Distribution waterfalls define the economic relationship between the equity participants involved in an investment. In private equity transactions this generally focuses on the relationship between the general partner (“GP”) and limited partners (“LP”). If these terms are unfamiliar to you, think of the general partner as the private equity fund, and the limited partners as all of the investors participating in the fund. In this context, the purpose of a distribution waterfall is to prioritize the distribution of cash flows between the investors and private equity fund managers. Note: Excel file available for download at the bottom of this post.

I believe the easiest way to grasp this concept is to focus on the acquisition and sale of one business. This limits the exercise to two cash flows, the capital invested to make the acquisition, and the transaction proceeds received at exit (when the business is sold). In this process, the limited partners would provide the capital to make the acquisition, and the general partner would identify the target company, work towards an acquisition, manage the investment over a three to seven year period, and finally identify a buyer. Upon a successful exit (sale of the business), the GP would earn a carried interest (share of the proceeds) for their efforts.

In the Excel file attached you will find four simple examples in increasing order of complexity. The first tab titled “80_20,” includes only two steps (see below). Real estate distribution waterfalls often follow a similar approach, but the split between the GP and LP is more favorable to the GP. You might see a 50/50 split in place of an 80/20 split, for example.

First, 100% of all cash inflows to the LP until the cumulative distributions equal the original capital invested plus some preferred return. In the examples provided in this post, the preferred return is equivalent to 8% per annum.

Second, thereafter, cash flows in excess of distributions made in step 1 (if any) are distributed 80% to the LP and 20% to the GP. This is often referred to as an “80/20 split.”

The second tab titled “20% & 80_20” includes three steps. Within the private equity community, some variation of this approach, including additional detail around fees and, in the case of a fund, whether or not this should be calculated for each deal or the fund as a whole, is not uncommon.

First, 100% of all cash inflows to the LP until the cumulative distributions equal the original capital invested plus some preferred return.

Second, a “20% catch-up” to the GP equivalent to 20% of the of the distributions realized in step 1 plus the distributions realized in this step.

Third, thereafter, cash flows in excess of distributions made in step 1 and step 2 (if any) are distributed 80% to the LP and 20% to the GP.

The third tab titled “20% After Pref & 80_20” adds one step to the sequence above so that the 20% catch up is limited to distributions made after the return of invested capital. Though simplified, this is perhaps the most frequently cited example for a private equity transaction. Hopefully the jump from tab two to tab three makes it a little easier to understand.

First, 100% of all cash inflows to the LP until the cumulative distributions equal the original capital invested.

Second, 100% of all cash inflows to the LP until the LP has received a preferred return on the capital invested in step 1.

Third, a “20% catch-up” to the GP equivalent to 20% of the distributions realized in step 2 plus the distributions realized in this step.

Fourth, thereafter, cash flows in excess of distributions made in step 1, 2 and 3 (if any) are distributed 80% to the LP and 20% to the GP.

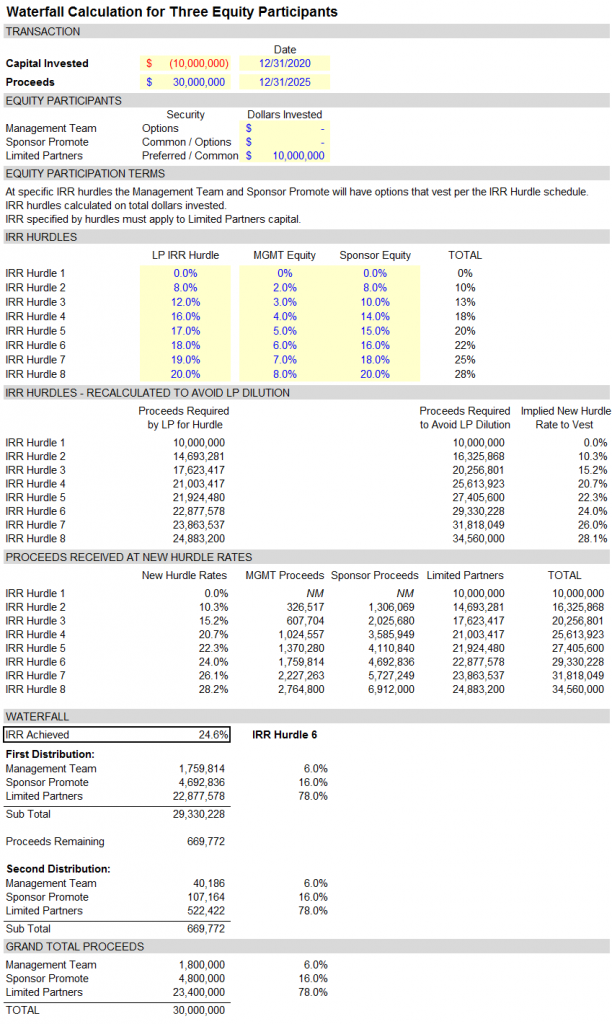

The final tab gets a little more creative, and rewards the management team and sponsor according to IRR hurdles achieved. As the number of private equity groups and fundless sponsors has grown, I have seen a variety of new approaches, this being one of them. I also wanted to include it to demonstrate the degree to which there is flexibility in negotiating the terms of a distribution waterfall. A screenshot of this tab has been provided below.

Excel Template: Distribution Waterfall_5 Examples

For an explanation of the math behind the 20% catch up click HERE.