In this post we are going to explore the relationship between profitability on the income statement and cash flow by taking a closer look at working capital. I think this is one of the most important relationships to understand, because a healthy business with positive working capital should have the capacity to fund some or all of its working capital needs through profits generated via the sale of its goods and services.

There are exceptions to this rule. If a company’s revenue experiences strong growth, then it may be necessary to raise outside capital to meet the associated working capital increase in advance of this growth. But there should be some amount of growth that the company can fund itself. To demonstrate how this works we will be taking a closer look at relationships between the income statement and the cash flow statement for a company in the business of manufacturing and selling sailboats. More specifically, we will be exploring how working capital ties up liquidity, and the risks that can arise if cash is mismanaged.

Working capital is equal to current assets minus current liabilities. Changes in this account are crucial to translating net income into cash because when assets increase, cash flows out (due to the purchasing of the assets) and when liabilities increase, cash flows in (due to, for instance, the borrowing of money). To illustrate, imagine our sailboat company sells a 40-foot sloop for $10 million.

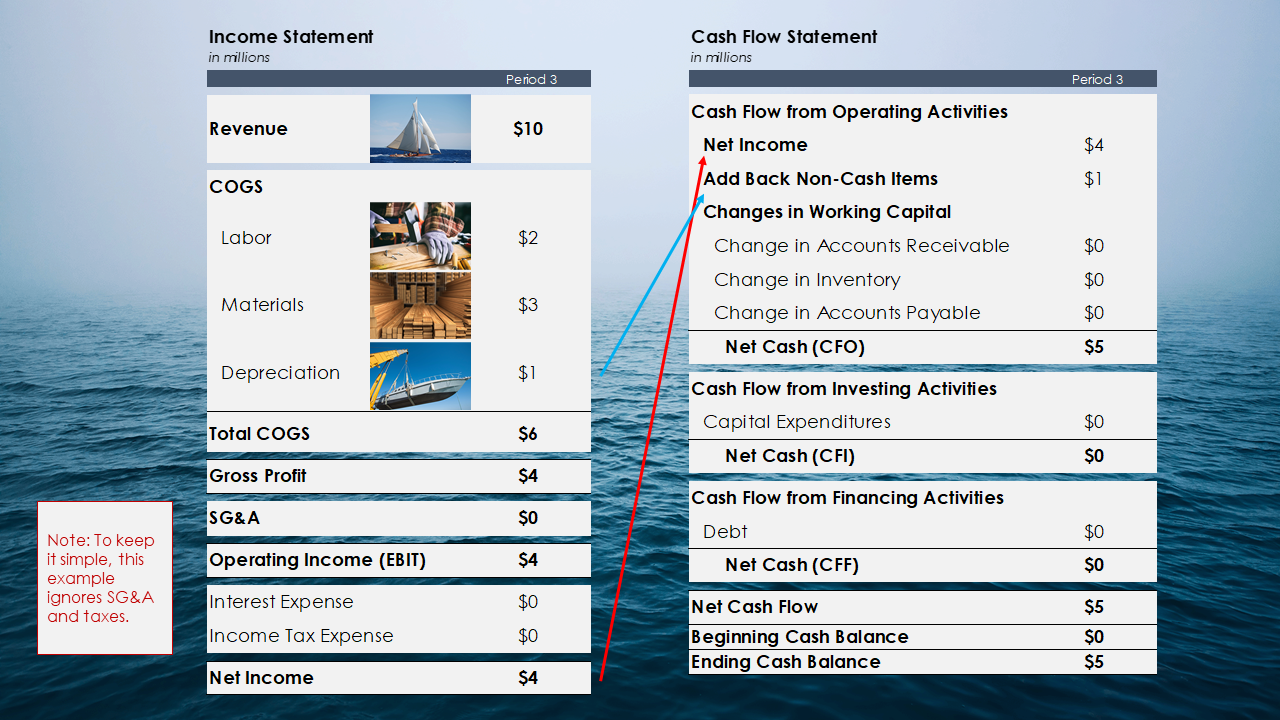

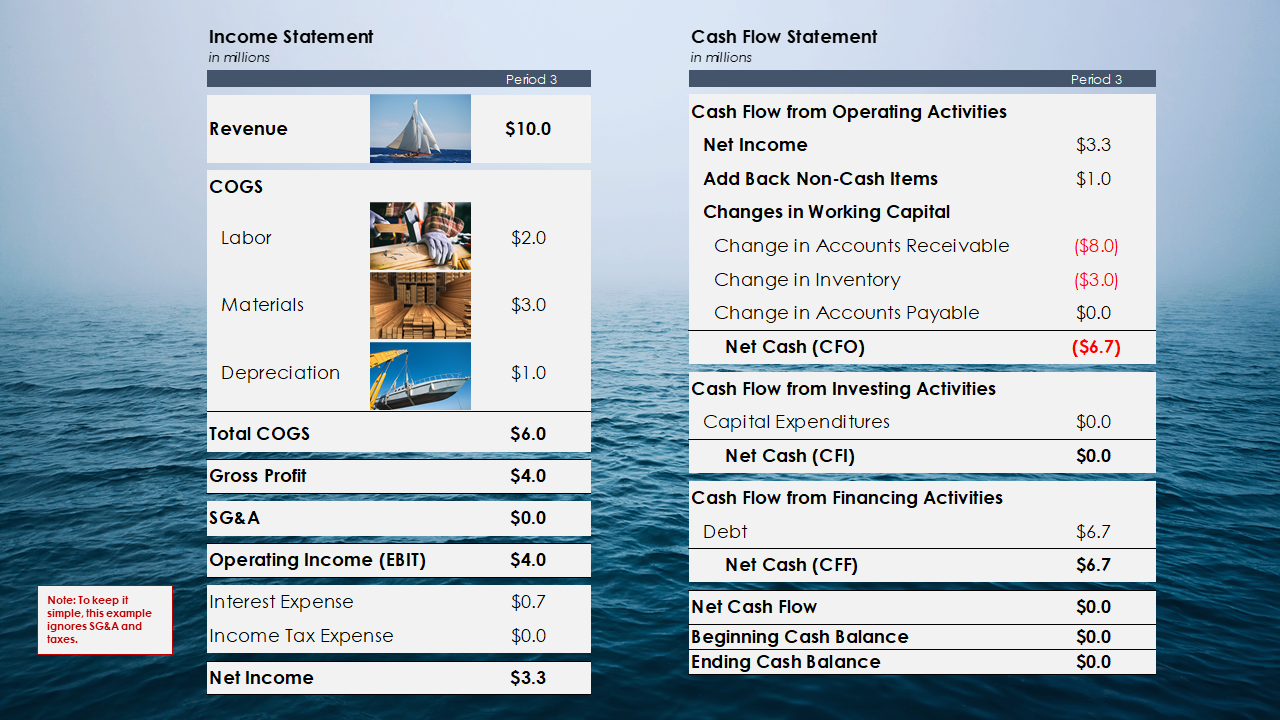

In the image above you will see the purchase of the sailboat recorded on the income statement (to keep it simple, this income statement ignores SG&A and taxes). The red arrow in the image above shows net income linking to the top of the cash flow statement, where we start with the same $4 million sum. Next, we add back non-cash items (the blue arrow in the image above), which in this case includes depreciation expense of $1 million. We are assuming that no additional capital expenditures are required and that depreciation is equal to $1 million in each period.

With no changes in working capital accounts, no additional capital expenditures, and in the absence of issuing debt, the company has generated $5 million of cash flow in this period. We are further assuming that the company had a zero cash balance in the prior period (Beginning Cash Balance in the image) to arrive at an Ending Cash Balance of $5 million.

