The three-statement framework is one of the most important to understand. It’s the foundation of most every important financial decision, and ultimately it determines how most people are compensated. If you understand it thoroughly, you have a clear advantage in this world.

So, can you explain how the financial statements work together in under 60 seconds? This has been one of my favorite interview questions since I started working in private equity (except I don’t normally apply a time limit, that was included for internet attention spans). The confidence and detail with which candidates answer it exposes a lot about their knowledge and how they think.

Here’s an example (also available on Instagram and TikTok) of how to answer this question in video format with images and text below for those that want to spend more time with the material (click on the image below for a video explanation).

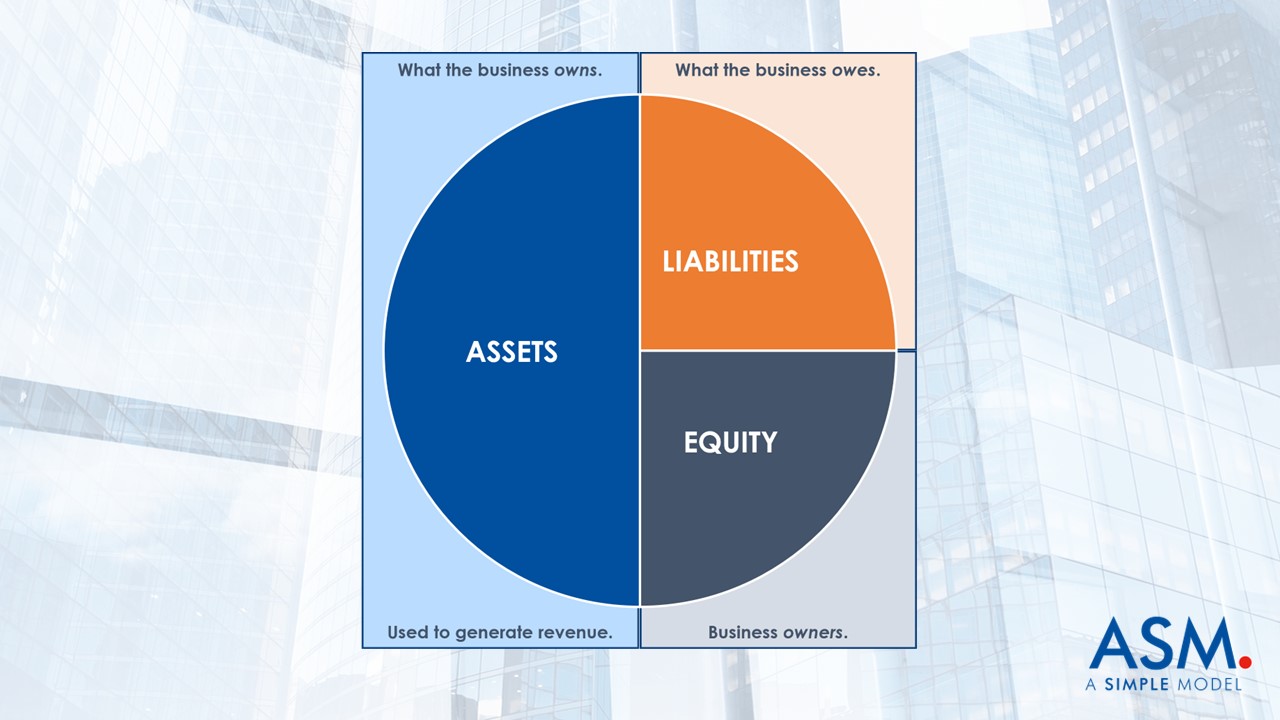

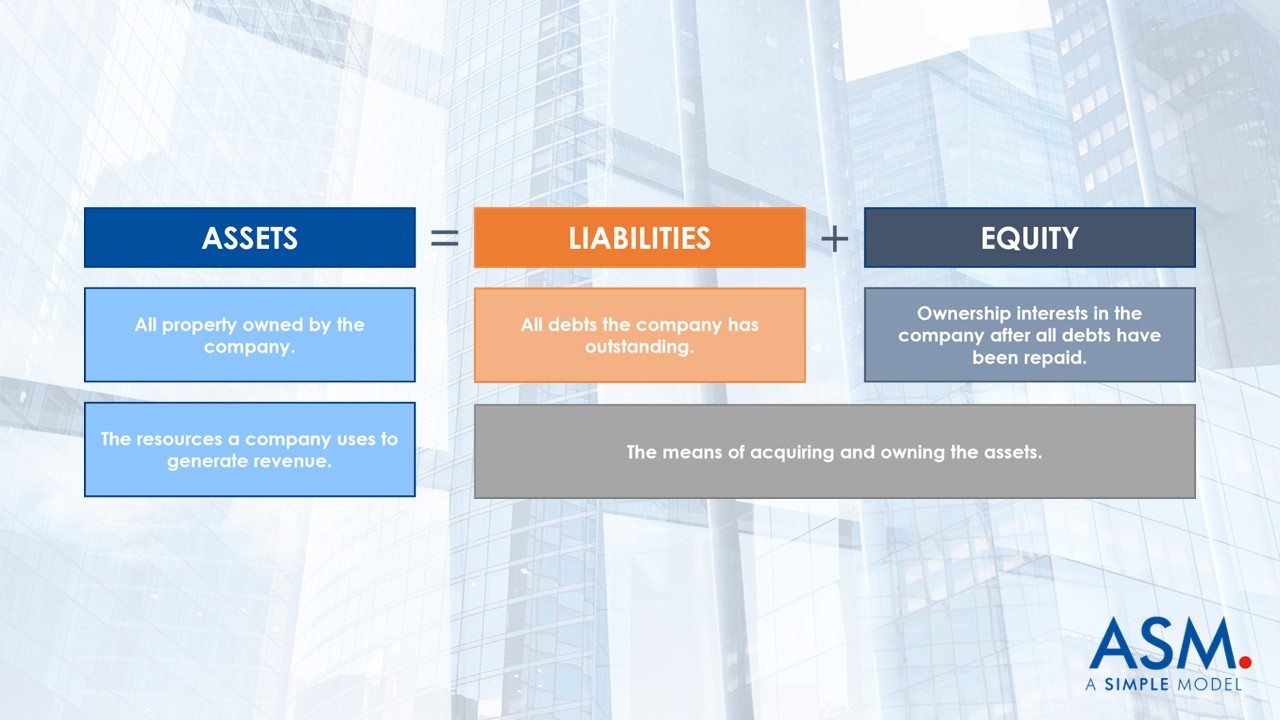

The balance sheet shows everything a business owns and owes, and the business uses what it owns, its assets, to generate revenue. Let’s break down the three categories below into a little more detail:

- Assets: Very broadly, assets are the resources a company uses to generate revenue. Assets that are expected to be converted to cash, sold or consumed within one year are listed as current assets. Fixed assets (aka long-term assets) are expected to benefit the company for a longer duration. You can have both tangible and intangible assets.

- Liabilities: The liabilities of a business represent the debts incurred in the ordinary course of business. Short-term liabilities include accounts payable and a company’s line of credit. Long-term liabilities include more formal borrowings (e.g., a loan from a bank).

- Stockholders’ Equity: This account reflects the ownership interests in the company. Under stockholders’ equity you will find contributed capital (value of the capital contributed by shareholders) and retained earnings (retained profits).

