Insights

Debt Recapitalization in a Three-Statement Model

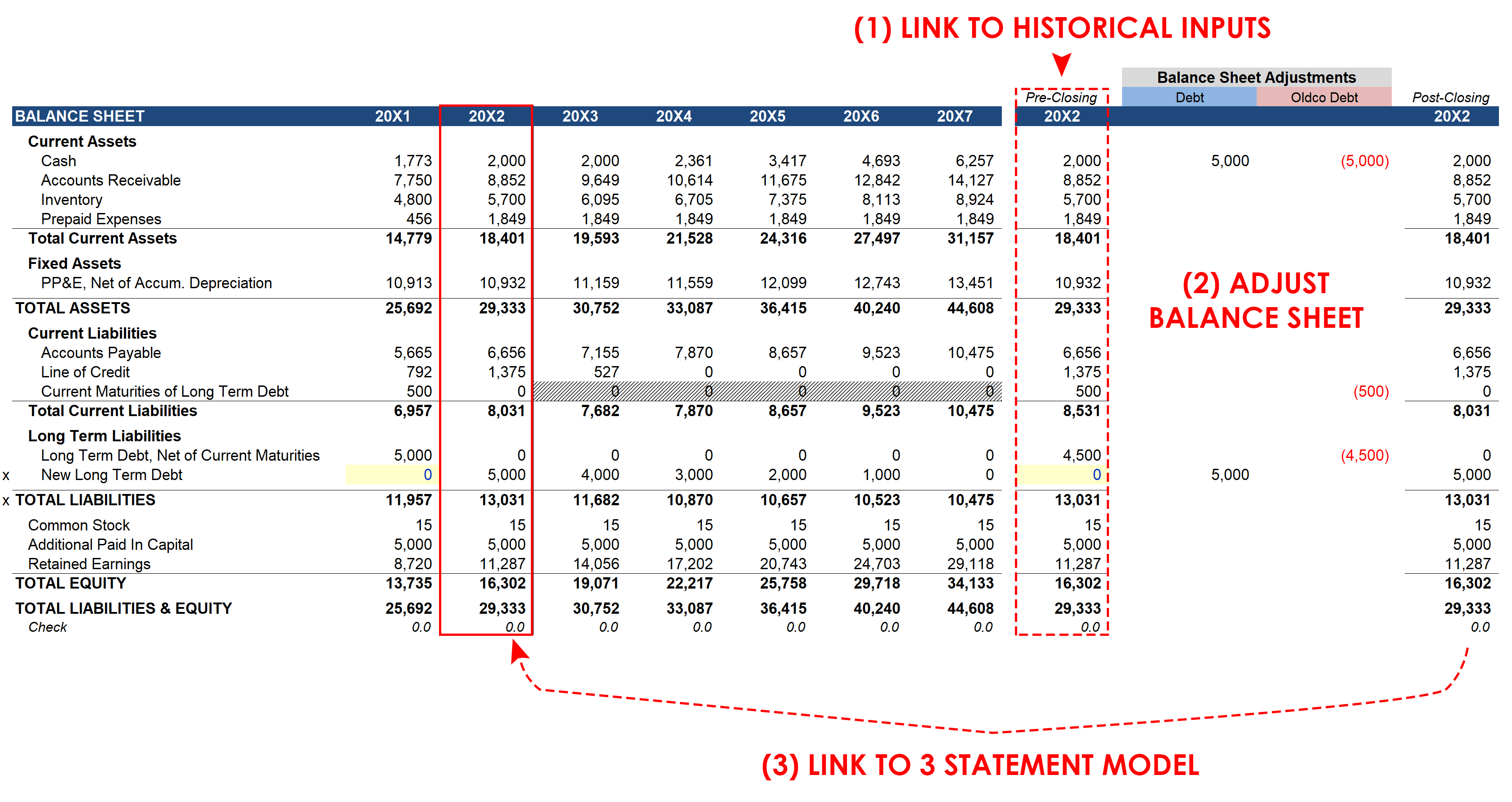

In this post we will cover a simple debt recapitalization in a three-statement model. This is a continuation of the post titled “Adding a Loan to a Three Statement Model,” and relies on the same workbook.