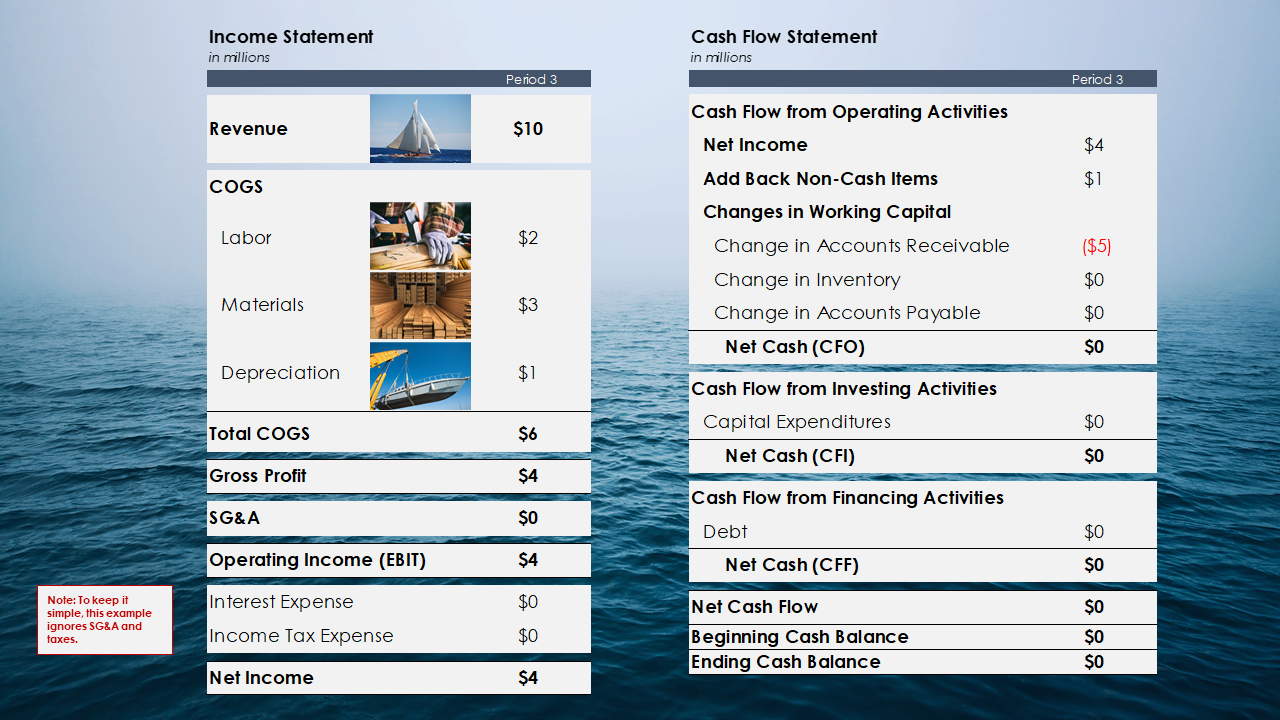

But let’s assume sales are slow, and you want to encourage the buyer to make the purchase. As the founder of the business, you offer that the customer can pay 50% of the purchase price in the next accounting period. This is an example of trade credit, where the customer is allowed to purchase goods or services and pay the vendor at a later scheduled date. Per the explanation in the balance sheet video, this activity causes accounts receivable to increase by the unpaid amount. In the image visible below, you will see that an increase in accounts receivable has a negative impact on cash.

By extending trade credit to the customer in the amount of $5 million dollars, the company no longer generates any cash on the sale. You will note, however, that nothing has changed on the income statement. If these two scenarios represented two different companies, and only the income statement was provided for review, it would be easy to assume that both companies enjoyed equal success. But the reality is that in this second scenario, the company doesn’t have any liquidity to fund growth. This relationship between profit realized on the income statement, the amount of working capital required to generate sales, and the amount of cash generated on the cash flow statement is paramount. In my opinion, it is wildly overlooked or misunderstood by many businesses.