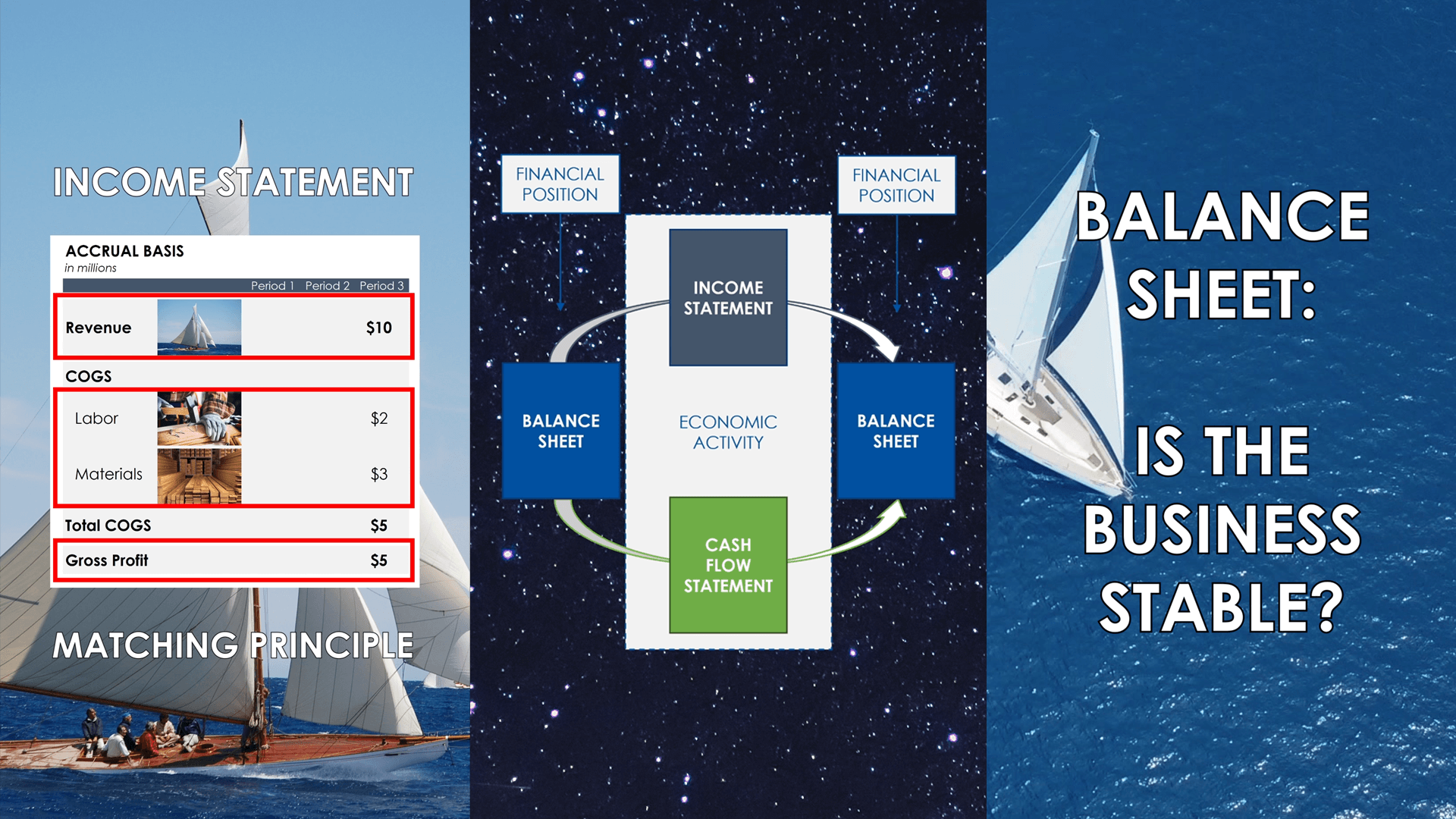

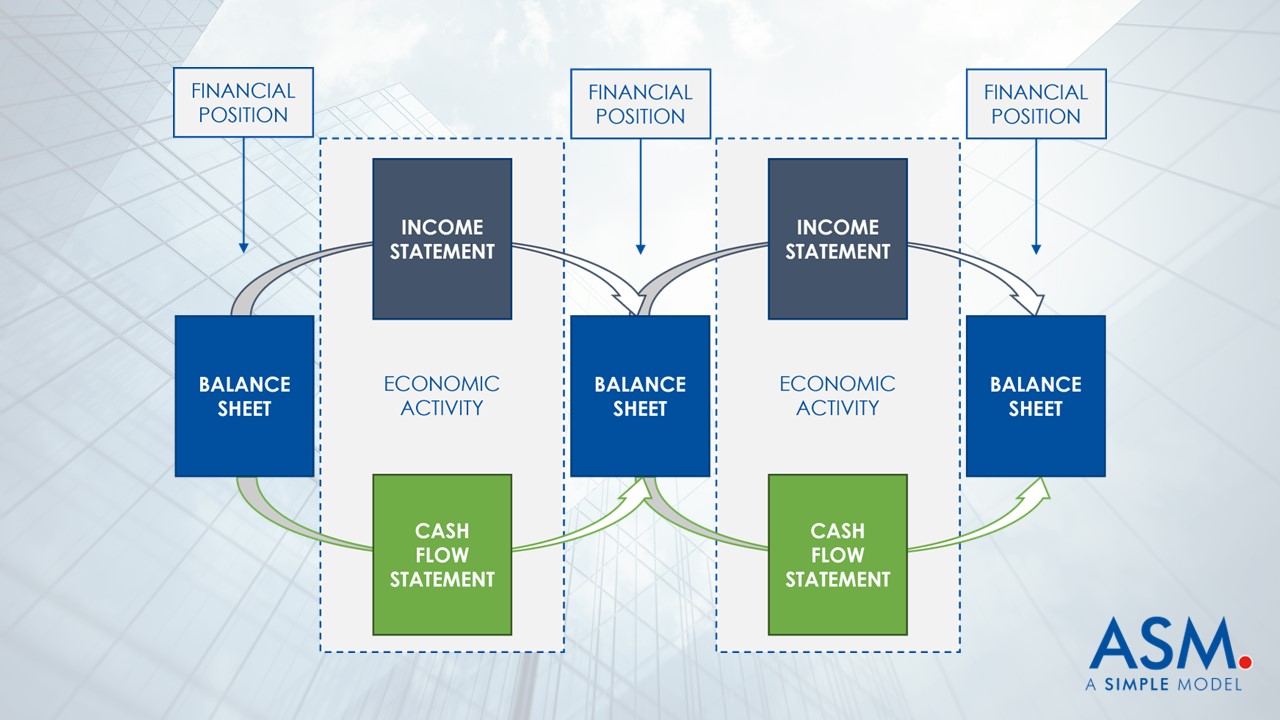

A sale gets captured by both the income statement and the cash flow statement, which link consecutive balance sheets explaining the economic growth that takes place between them.

That means that both the cash flow statement and the income statement record the activity taking place in each accounting period. In other words, they represent activity over a period of time. The balance sheet, on