Last week Bloomberg published an article criticizing luxury goods maker LVMH for unpaid labor in a supply chain that enables the company to sell a $9,000 vicuña sweater. I made a short video (TikTok | IG) about it because it overlooked a lot of variables. I find it frustrating when the media attacks companies for success. There are plenty of examples of bad behavior that warrant such attacks, but success shouldn’t be one of them. And occasionally an attack misses the mark entirely.

A common example is a journalist reporting that a consumer staples company (i.e., a company that makes and sells something frequently purchased, like cereal) made “record profits” while the consumer took the hit in the supermarket aisle from rising prices. In most instances, these profits are reported on a dollar basis, and not on a percentage basis relative to revenue. But if profit had declined on the latter basis, then “record” profits do not necessarily mean the company is healthy. And since a company uses profits to fund its operations and working capital, if margins (profit as a proportion of revenue) drop, eventually the company will need to rely on outside sources of capital such as debt, which will cost money and further reduce profits, which can kick off a vicious cycle (related post: Working Capital and Cash Flow).

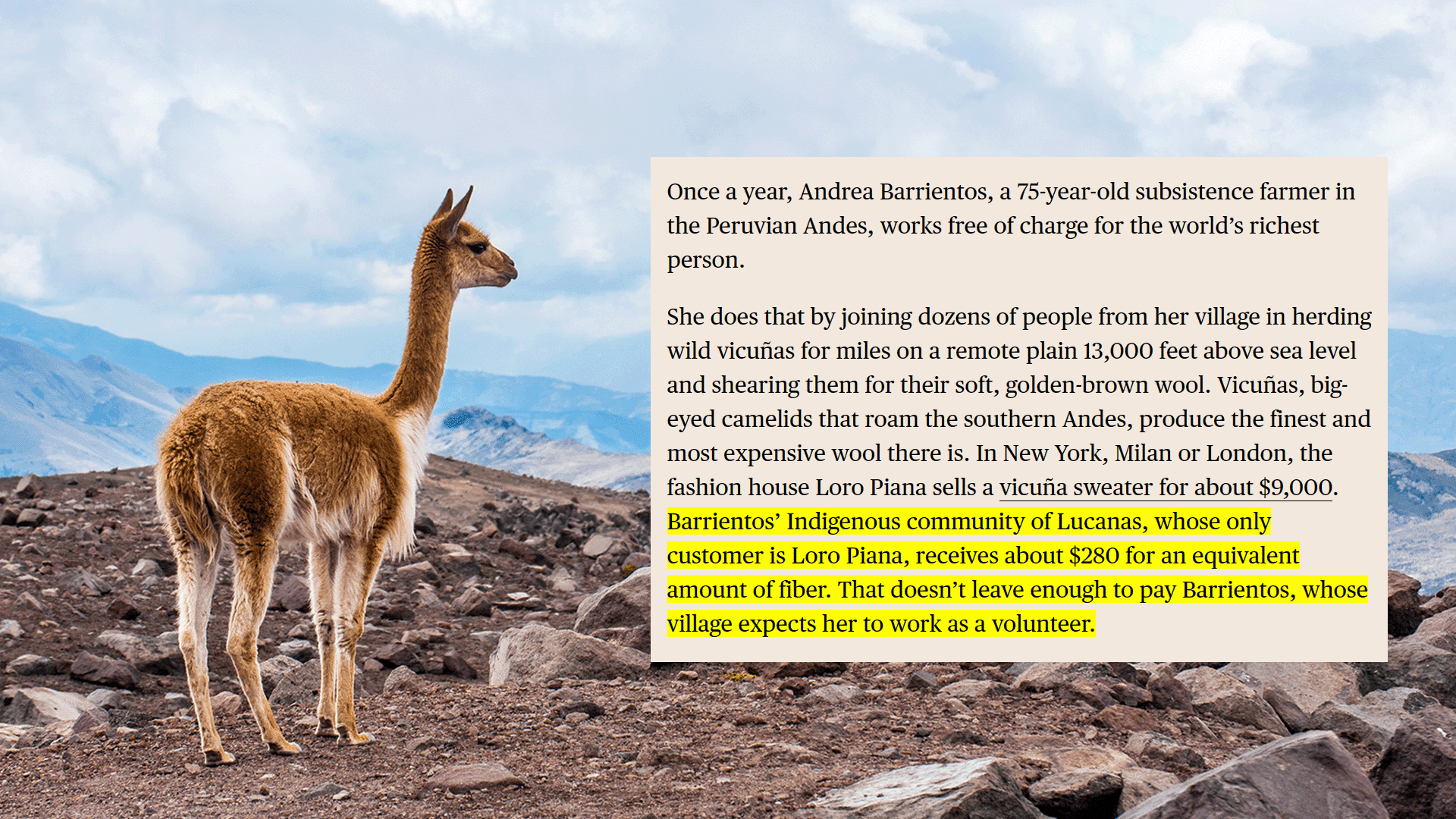

Getting back to the Bloomberg piece, the article opens with the misleading claim that, “Once a year, Andrea Barrientos, a 75-year-old subsistence farmer in the Peruvian Andes, works free of charge for the world’s richest person.” They are of course referring to the founder and CEO of LVMH, Bernard Arnault. What a way to get your readers fired up. The conclusion of the very next paragraph states that the farmer is asked to volunteer because her village cannot afford to pay her…which is not quite right. So let’s explore what’s really happening. But first, a little more about this soft and adorable creature with the in-demand wool—the vicuña.

(Source: Bloomberg – LINK)

WHAT IS VICUÑA WOOL

I never would have guessed this, but the vicuña is the smallest living member of the camel family, and (would’ve guessed it) the wild cousin of the better known and domesticated alpaca. A native of the Andes mountains of South America, vicuñas were on their way to becoming a tragedy of the commons before receiving legal protection in 1969. The global population had dropped to around 6,000. With no incentive to protect the population, over which no one held property rights, hunters were simply killing and skinning the creatures for their wool, which is valuable.