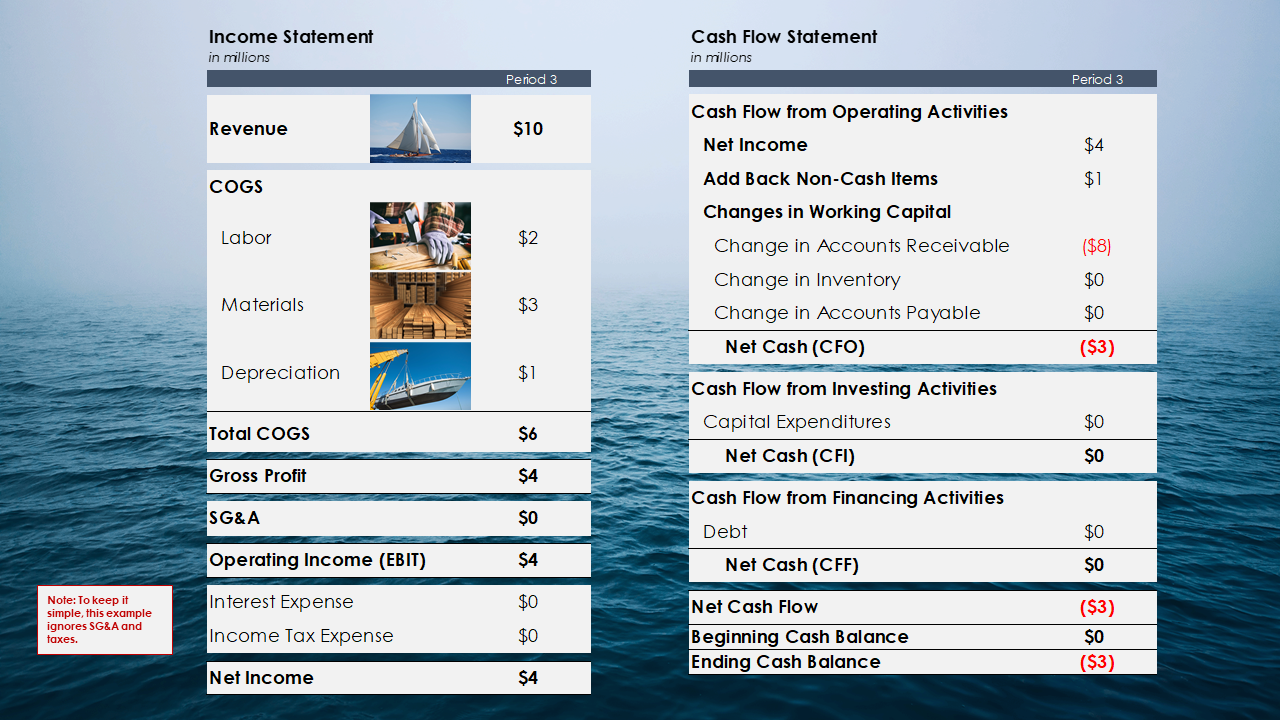

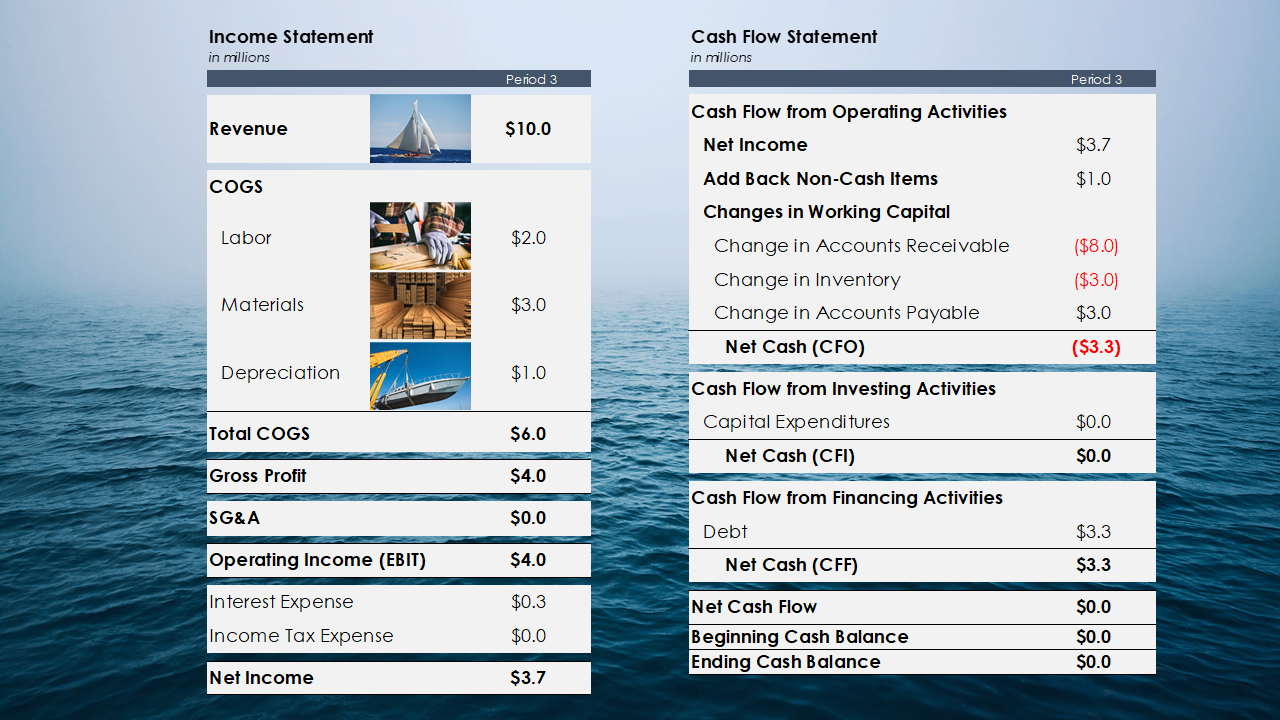

To understand why, let’s continue with this example and assume that instead of $5 million of trade credit, the company extends $8 million of trade credit (note: this would be highly unlikely, but exaggerated scenarios can helpful for illustrative purposes). In the image below you will see that now the business has a negative net cash flow for the period of $3 million.

But a business cannot have a negative cash balance. Obligations have to be met or the business will become insolvent. To remedy the situation, the company raises debt – typically by drawing down its line of credit – to cover the shortfall. If you’re guessing that the business only needs to raise $3 million, then you haven’t thought about interest expense.

