Insights

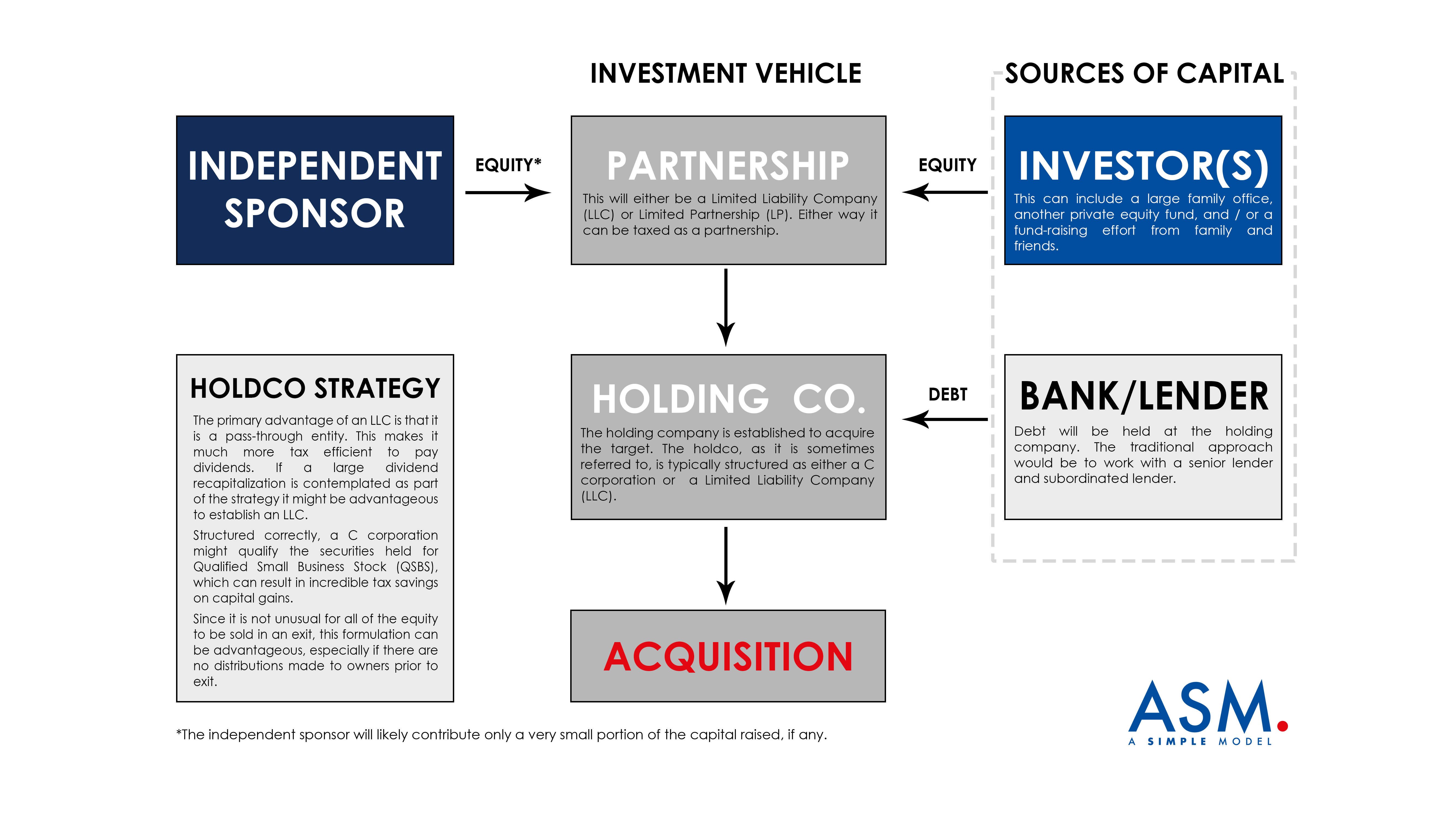

Independent Sponsor: Company Control without Majority Capital

How an independent sponsor gains company control absent a majority equity stake or controlling interest in the company acquired.

LLC and LLC Operating Agreement

LLCs are popular in private equity transactions because they are easy to establish and because they offer a lot of flexibility for different equity structures.

Interview: Starting a Sector-Focused Hedge Fund

In this interview Adam Rodman explains how he launched a special purpose investment vehicle to pursue a contrarian investment thesis.

