The world of private equity is notorious for grinding, 100-hour workweeks, particularly in the case of younger professionals. But like any job, there are always stretches where your firm’s deal flow (and urgent, need-it-done-yesterday work) slows down. That’s when private equity professionals may occasionally find themselves asking: how do I fill the hours between 9am and 6pm?

It’s a timely question, because aggregate deal volume has been declining since a record-breaking 2021 (see figure 1 below), as interest rates and fears of economic headwinds have increased. However, that doesn’t mean private equity investors are resting on their laurels, since even in slow periods, those who pull back are often missing out on opportunities that someone else is happy to reap in their absence.

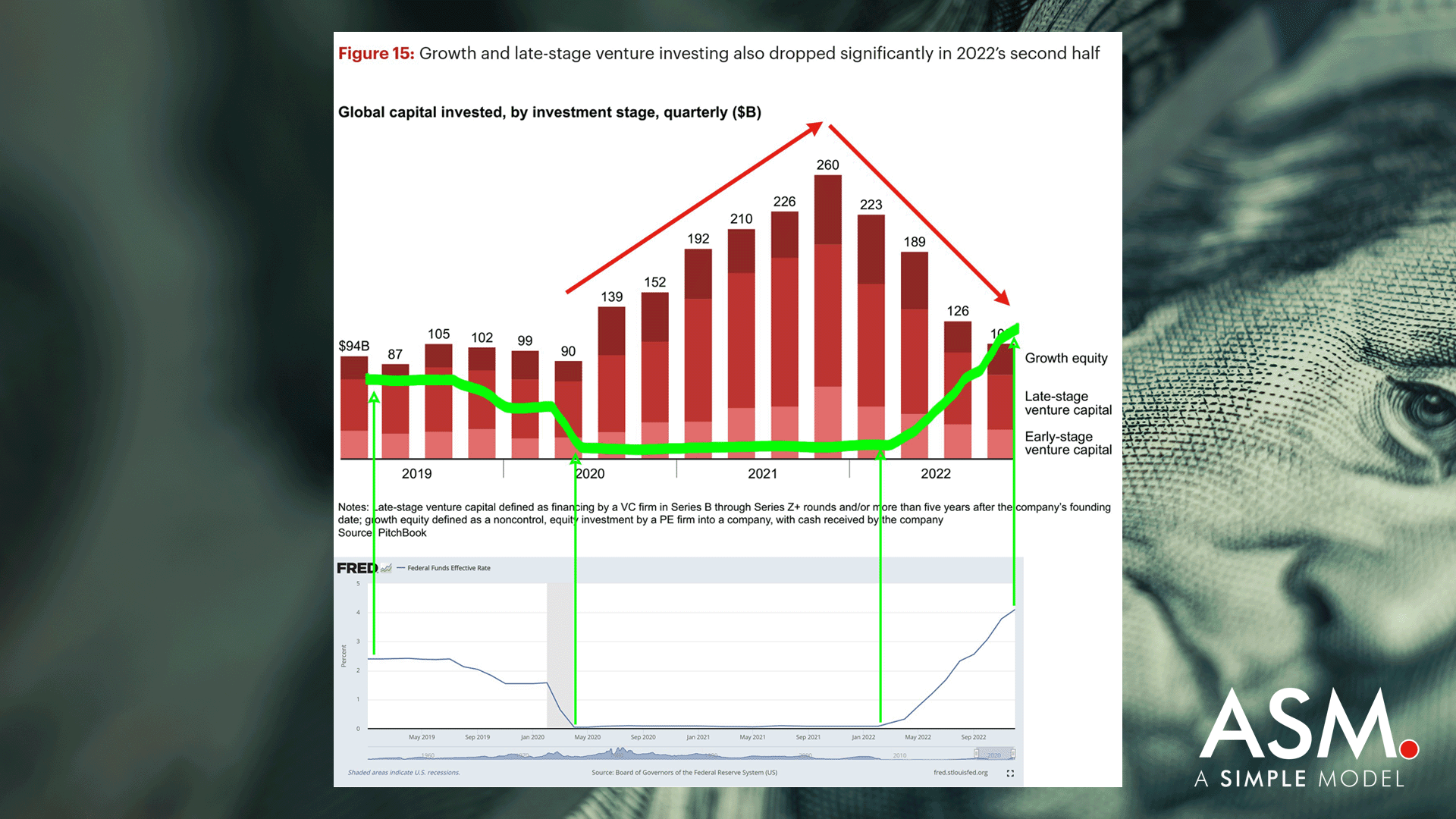

Figure 1. As interest rates have risen, global private equity buyouts have started to fall (sources: St. Louis Federal Reserve, Bain & Company 2023 Global Private Equity Report Global Private Equity Report 2023 | Bain & Company). This is especially pronounced in growth and late-stage venture investing.