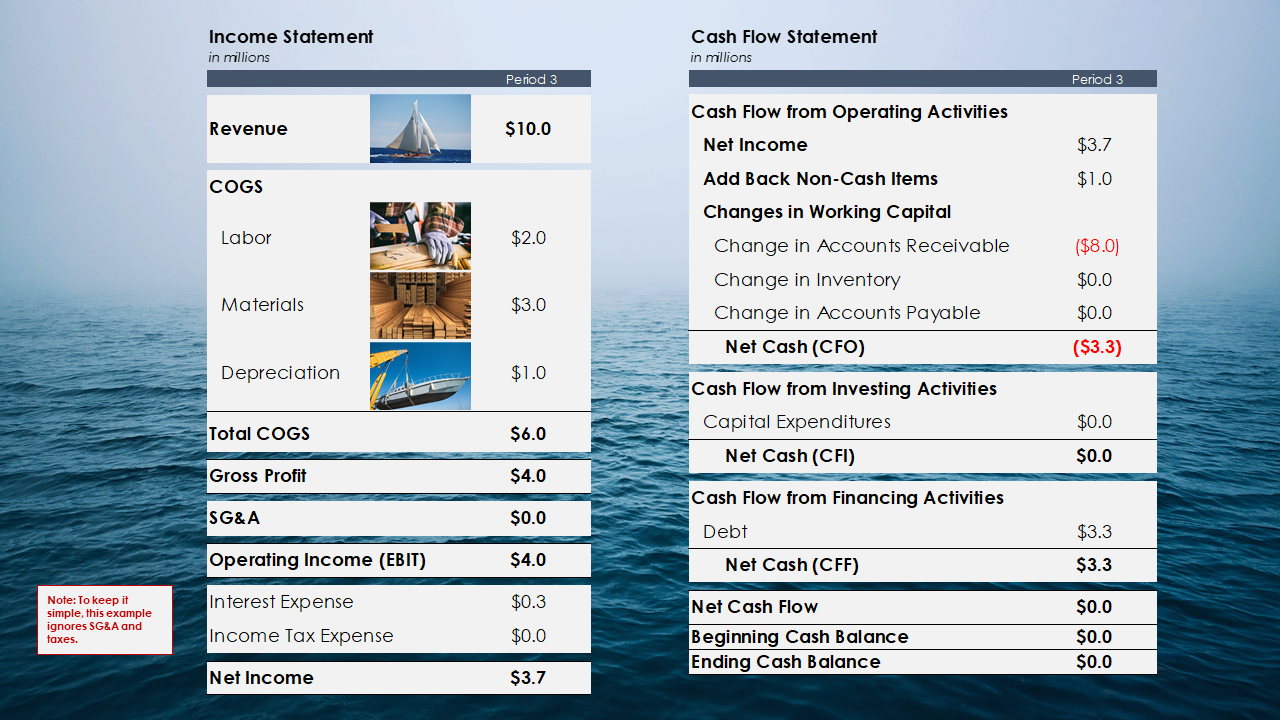

To make the math easier to follow, let’s assume the business borrows money at an interest rate of 10% per period. With no cash on the balance sheet in the previous period, the current period needs to cover the current shortfall from the sale of the boat and the interest expense due in that period. Now our income statement has changed, in the image above you will see interest expense of $300,000, which reduces net income to $3.7 million. On the cash flow statement, you will see a cash inflow of $3.3 million dollars under cash flow from investing activities and net cash flow back to a zero balance.