the other hand, shows the financial position of a company at a given moment.

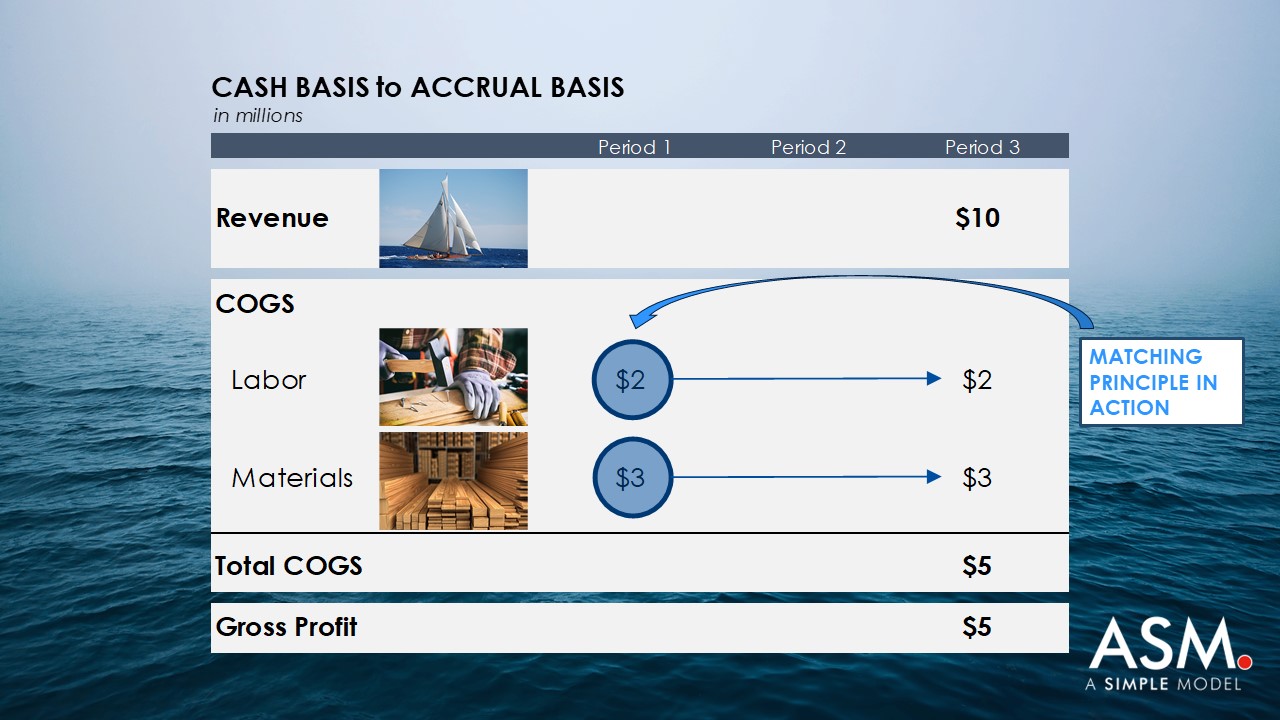

If you’re selling boats (per the example in the video), the income statement shows how successful the company is with the matching principle. This means that the sale of the boat is matched with the cost of making the boat. This makes it easier to determine the profit realized on a sale, which is the ultimate measure of success in selling a good or service.

