Private equity funds are closed-end investment vehicles, which means that there is a limited window to raise funds and once this window has expired no further funds can be raised. These funds are generally formed as either a Limited Partnership (“LP”) or Limited Liability Company (“LLC”). The advantages of these structures for a private equity fund are as follows:

1) Perhaps the biggest advantage for investors is that they are exposed to limited liability. If anything goes wrong in the investment process (bankruptcy, lawsuits, etc.), the investor risks only the capital they have committed.

2) LPs and LLCs are pass-through entities for federal income tax purposes.

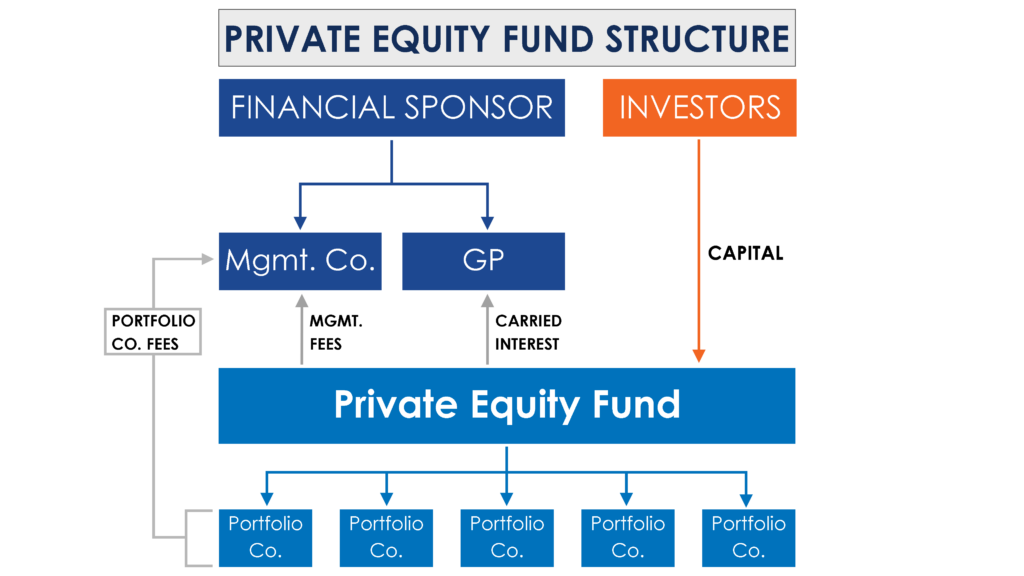

Illustrated Organizational Chart:

Raising a private equity fund requires two groups of people:

1) Financial Sponsor (“Sponsor” in image): The team of individuals that will identify, execute and manage investments in privately-held operating businesses. This is generally comprised of a General Partner and a Management Company.

General Partner: The entity with the legal authority to make decisions for the fund. This entity also assumes all legal liability.

Management Company: The operating entity that employs the investment professionals responsible for allocating capital and managing investments.

2) Investors: The individuals that will provide the capital to make those investments. Because funds are generally formed as Limited Partnerships, investors are often referred to as limited partners.

In raising a fund, the fund founders will reach out to sources of institutional capital such as pension plans and university endowments, as well as high net worth family offices and individuals. The commitment to the fund, known as the “capital commitment,” will be made via a partnership agreement stipulating that the capital invested or resulting assets will be returned within a fixed period of time (typically 10 years). In most cases this is structured as a limited partnership agreement (LPA). The LPA will typically include the following:

Mandate: The partnership agreement may provide parameters for acceptable investments. These restrictions could relate to scale, geography and security type, etc.

Fund Term: This defines the time horizons available for investment and divestment.

Management Fees: This defines the fee tied to the capital raised, or assets under management (“AUM”). The Management Company will typically earn an annual 2% fee on AUM.

Distribution Waterfall: Distribution waterfalls define the economic relationship between the general partner (“GP”) and limited partners (“LP”). This is how the GP earns what is known as a carried interest, which is typically 20% of the proceeds after the LP has received distributions equal to the original capital invested plus a defined preferred return. Please follow this link for an example.

Introduction to Private Equity Series:

Part 1: PE Defined | 3-Statement Model vs LBO | Benefits of Leverage

Part 2: How Leverage Can Create and Destroy Value

Part 3: How to Determine the Appropriate Amount of Leverage

Part 4: PE Participants | Independent Sponsor | PE Fund

For more information about private equity please see ASM’s private equity training course.