Now we have a different problem, the business doesn’t have any cash to pay for raw materials to make another boat. Waiting for the customer to pay means stalling your operation, so the company raises more debt (again, typically via the line of credit) to fund the purchase of inventory.

On the income statement, interest expense increases once again, and the company’s bottom line further deteriorates to $3.3 million. So, what have we learned?

- Working capital ties up a company’s liquidity.

- If the profits generated by sales are not sufficient to fund a company’s working capital needs, the business will have to raise cash by issuing debt.

- Debt impacts the income statement by reducing profitability by the amount of interest expense owed in each period.

In my opinion, absent a strong ramp in sales, the decision to raise cash by issuing debt should be a choice. A company should manage its margins and working capital such that profitability funds all or a portion of the company’s working capital needs. In this admittedly more extreme example, the company cannot operate without raising funds, and that substantially increases business risk. Cash on the balance sheet is always your best defense.

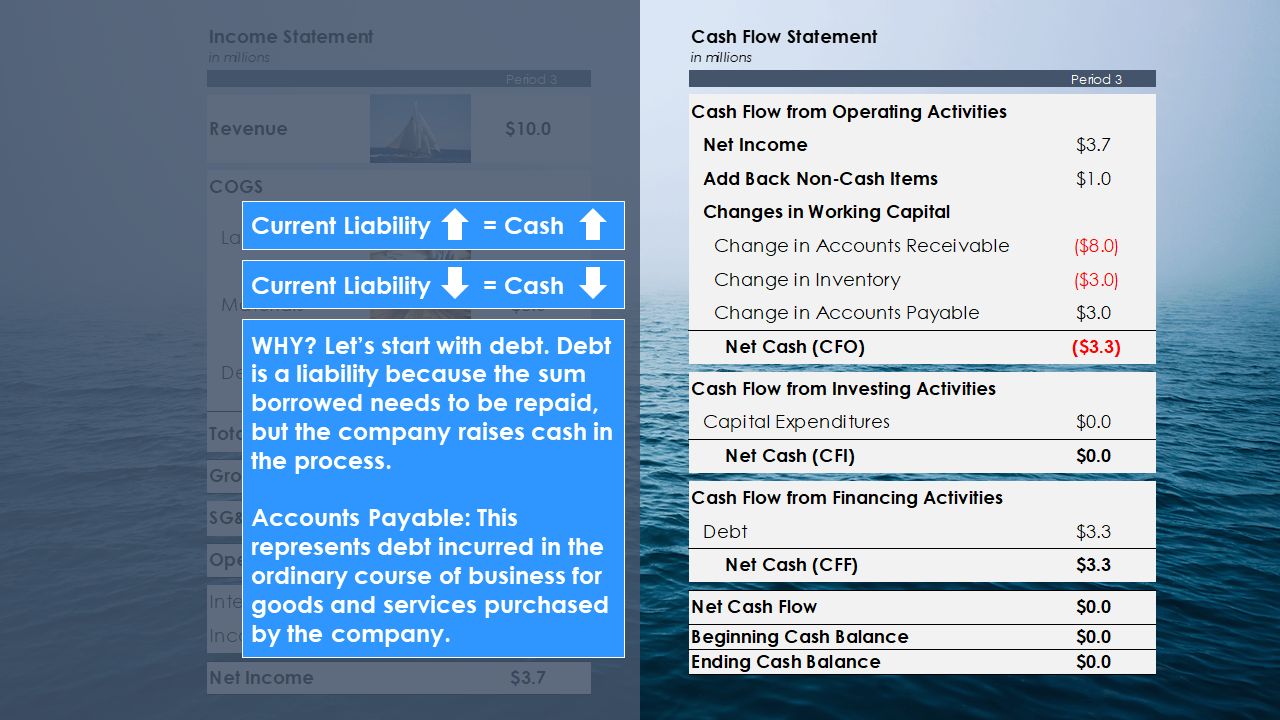

Fortunately, we haven’t touched on accounts payable, the only current liability listed (recall that accounts receivable and inventory are both current assets). Let’s assume that the supplier of raw materials also extends terms to the company when inventory is purchased.

