the objective should be to win by the smallest margin possible. Every participant knows this in theory, but the gamesmanship and strategy involved in an M&A auction can make it difficult in practice (as the first video below will demonstrate). But before we dive into the strategy, let’s first outline the process.

Personal Budget Template in Excel

In this post we are including a personal budget template and a “watch-me-build-it” tutorial video that explains how the template works. Please see the video below for more detail.

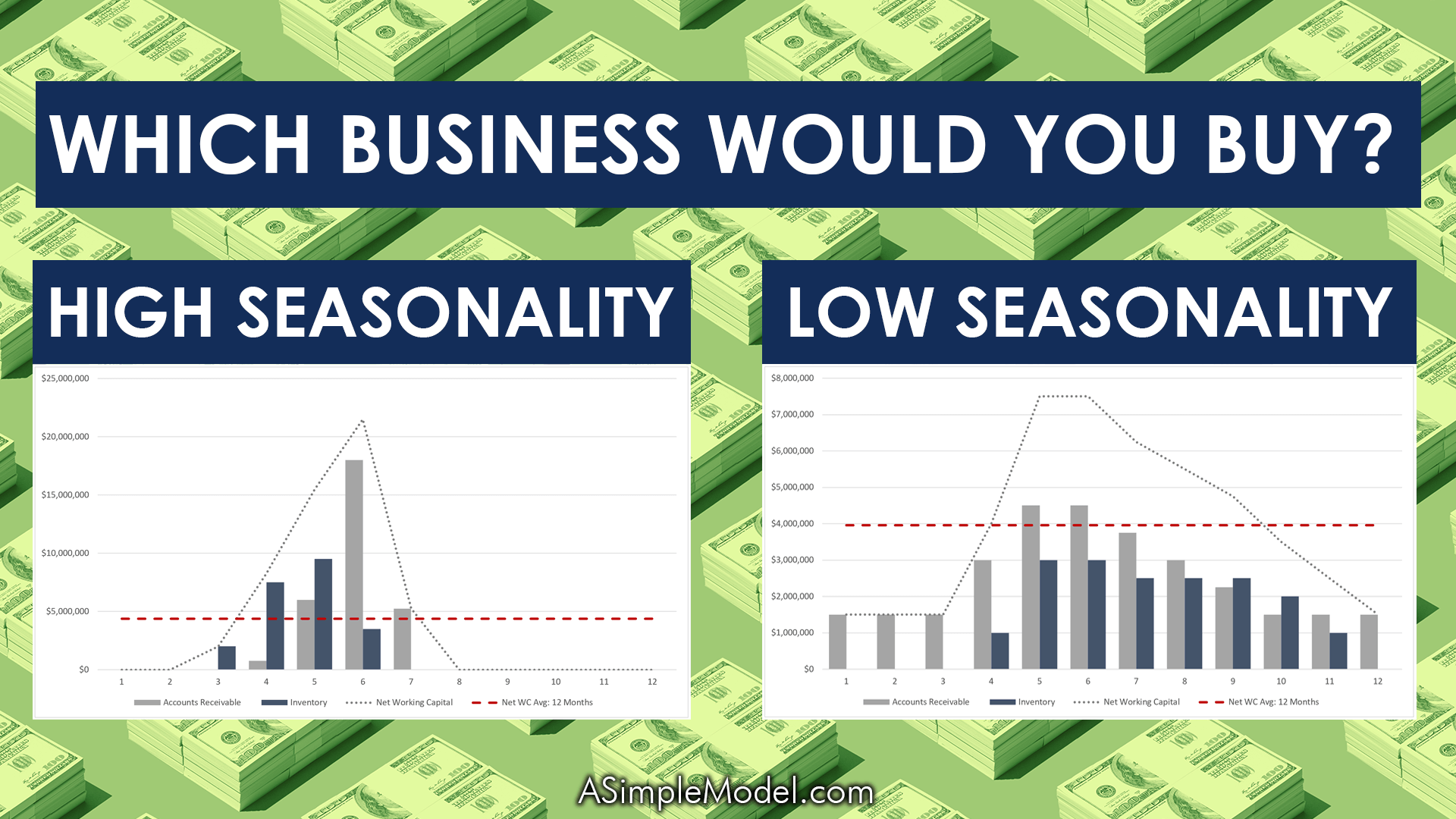

Working Capital in a Seasonal Business

Seasonality can have a drastic impact on the amount of working capital required to run a business, which is why it is frequently cited as one of the primary revenue-related challenges in negotiating the working capital adjustment in a private equity transaction (aka “the working capital peg”). To help give this concept some teeth, in this post we will use visuals to explore how seasonality impacts the liquidity required to maintain a business.