To prevent that from happening, and to give you an idea of what a “slow” work week might look like, here are four categories of activity that private equity professionals often turn to when their days aren’t full of diligence and dealmaking.

1. Building Your List

Just because there is no urgent due diligence on existing targets does not mean acquisition funnels grind to a halt. If anything, investors with more time on their hands should devote more energy to finding new targets to cultivate relationships with. This is doubly true when a looming recession or other event might prompt a new uptick in sales activity. The Internet is a big place, with an ever-evolving roster of databases, industry associations, and LinkedIn profiles to surf. Cold reachouts through emails or phone calls can quickly build a dialogue with new prospects, though funds larger than, say, $1 billion are typically not likely to find new deals this way.

If cold reachouts don’t fit a fund’s particular size and mandate, going through Rolodexes to, say, follow up with a former portfolio company CEO who’s at a new firm or check with a friend at a smaller firm about how their investments are growing can be a beneficial way to open up new deal avenues for when the market picks back up. Similarly, contacting brokers or other industry experts to ask what they are seeing in the market, and whether they know of any businesses that might be interested in doing a deal in the near (or even more distant) future, is always a good activity. Lest we forget, many private equity deals, particularly proprietary ones, are often the culmination of multiple years of conversations and relationship building and not something that just appears overnight. (ASM subscriber lesson: Private Equity Deal Sourcing Process)

Finally, many investors will use slow periods to revisit existing investment theses and think through how market or technological developments may affect which industries and/or businesses should be highest priority within their acquisition funnel. For example, does an impending recession make certain industries more appealing? Or have AI tools reached the point where they can generate significant efficiencies in a certain type of business model?

2. Advancing Ongoing Conversations

A good investor never lets a conversation with a priority acquisition die out completely, even if the business is not looking to sell or interest rates are too high to make a deal feasible at the moment. The goal is to ALWAYS be the owner’s first call if and when they decide they’re ready to entertain serious offers. Occasional calls or meetings for coffee or lunch are great ways to do that, even if this “courtship” continues for years. The key is making sure to evince a genuine interest in and concern for the individual and their business during these get togethers, since no investor wants to be thought of as a vulture circling a company solely for their own gain.

3. Focusing on Existing Portfolio Companies

When one door closes, another one usually opens. If the flow of new deals has slowed, that just frees up time to work on existing portfolio companies (assuming a firm has them). In cases where reduced deal flow is due to rising interest rates or an economic contraction, existing “portcos” may simultaneously be facing market challenges that will require almost all of an investor’s attention. And even if the business climate is healthy, portfolio work may often take up 50% or more of an investor’s time when new deal flow slows, particularly if the investor oversees multiple portcos. This time might involve meetings with management, financial planning and analysis (FP&A) activities, finding ways to improve processes, and upgrading talent.

In cases where the business is distressed, the work will likely be even more hands-on, involving, for instance, modeling cash flows, exploring cost-cutting strategies, negotiating with creditors, and other turnaround-type work. See related posts: (1) Modeling a Crisis; and (2) Budget Revision Template: Downside Scenario.

