Insights

Building a Financial Model for a Startup: A Live Experiment

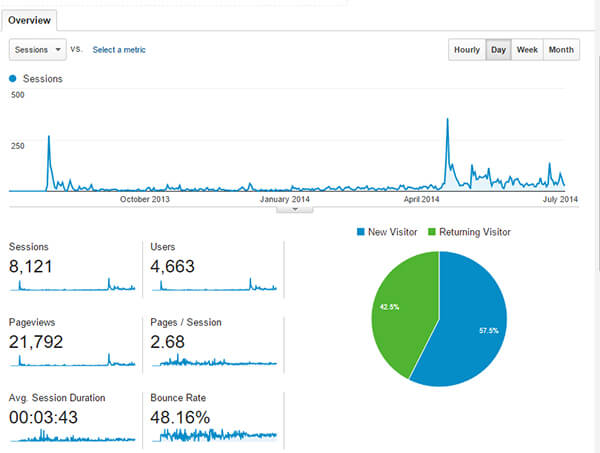

The Business Development video series on this website uses real data to build a financial model for ASM, which effectively makes the series a startup financial model tutorial. When I launched this website in July of 2013, my professional experience analyzing companies was limited to large public or private businesses. I did not have any prior exposure to startups, but that started to change rapidly as I began contemplating this project. Since ASM went live, I have found myself interacting with entrepreneurs and VC investors more frequently. It’s been a terrific experience to gain this new perspective.

Integrating Financial Statements Video Transcribed

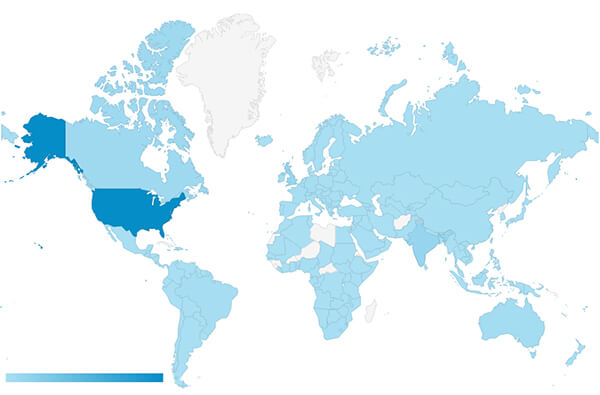

As the site grows it has been fantastic to watch the user base expand across the globe. Recently I have received a few requests from Spanish and French speaking users of the website for a transcription of one of the longer videos: Integrating Financial Statements.

Excel: =IRR() vs. =XIRR() (continued...)

I thought it would be worthwhile to provide a follow up to my original post on this topic. In my conversations with business owners this discrepancy gets a lot of attention on account of the critical role these figures can play in a transaction (as my previous post explains).

FASB Announces Accounting Standards Update

Per the image above, while it may not be the most exciting news, it’s information you need to know: The Financial Accounting Standards Board (“FASB”) has issued a final standard to simplify the presentation of debt issuance costs. Most concisely, this new standard requires that the costs associated with debt issuance be presented as a direct deduction from the associated debt liability. This is in contrast to the previous approach, which called for capitalizing this expense and amortizing it over the life of the loan. This update became effective for financial statements for fiscal years after December 15, 2015, and interim periods within fiscal years by December 15, 2016.

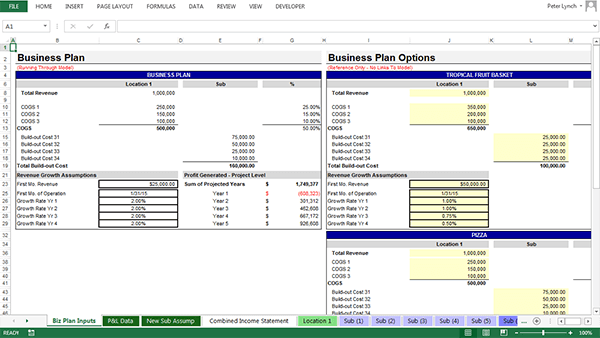

Multi Location Model (Franchise Model)

This video walks through a model that assumes you operate a single-location business, and that you are contemplating opening new locations. The Excel template permits adding new locations and outputs the financial performance of the combined entity. In this installment the model will be introduced, and the process of inputting different assumptions will be explained.