FIXED CHARGE COVERAGE RATIO

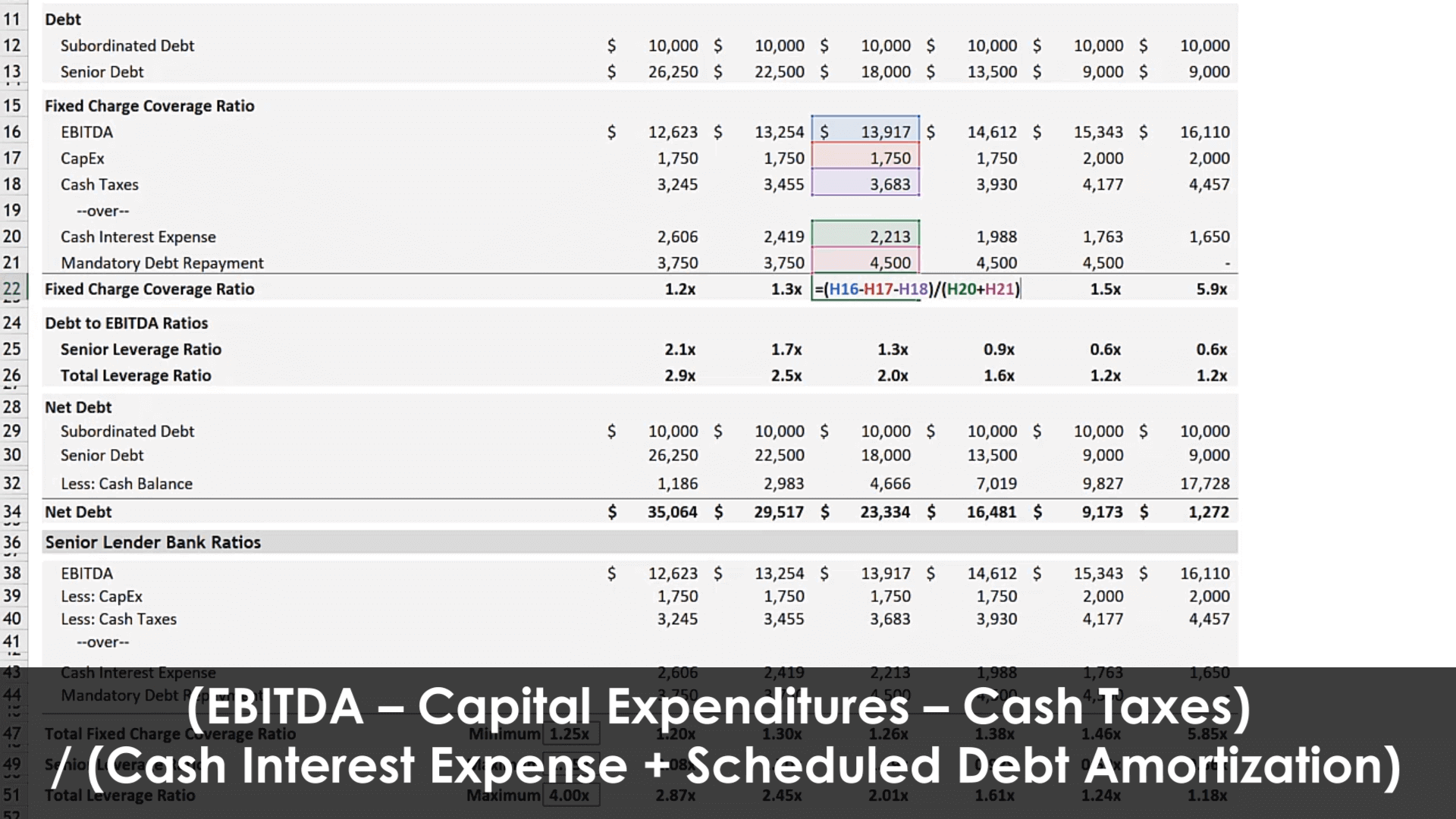

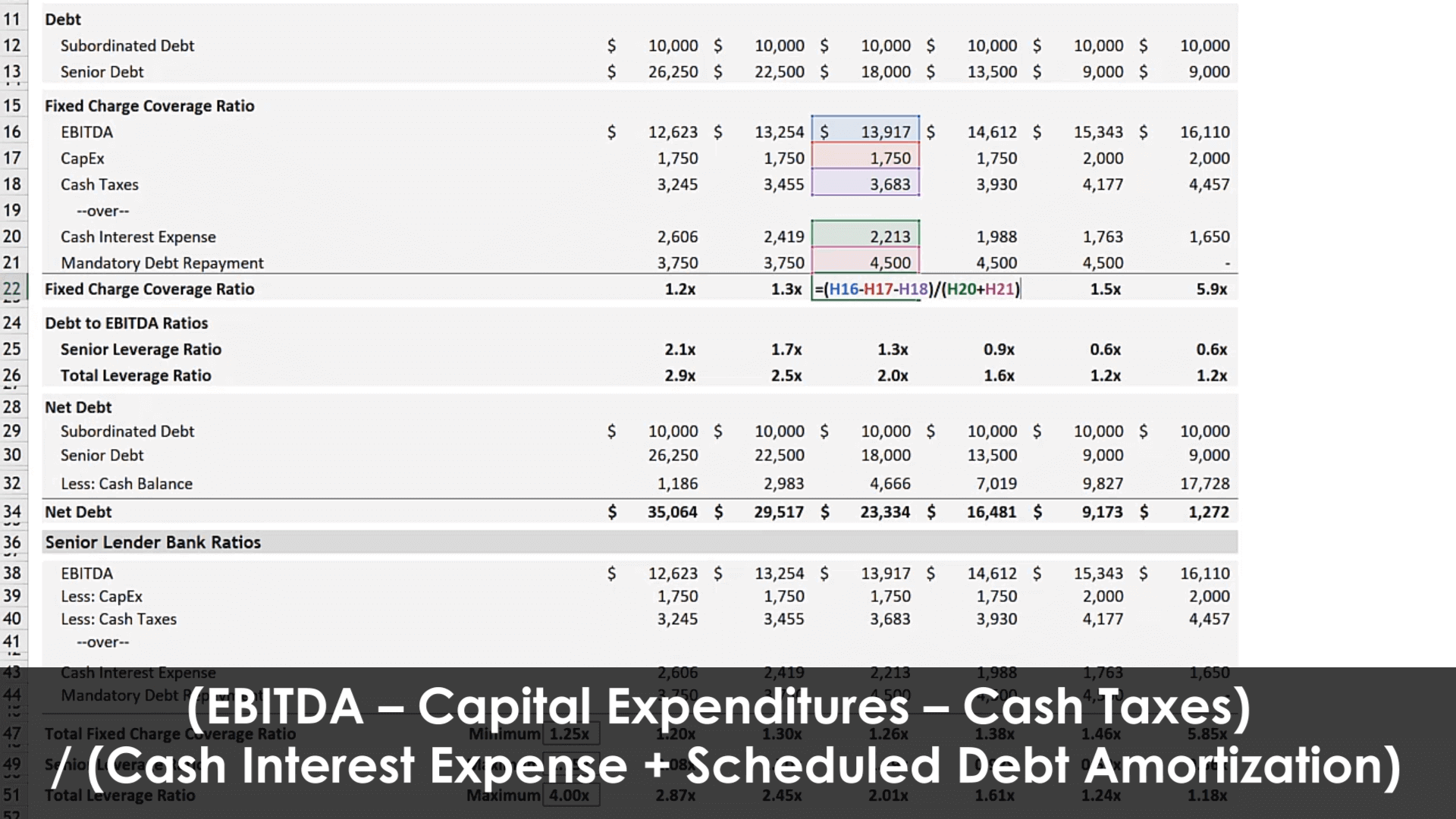

As the video demonstrates, however, EBITDA is not a good proxy for cash flow and the total debt balance fails to communicate what is required in each period to remain in compliance. The Fixed Charge Coverage Ratio (FCCR) is introduced as a solution to these shortcomings.

The fixed charge coverage ratio is used to measure a company’s ability to cover its “fixed charges” (largely debt-related payments but this can include additional obligations as you will see below) due in any given period. Below we will start with a simple visual and expand on this by including the definition a senior lender might use in a term sheet.

The Fixed Charge Coverage Ratio gets more precise by subtracting additional uses of cash from EBITDA to get to a closer approximation of cash flow for the period. The logic behind subtracting capital expenditures instead of depreciation and amortization (the “DA” in EBITDA) is that capital expenditures are a cash outflow whereas D&A are noncash items. After that, cash taxes are subtracted to arrive at a better approximation of cash flow. Interest expense is not subtracted, but it can be found in the denominator (interest expense is one of the “fixed charges”).