Insights

What is an Earnout?

In a private equity transaction or M&A deal, an earnout is a contractual provision stating that the seller of the business is entitled to additional future compensation based on the performance of the business post-acquisition.

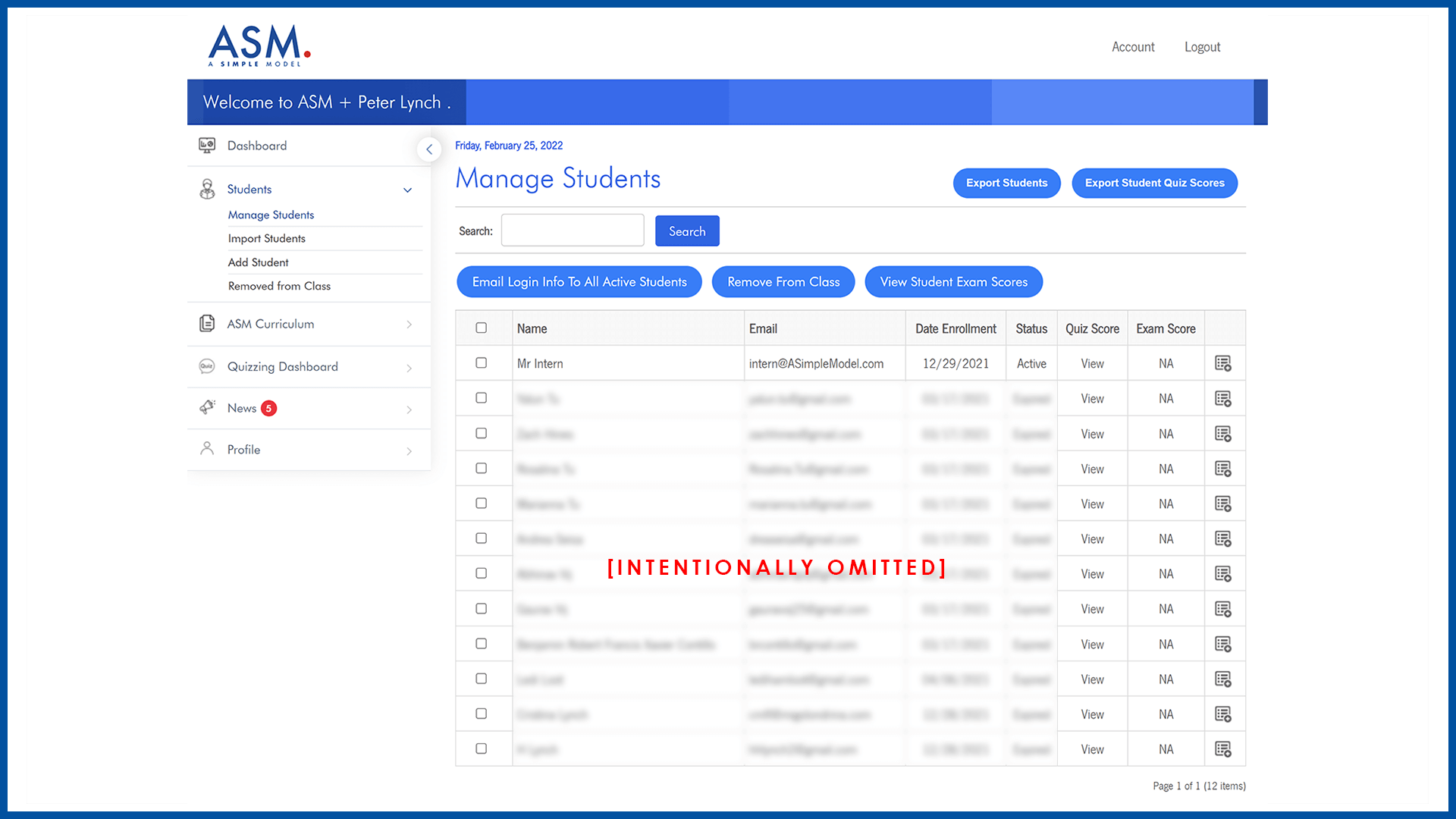

New Features for Professors Teaching Financial Modeling Courses

New updates for professor accounts at ASimpleModel.com! This feature grants professors free access to the financial modeling curriculum for use in a classroom environment.