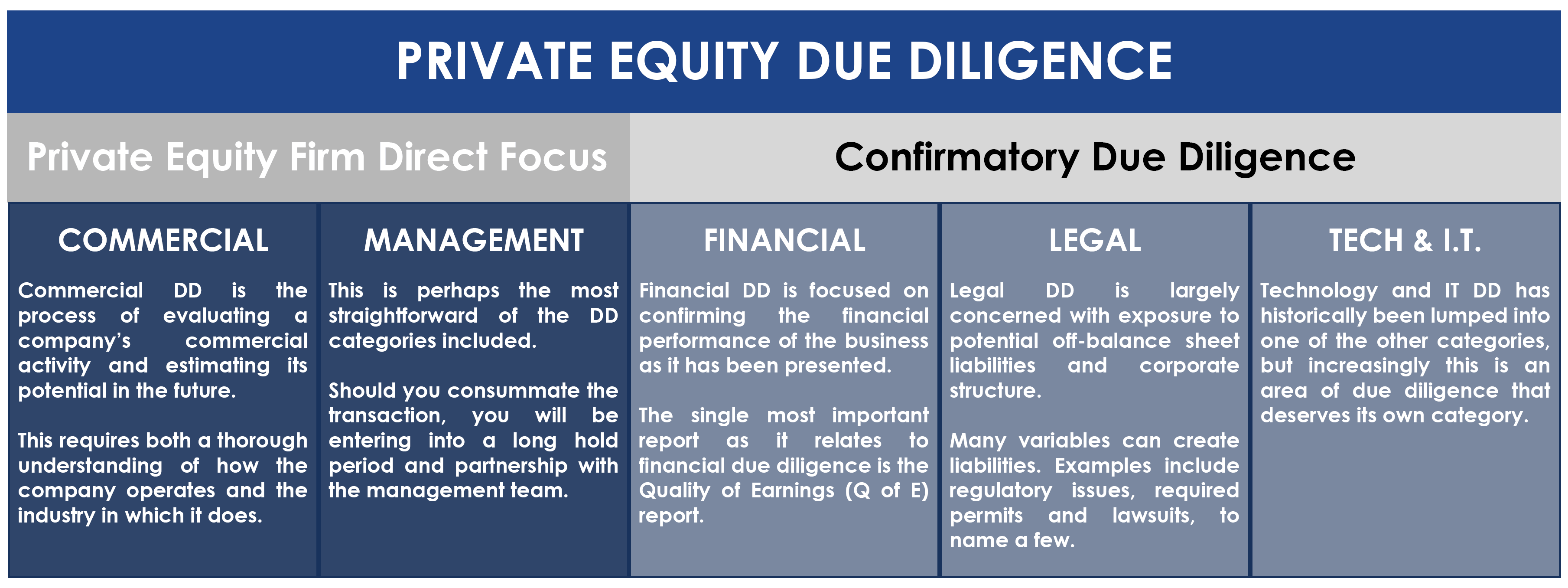

Private Equity: Types of Due Diligence

Private equity due diligence has been traditionally taught with a focus on commercial, financial and legal due diligence. But you will not find a single investor that will downplay the role of management in an operating business, and while information technology (IT) may have been viewed largely as a support function historically, it is increasingly viewed as a driver of growth and value within an organization. For these reasons in this post we will address management due diligence and IT due diligence as well.

Private Equity Deal Sourcing Process

Finding an attractive deal in private equity requires a tremendous amount of work. This video highlights the number of opportunities a private equity firm evaluates before closing a single transaction.