With a diameter of only 12 microns (1/12,000 of a millimeter), vicuña hair is one of the finest natural fibers in the world. Products made from it are incredibly soft, and a single animal produces, at most, only about 0.5 kilograms, or 1.1 pounds, of wool. A period of three years is required for the animal to regrow its coat.

Since protections were put in place, the population of vicuñas has recovered to about 350,000 today. And a legal market for the wool, which can be sheared from the animals without hurting them, has provided the impoverished communities of the vicuñas habitat an opportunity to profit from a natural resource.

So why aren’t farmers in the Lucanas community getting paid?

WHY DOES THIS HAPPEN?

The very same Bloomberg article links to a study that explains it: It’s the local community in Peru and its elected president that negotiates the price for wool with Loro Piana and decides how to distribute the earnings they receive from the company (more details at the bottom). Loro Piana doesn’t make the call about whether the shearers are paid. I can’t confirm it, but if I had to guess, I would assume the community president does get paid (per the study, “Management is directed by a manager, and all staff are paid.”).

The second thing this article overlooks is that raw materials—precious metals, diamonds, and gemstones aside—typically comprise a very small percentage of the sale price for most luxury goods.

THE COST OF RAW MATERIALS

Likewise, the shearing of a vicuña is a very small part of the process of producing a finished product from its wool. Spinning the tiny fibers into quality yarn, for instance, requires expensive machinery and sophisticated expertise, and communities like Lucanas have so far lacked the resources to climb the supply chain and earn greater returns by adding value to the raw material.

Interestingly, the largest value add in the entire supply chain occurs at the final stage, when a product such as a sweater becomes something more ethereal—a brand—something that skilled marketing has led consumers to see as being worth more than the sum of its parts. And this dynamic is hardly unique to vicuña sweaters.

COST TO MANUFACTURE A ROLEX

As I explored in a past post (What Makes a Rolex so Expensive?), the cost of raw materials in a Rolex watch can be almost insignificant compared to its sales price. The stainless steel in a Rolex Cosmograph Daytona amounts to less than a dollar of its roughly $13,000 price. Even the white-gold model of the same watch has only about $8,000 of precious metal in its $41,000 price tag. (Note: These prices are from an article dated 2020. Before the pandemic caused watch prices to take off.)