Now you will see a reversal in performance. Cash flow from operations has improved because we have delayed the payment for raw materials purchased, which is visible on the cash flow statement under changes in accounts payable. Let’s explore what’s taking place.

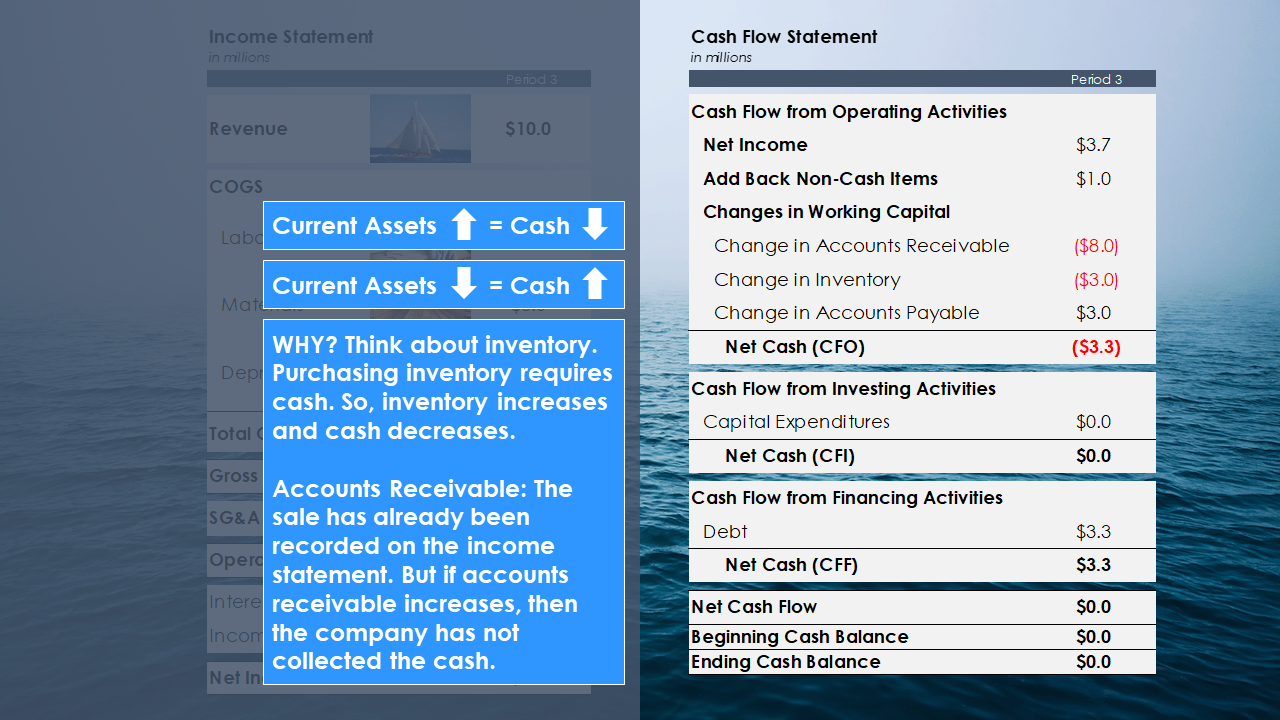

When a current asset increases on the balance sheet, the change is realized on the cash flow statement as a decrease in cash (and vice versa).

When a current liability increases on the balance sheet, the change is realized on the cash flow statement as an increase in cash (and vice versa).

In other words, changes in current assets have an inverse relationship with cash flows, and changes in current liabilities have the same relationship with cash flows.

But most importantly, how a business manages its working capital can have a drastic impact on the company. As you can see in the images above, positive working capital reflects real value because it consumes cash. If it is mismanaged, then the company is tying up resources that could be put to better use. If it is managed appropriately, then the business can comfortably generate a profit and choose how to fund its growth.

It’s also important to note that this liquidity need isn’t visible on the income statement until you arrive at interest expense. On the income statement, everything above and including EBIT remains the same in every scenario. To properly gauge the value of a sale requires evaluating how the sale impacts cash flow. The takeaway is that not all revenue is created equal, even if the margin secured on the sale is identical.

Learn more about financial statement analysis with the Introduction to Financial Statements course available at ASM.