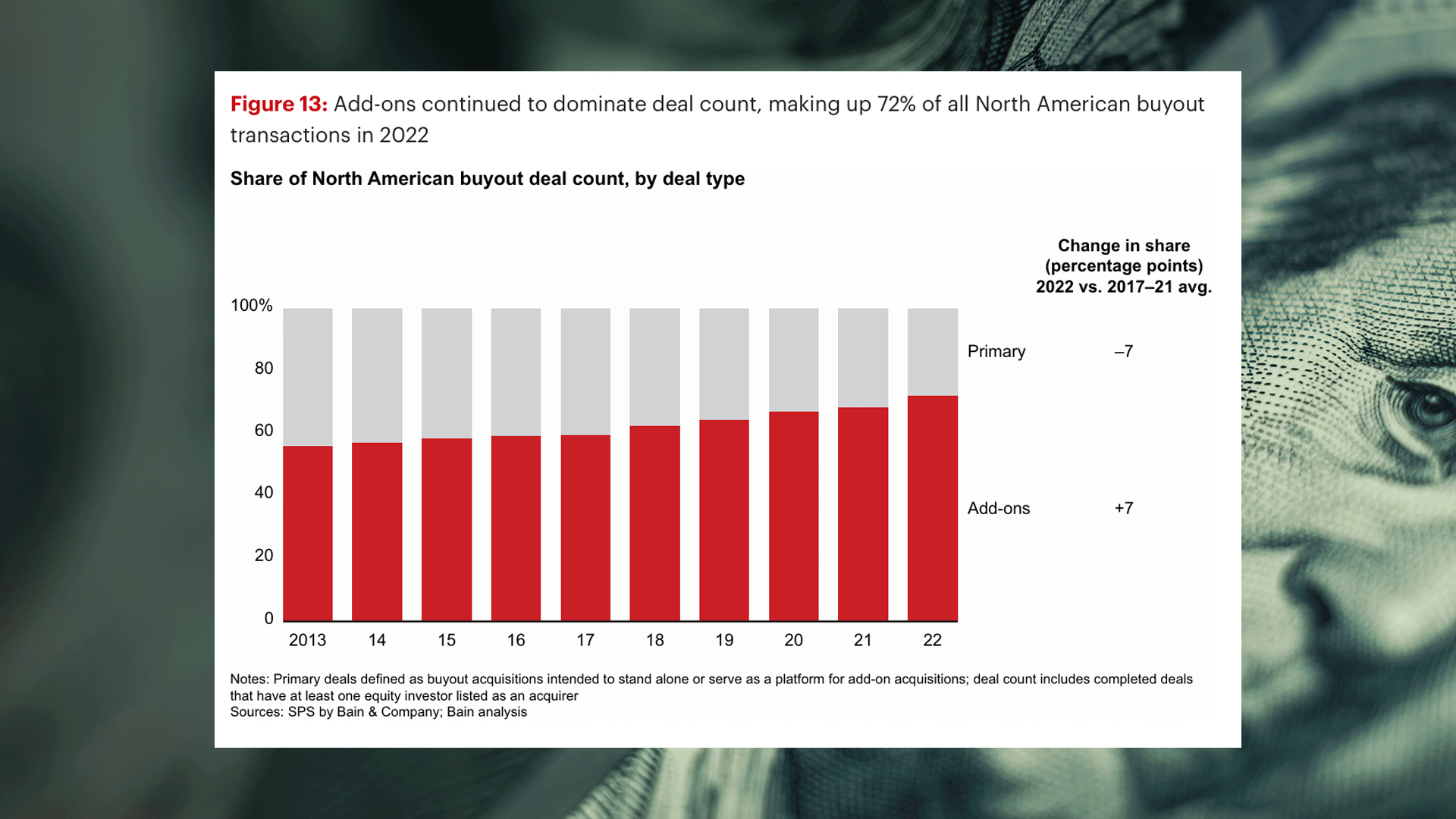

In addition, a slowdown in primary or “platform” acquisitions does not necessarily mean that smaller, add-on deals for existing portcos will slow down as well. In fact, it’s often the opposite. As figure 2 shows, add-ons as a proportion of North American buyout deals have been growing steadily since 2013, reaching 72% in 2022.

Figure 2. The share of North American buyout deals made up of add-on deals is increasing, 2013-2022 (source: Bain & Company 2023 Global Private Equity Report Global Private Equity Report 2023 | Bain & Company)

One reason why add-on activity may continue or even increase when larger deal flow is down is that add-ons can often be closed without the need for raising debt, so high interest rates may not be an obstacle. And since recessions often hit smaller firms first and hardest, they may be ripe for acquisition by larger PE-held platforms looking to execute a roll-up strategy.

4. Thinking Outside the Mandate

Strange as it sounds, sometimes private equity can be neither private nor equity. Depending on a firm’s mandate as spelled out in its agreements with LPs, a fund may be allowed to invest up to, say, 30% of its resources in non-private and/or non-equity assets. That can create significant flexibility when market conditions are working against the usual thesis. By expanding into public stocks, bonds, or private credit instruments, investors might find ways to keep a fund active and profitable in almost any kind of environment. For instance, after the pandemic hit in 2020, many large private equity funds had their associates spend quite a bit of time evaluating the purchase of debt positions in distressed companies at significant discounts from face value, a play that allowed them to deploy dry powder while new equity plays were slack (and, in some cases, putting them in a position to potentially take over control ownership of a still-appealing asset through restructuring).

Conclusion

There is really no end to the potential work to be done in the pursuit of returns in private equity. But the type of work evolves in response to the ebb and flow of opportunities. And for those of us in the profession, especially newer investors, that’s a good thing. It allows you to do something different, learn new skill sets, and flex alternate conceptual muscles, something you miss out on when you are simply jumping from one due diligence to the next. Whether the change includes developing new thematic theses for the fund, cultivating new relationships with potential acquisitions, or coaching a portfolio company through difficult times, this is exactly the kind of seasoning that turns private equity newbies into successful senior investors.

Learn more about private equity transactions with ASM’s Private Equity Training course. The Private Equity Training course at ASimpleModel.com was developed by industry professionals. The content below goes beyond the LBO model to explain how private equity professionals source, structure and close transactions.