COST TO MANUFACTURE A BIRKIN BAG

It’s the same story with Birkin bags (Cost to Manufacture a Birkin Bag), which despite being handmade have been reported by The Economist to cost only around $800 to produce. That’s for a basic bag that might sell for the low five figures. The crocodile pelt for a $50,000 Birkin bag? It will cost around $1,000 to $1,500, just 2% to 3% of the purchase price. And Hermes can sell the most exclusive versions of this product for hundreds of thousands of dollars. That’s the power of branding.

COST OF RAW MATERIALS FOR A VICUÑA SWEATER

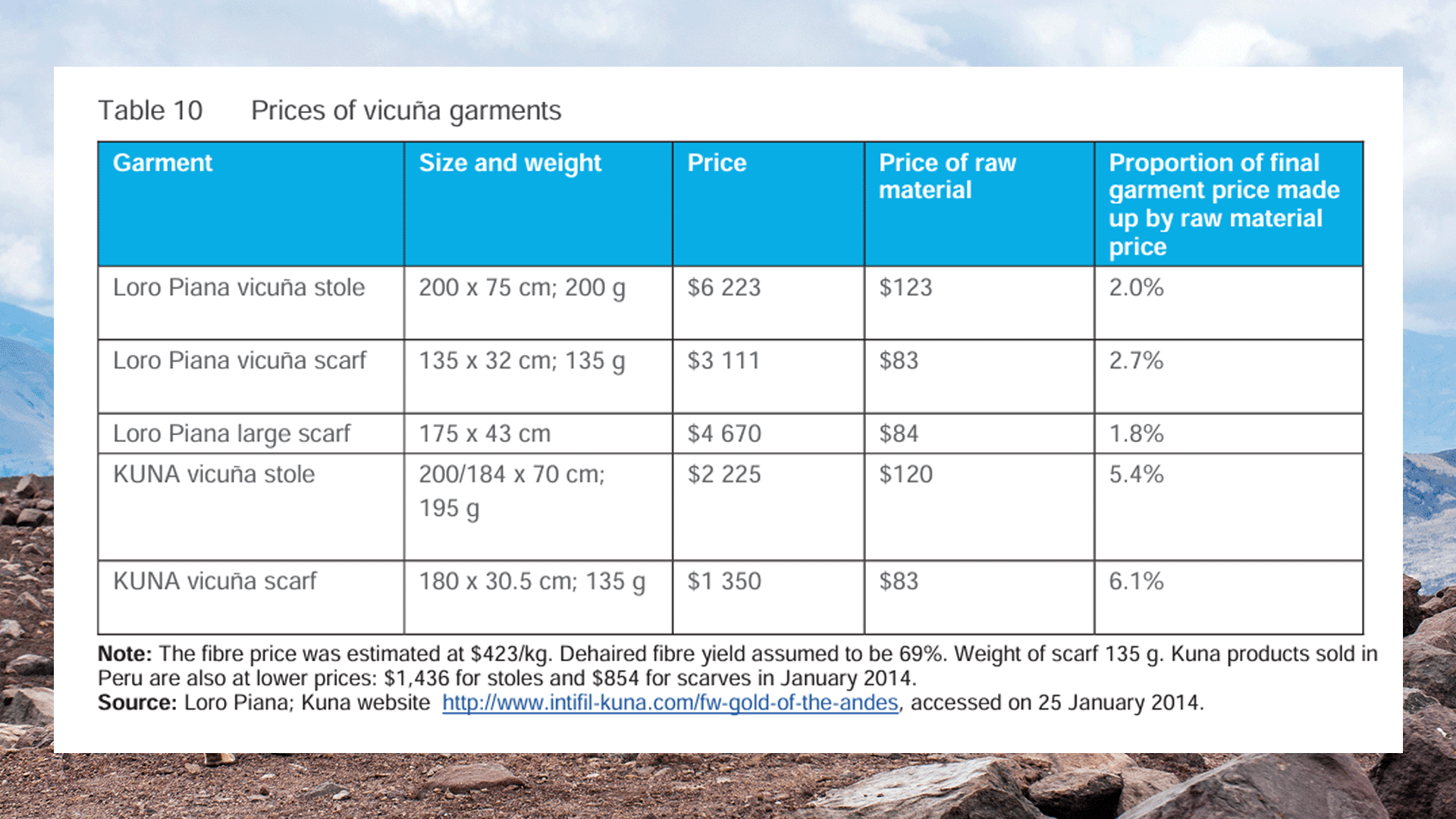

As with Rolexes and Birkins, the raw material of vicuña products from Loro Piana only accounts for about 2-3% of the sales price, as the table below shows. Even for a lesser-known brand such as Kuna, vicuña wool accounts for only around 5-6% of the final product’s price.