Adding a Loan to a Three Statement Model

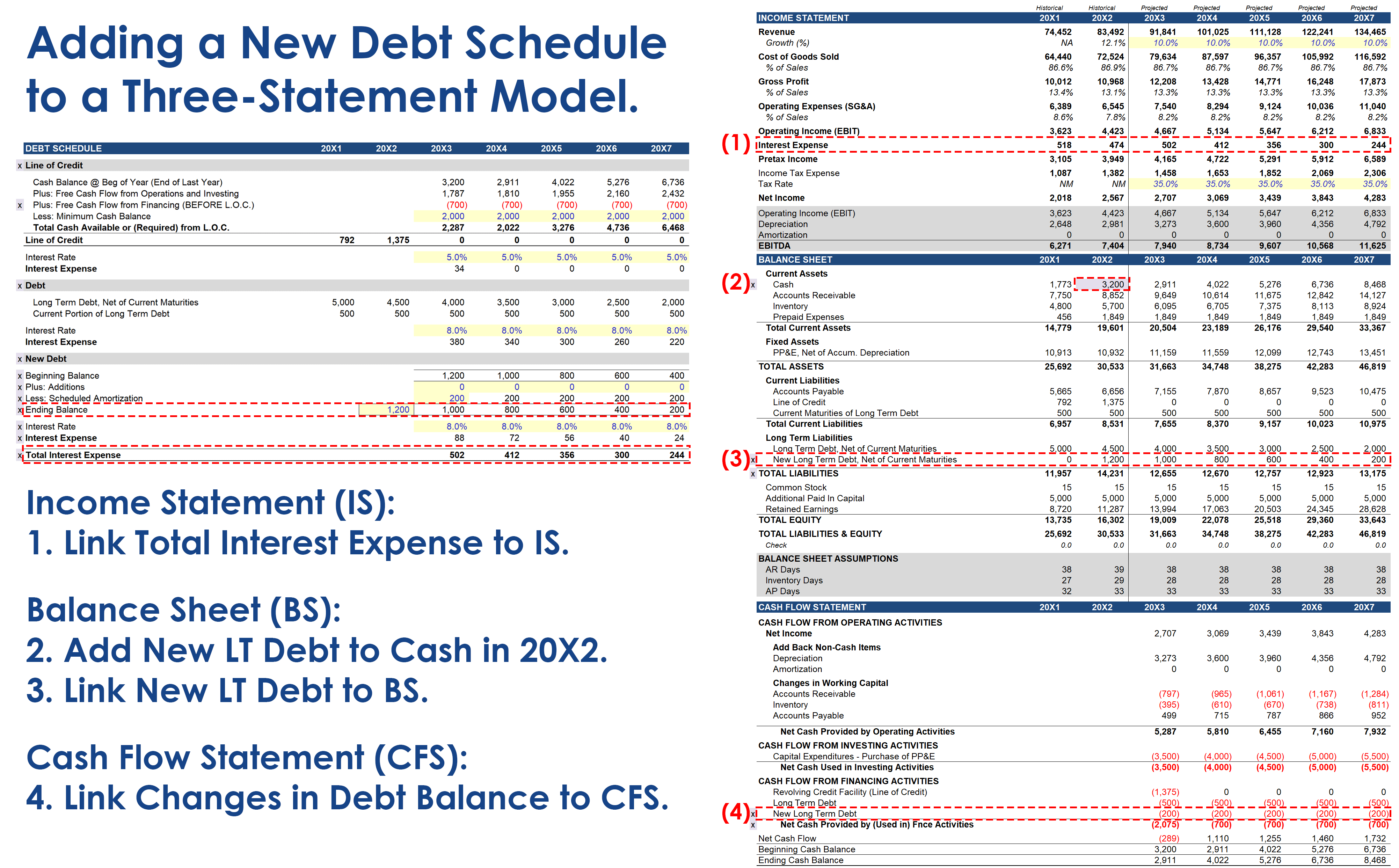

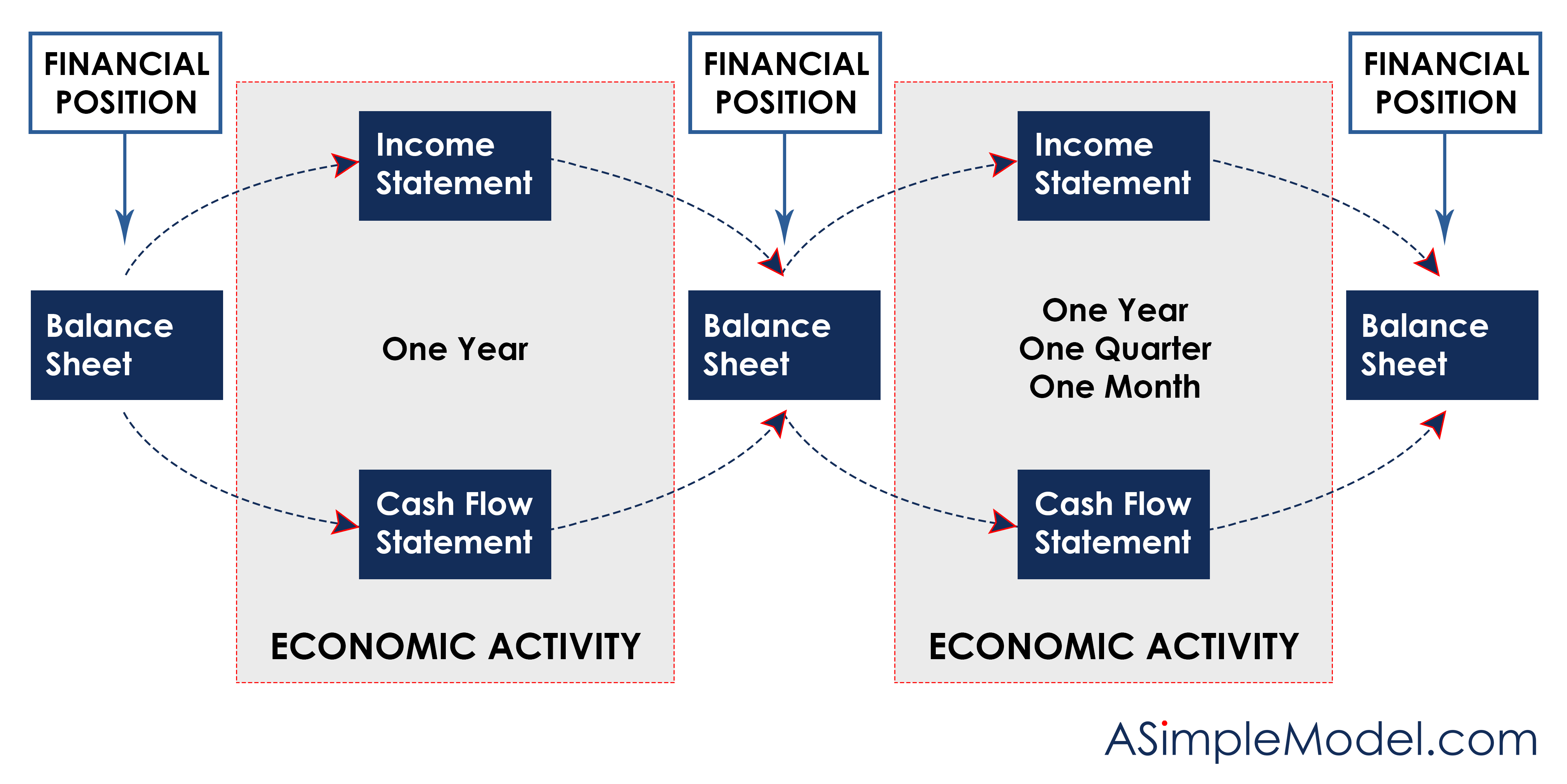

In this post we will cover the process of adding a new debt schedule to a three-statement model. For this exercise we will be using the three-statement model built at the beginning of the Integrating Financial Statements video series (template available for download at the bottom of this post).

Representations and Warranties of the Seller

This section of the stock purchase agreement contains statements of fact and assurances made by the Seller that must be true and correct as of the closing date. In an aggressively summarized format, the Buyer is looking to have the following confirmed:

Interest Expense in a Monthly Financial Model (Cash Interest vs. Interest Expense)

Interest expense is a period expense, so it appears in each period on your income statement in a financial model. Per most credit agreements, however, interest is only paid on a quarterly basis. Consequently, in a monthly financial model you will have periods with interest expense on the income statement without a corresponding cash outflow for interest paid. (Template available for download at the bottom of this post.)

Converting an Annual Growth Rate to a Monthly Growth Rate

The most common error I see in financial models as it relates to growth rates is to divide an annual growth rate by 12 to arrive at the monthly growth rate. In this post we will explore the correct way to convert growth rates for all periods.