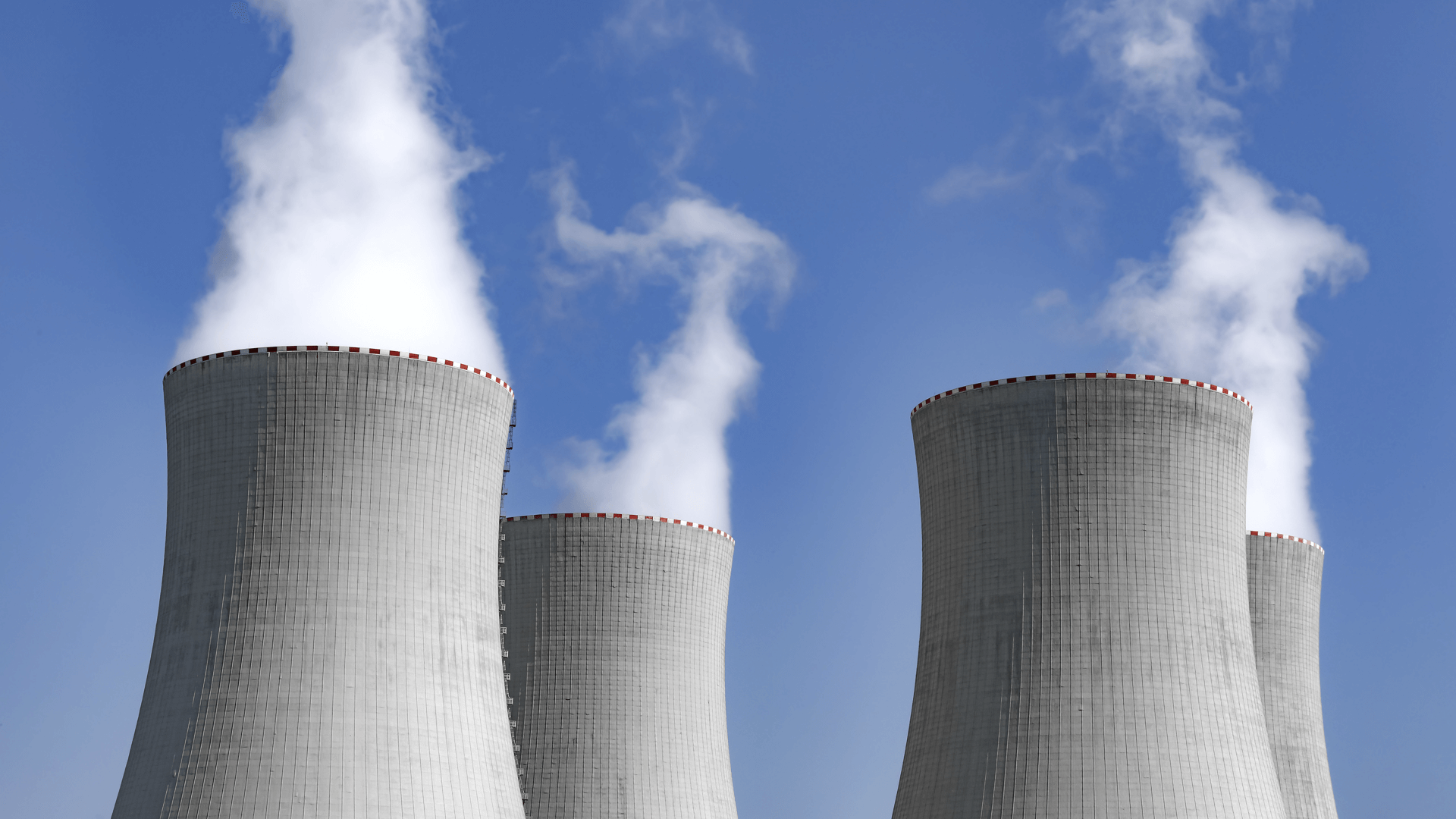

Contrarian Investing Example: Uranium

In this article we explore an example contrarian investment thesis using Segra Capital’s bet on the price of uranium.

Pitching a Startup

This post addresses financial topics that I frequently find are missing in an early-stage investor deck. What follows applies largely to investment proposals for companies with $250 thousand to $5 million of revenue that are not yet profitable.