(Source: Convention on International Trade in Endangered Species of Wild Fauna and Flora – LINK)

THE VALUE OF A BRAND

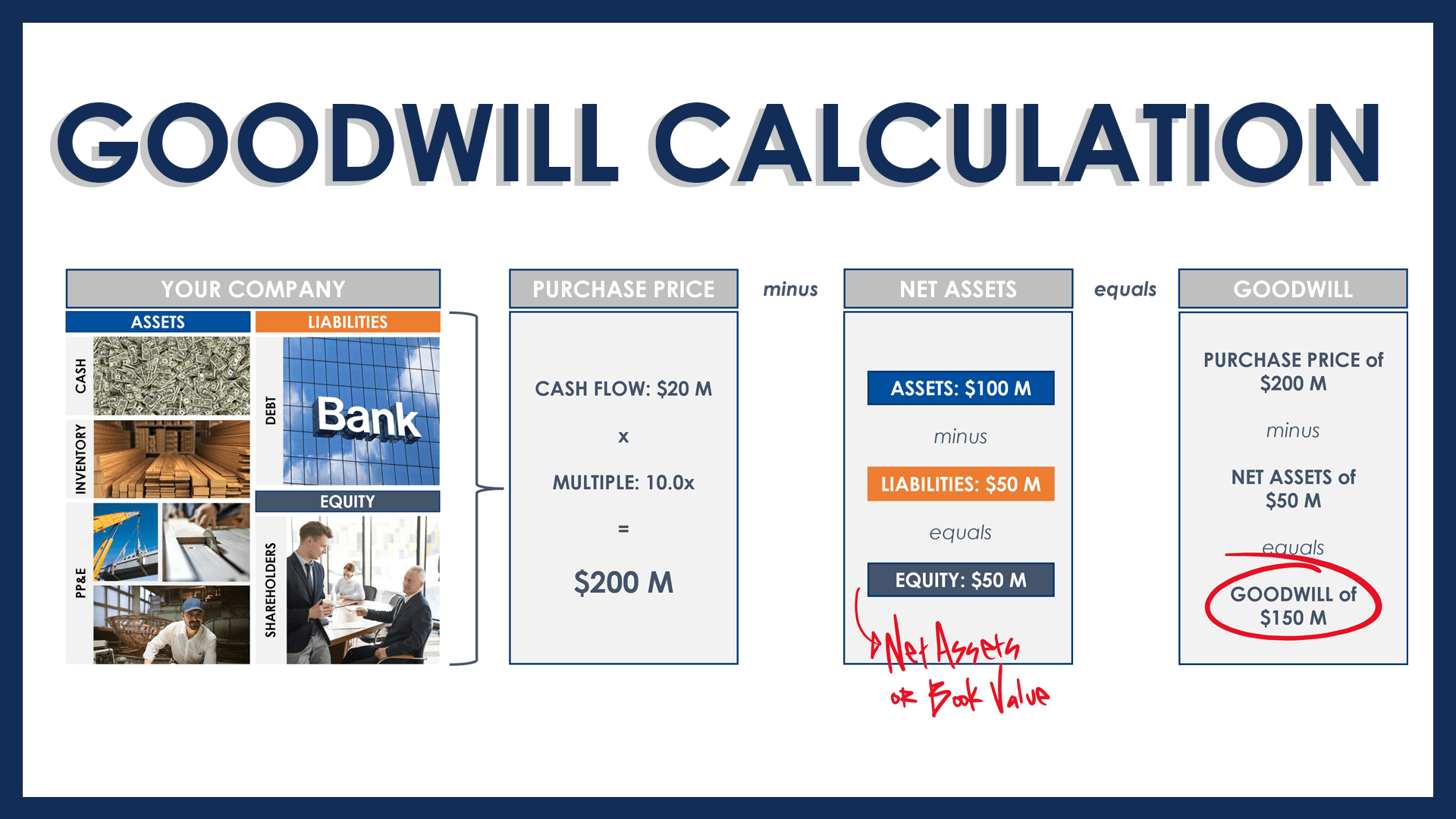

If you purchased one of these luxury companies, you would have to allocate a substantial amount of the purchase price to goodwill. This is because a huge portion of the value is not in the company’s tangible resources, but in the intangible value of a brand like Loro Piana (founded 1924) built over decades, or in the case of Hermes (founded 1837), nearly centuries.

