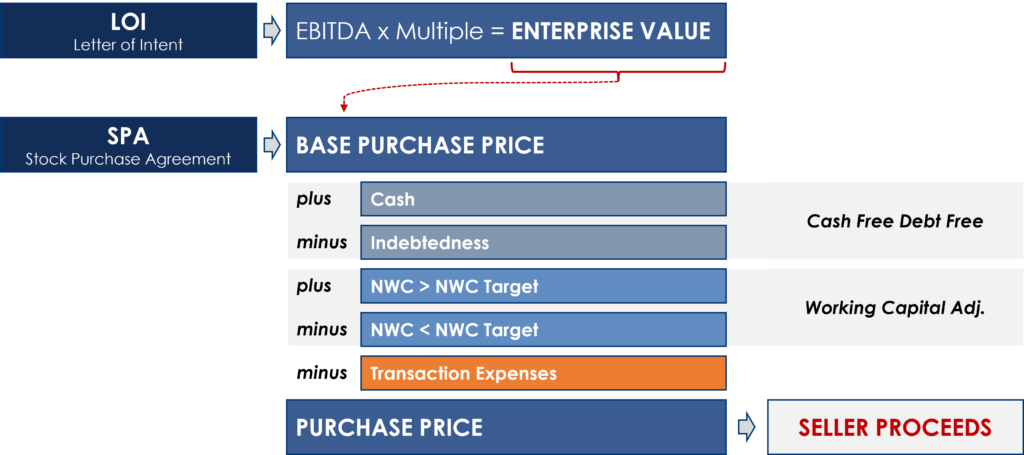

The working capital adjustment in a stock purchase agreement can have a direct impact on the price paid for the business. Given that price is arguably the most important variable in a transaction, and that the working capital adjustment can impact price, it follows that the working capital adjustment deserves special attention.

This adjustment is required because it is impossible to know what a company’s working capital (i.e., generally, current assets minus current liabilities) will be on a future date (specifically the date of the sale). It can take a business anywhere from a couple of weeks to a couple of months to close its books, making this an adjustment that can only take place after the transaction has closed.

Sequence for the Working Capital Adjustment:

On the closing date of the transaction, Buyer will pay to Sellers an initial purchase price, which is subject to an adjustment for working capital (note: additional adjustments can be included, but this post will focus solely on the working capital adjustment). The initial purchase price will include an estimate for working capital for the closing date (Target Working Capital).

Between 60 and 120 days after the closing date, the Buyer will deliver a statement to Sellers with Buyer’s calculation of working capital (Final Working Capital). If all parties agree that the calculation is accurate, then an adjustment will be made as follows.

- If the Final Working Capital is greater than the Target Working Capital (Excess Amount), then Buyer shall pay directly to Sellers an amount equal to the Excess Amount, and Buyer and Sellers shall promptly deliver a joint written instruction letter to the Escrow Agent to release all funds in the Working Capital Escrow Account to Sellers.

- If the Final Working Capital is less than the Target Working Capital (Shortfall Amount), then Buyer and Sellers shall deliver a joint written instruction letter to the Escrow Agent to release an amount equal to the Shortfall Amount from the Working Capital Escrow Account to Buyer.

Working Capital Adjustment Example to Provide Context:

When a healthy business is acquired, the purchase price is generally based on a multiple of earnings (commonly EBITDA). What the purchase price assumes, among other things, is that the business will have adequate working capital on the date it is acquired to maintain this level of earnings.

For a simple example, let’s eliminate all working capital accounts with the exception of inventory. Assume that you acquire a business that uses raw materials (a component of inventory) to sell a finished good. Post acquisition you learn that the business does not have any inventory. This is an extreme example that would hopefully never occur because you followed a proper due diligence plan, but it helps communicate the need to adequately measure working capital accounts. Without raw materials production would halt and you would have to use cash to purchase the amount of inventory required to continue operating. The working capital adjustment in a stock purchase agreement secures this cash from the sellers so that the buyer is made whole.

In other words, the working capital adjustment makes sure that the buyer receives a historically normalized level of working capital at closing so that the business can be operated as it was prior to the transaction.

Additional Content:

The ASM+ PRO tier covers the working capital adjustment in detail. The Private Equity Training curriculum will walk you through a detailed example of the working capital adjustment process. There is also a mini course titled Stock Purchase Agreement that contains hypothetical language detailing how the working capital adjustment might appear in a stock purchase agreement.