The image below shows how the matching principle converts the economic activity of a business from a cash basis to an accrual basis of accounting on the income statement. Regardless of when the inputs required to make a boat are purchased (Period 1 in the image below), the matching principle requires that the expense appears on the income statement in the period that the boat is sold (Period 3 in the image below).

Note: Depreciation is also included in cost of goods sold (COGS). For a more detailed explanation please see the related links at the bottom of this post.

The cash flow statement tells you how likely you are to survive. This statement doesn’t care when the product is sold. It only cares when cash enters and leaves the business. When you buy the materials to make a boat and then sell the boat later, the cash flow statement shows those cash outflows and inflows in the periods that they took place.

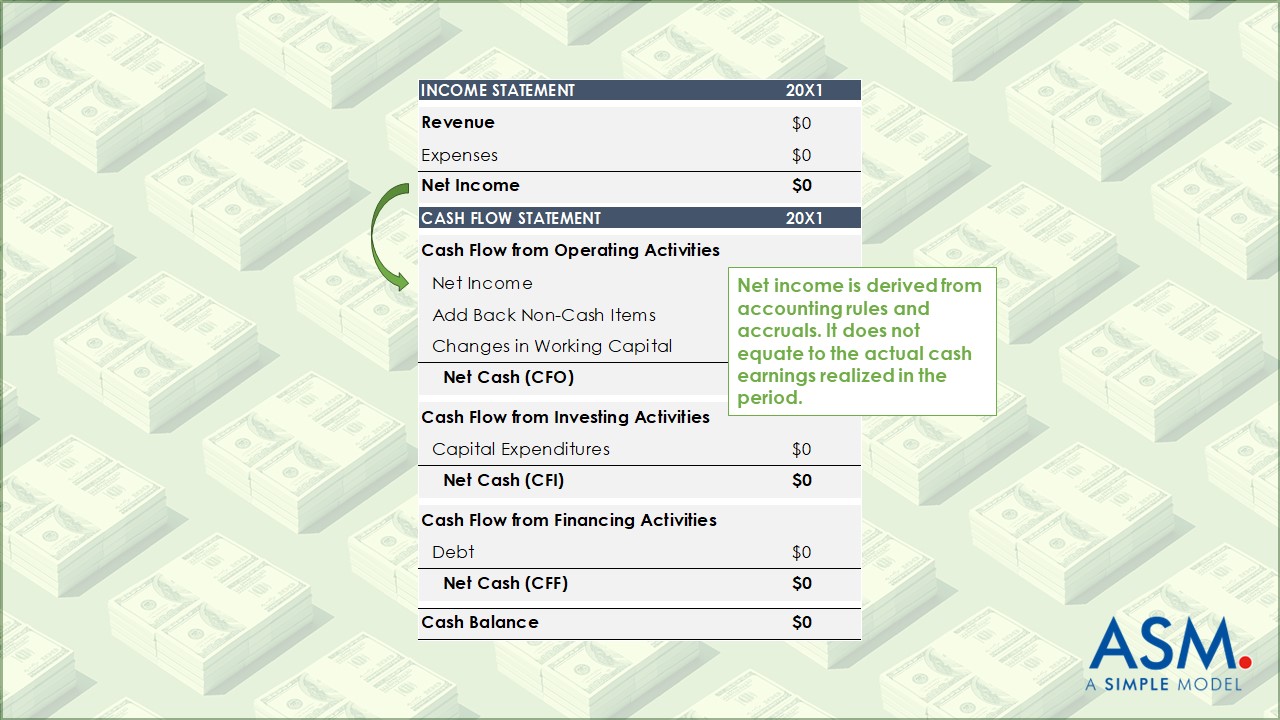

The cash flow statement starts with net income and makes adjustments to transform it into the ending cash balance for the period. In the visual below, the green arrow shows how net income makes the “jump” from the income statement to the cash flow statement.