WHY DON’T THE FARMERS GET PAID?

Fair enough, but 2-3% of $9,000 for a Loro Piana sweater is obviously greater than zero. So why isn’t Andrea Barrientos being paid for her work? Her village, Lucanas, operates as a communal economy still rooted largely in tradition. Elected village leaders negotiate the price of vicuña wool with Loro Piana, and at current prices, “This doesn’t leave enough to pay Barrientos,” according to the article. From what I read, outside of the labor associated with rounding up and shearing the vicuña, there is little cost associated with this process. The vicuña live freely and are rounded up once a year. So it doesn’t “leave enough” after what?

Lucanas’ leaders have decreed that villagers must shear vicuña for free, and the article states this towards its conclusion without revisiting Loro Piana’s involvement. Leadership then spends the proceeds on things that will presumably help the entire village. Do they? And if so, why isn’t it mentioned as a benefit? The amount paid is a factor, but how it gets distributed should be a focus as well.

WHAT IS AN OLIGOPSONY

Could Loro Piana pay more? Is the current price fair? This is a tiny market that can be easily influenced, which makes it tricky to define fair. And it operates as an Oligopsony, a market in which there may be many sellers, but only a few buyers. Loro Piana buys most of the world’s vicuña (because their brand can market it extremely well). As such, it is not an environment in which the seller always feels confident exercising their negotiating power. (How Experts Negotiate: Video | Text)

Conclusion

The Bloomberg article wants to tell a story of exploitation by focusing only on the top of a supply chain that involves large international corporations, government entities and local communities. But the story is not that simple.

It’s important to remember that Loro Piana has created awareness and demand around vicuña wool, which is attracting resources to an impoverished area. The article cites vicuña-shearing-related tourism in a negative light, stating that communities “derive more income from tourist activities surrounding vicuña shearing than from the sale of the most expensive natural fiber on Earth.” It’s contradictory to be angry about price and cite “the most expensive natural fiber on Earth.” I also don’t follow the logic suggesting that the price of the raw material should exceed the amount of tourism-related revenue. These communities should benefit from the largest audience possible, and the ability to derive more income should be a positive.

Few businesses operate at a scale that can turn raw material into a refined good via a tedious and expensive process, and successfully sell the finished good with confidence into a wildly competitive market. Maintaining the luxury brand that supports this effort requires a substantial investment (for an example, please see this video describing a $500 million investment in Tiffany & Co). It’s why fortunes are lost by many that attempt to do so.

That said, I don’t know what a fair price is for vicuña, and I don’t know what a community should be paid for delivery of this fiber. That would require more research. But this article is sensationalizing a claim supported by Congressman Robert Garcia and reported by the same journalist on Bloomberg without addressing important details:

“This seems to me as clearly exploitation and it is a huge multinational corporation that is owned by some of the wealthiest people in the world,” Congressman Robert Garcia said in an interview. “Seeing no benefit coming down to the immense labor that is happening here I think is really concerning.”

Garcia sent a letter Friday to Loro Piana Chairman Antoine Arnault and Chief Executive Officer Damien Bertrand demanding the company provide written answers to Congress by the end of April. Arnault is the son of Bernard Arnault, who controls LVMH and is currently the world’s richest person, according to the Bloomberg Billionaires Index.

From everything I’ve read, even if the price of the raw material did increase, the decision to pay the farmers of the Lucanas community would remain outside of the company’s control. In that context, what I dislike most about the article is that I struggle to think it will help solve the problem. A sensationalized claim that incorrectly links wealth accumulation to a supply chain concern outside of LVMH’s control seems more focused on inciting public outrage. And if a change in behavior suggests an admission of fault, what incentive does the company have to respond?