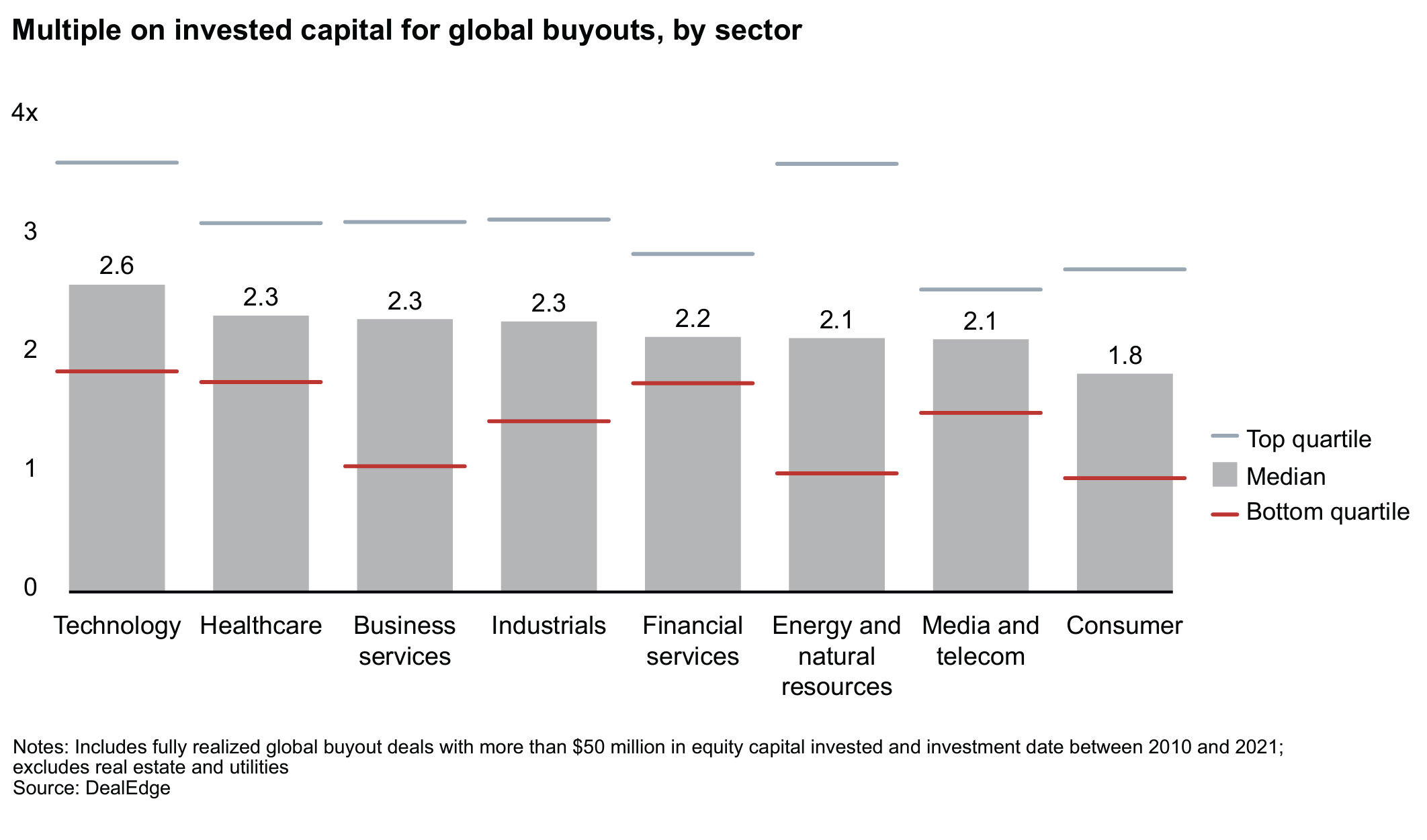

Private Equity Industry Focus

If you want to succeed, it helps to specialize. The most recent Global Private Equity Report released by Bain & Company explains how sector-focused private equity firms are gaining an edge over the classic buyout fund.

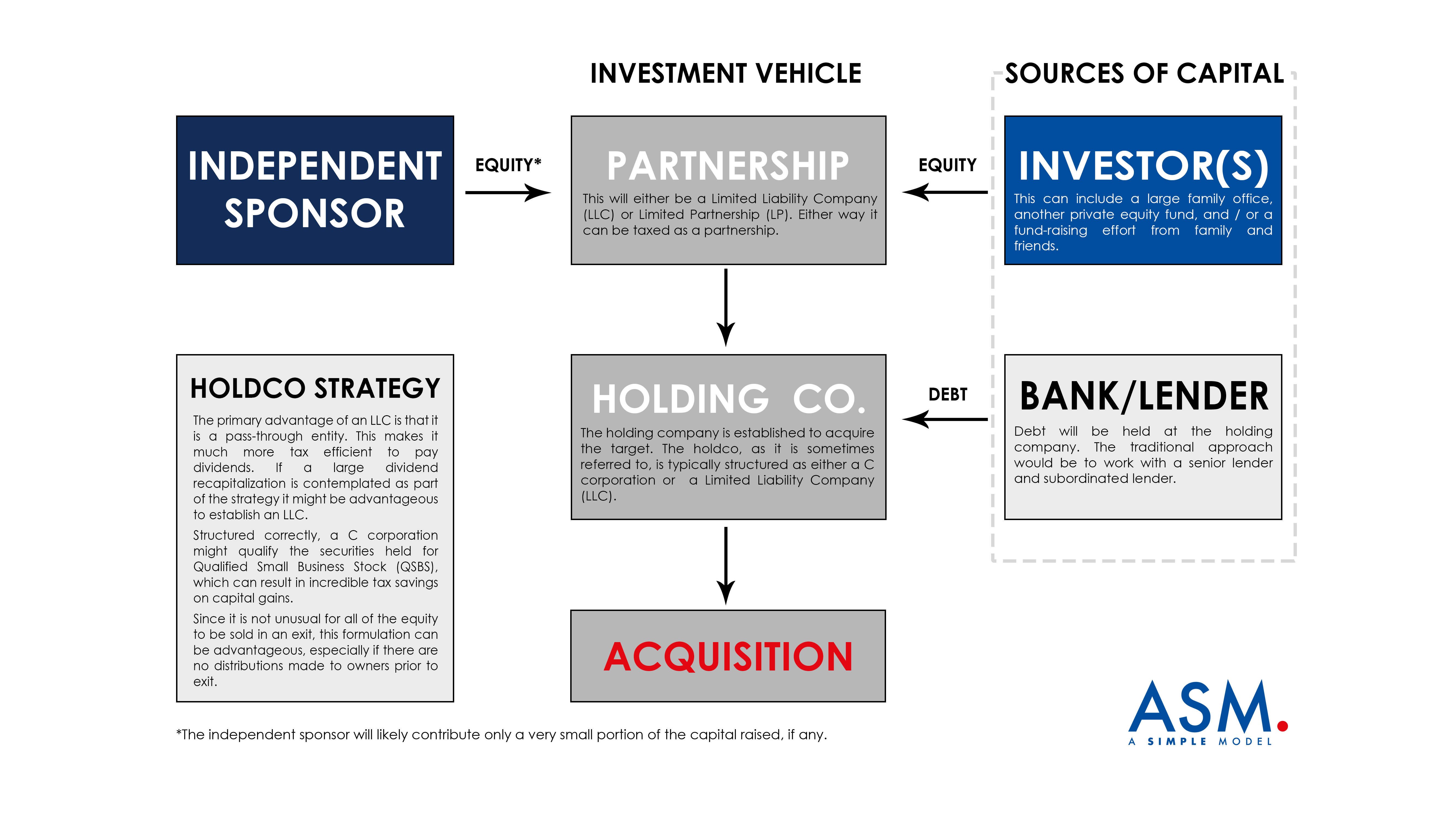

Independent Sponsor: Company Control without Majority Capital

How an independent sponsor gains company control absent a majority equity stake or controlling interest in the company acquired.

LLC and LLC Operating Agreement

LLCs are popular in private equity transactions because they are easy to establish and because they offer a lot of flexibility for different equity structures.