Cash is king. Some may argue that net income or earnings per share are more important (and if that someone is your professor, I recommend agreeing—until final grades are in). But if I could only list two arguments to support my claim, I would emphasize the following: First and foremost, without cash a business will fail, and second, cash flow ultimately determines a company’s value.

Legendary CEO Jack Welch said that if he had to run a company on just three pieces of data, “those measures would be customer satisfaction, employee satisfaction, and cash flow.” The only financial variable in Welch’s list is cash. That may be because unexpected downturns in a company’s financial performance can usually be absorbed if there is enough cash on the balance sheet. It also creates opportunity to explore strategy.

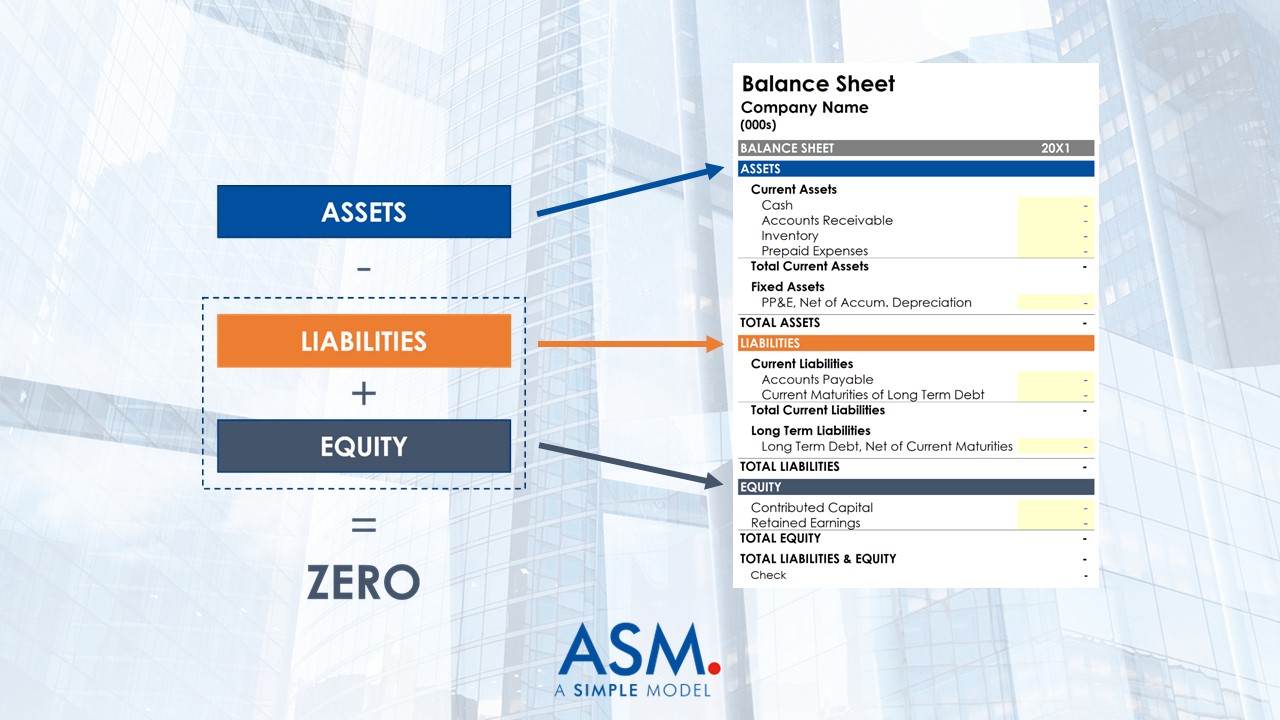

Finally, every transaction is captured so that your balance sheet balances according to this equation. Assets is equal to liabilities plus stockholders’ equity.

Always remember that the balance sheet is just a formal presentation of the accounting equation. Both have to balance, which is why the balance sheet includes a “check” on the bottom line (see image).

It’s important because your assets have to generate enough cash to maintain liabilities and keep your shareholders happy.

In summary:

- The balance sheet tells you if the company is stable.

- The income statement tells you if the company is profitable.

- The cash flow statement tells you if the company will survive.

Related Links: