If you are interested in investing, you should know about serial entrepreneur and investor Brad Jacobs. His recently released book, How to Make a Few Billion Dollars (Find it on Amazon), is a master class in acquisitions, roll ups, and “big, hairy deals,” the kind that sometimes create a ten-figure net worth. (Quick video introduction: LINK.)

BUY-AND-BUILD HISTORY

Jacobs started playing the entrepreneurial game early. In 1979, three years after dropping out of Brown University, he co-founded Amerex Oil Associates, serving as CEO until selling the oil brokerage in 1983, at which time it had offices worldwide and $4.7 billion in annual brokerage volume. He continued to focus on oil trading until 1989, when he founded United Waste Systems to acquire solid waste management firms. It was an interesting jump from the beginning of the supply chain, energy, to the end, waste disposal. In 1992 Jacobs took this company public, then sold it in 1997 for $2.5 billion. In five years as a public company, it had more than quintupled the performance of the S&P 500.

In September of 1997, Jacobs started United Rentals and began consolidating equipment rental companies across North America, building it into the largest equipment rental company in the world in only 13 months. Over the ten years Jacobs led the company, it completed 250 acquisitions and became the 536th largest corporation in America according to Fortune magazine. The company eventually became a “100-bagger,” with a share price that increased over 100 times its starting point of $3.50. Today it trades at over $675.

It’s not a coincidence that Jacobs named two of his early companies United. They were both highly successful roll-up plays, in which an investor acquires multiple smaller firms in the same industry, uniting them into a larger consolidated company. Since the market generally rewards scale with higher valuations, in one sense a roll-up strategy arbitrages size, with the PE firm or independent sponsor hoping to receive a higher multiple of EBITDA upon exit. There are other potential benefits to roll-ups, such as scale economies and cross selling, but multiple arbitrage is among the strongest value drivers, one Jacobs leverages at a scale few investors ever approach.

Jacobs’ next venture, XPO Logistics, began in 2011 with a $150 million private investment in public equity (PIPE) that gave him majority control of a transportation and logistics company named Express-1 Expedited Solutions. Jacobs built XPO into a market leader before dividing it into three different public companies (XPO, GXO, and RXO).

Now, having taken time to write his book, Jacobs’ investment firm—Jacobs Private Equity LLC—of which he is managing partner, is reportedly preparing to shake up the building products distribution space with a new venture, QXO.

CREATING SHAREHOLDER VALUE

Clearly, Jacobs has crushed it through conglomeration. But, multiple arbitrage notwithstanding, you can’t simply roll-up companies at random and expect to hit it big. Creating value is also important. “The easiest way I know to create tremendous shareholder value,” Jacobs writes,” is to buy businesses at profit multiples lower than the multiple our stock trades at, and then significantly improve those businesses.” (See Video)

VALUE-ADD ACQUISITION EXAMPLE

That is standard private equity roll-up language applied to publicly-traded companies. How to Make a Few Billion Dollars recounts a very clever way Jacobs added value to United Rentals. Shortly after founding the company, he acquired Wynne Systems, the firm whose software most of the equipment rental industry was using. This strategic coup gave United access to anonymized data on what was happening industry wide, letting them spot developing trends such as gluts or shortages and react to them quicker than competitors could.

SCALE REQUIRES LARGE, HAIRY TRANSACTIONS

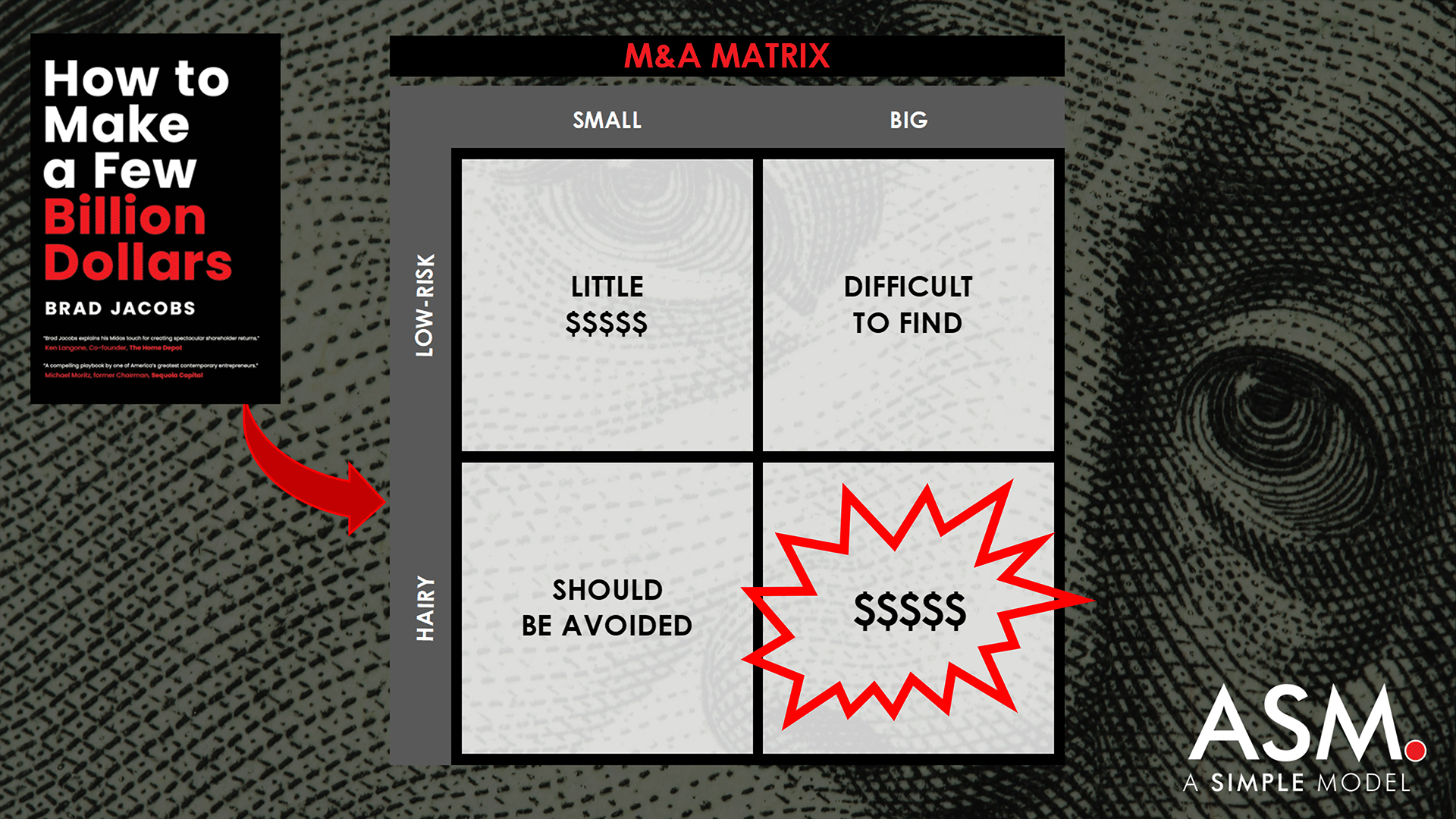

By now I’m sure you get the point about Jacobs; this guy is very, very good. And he didn’t get that way by playing it safe. “Big, low-risk deals are the ones everyone wants,” he writes, “but they don’t exist.” He illustrates this with a matrix like the one below, in which we will simply label big, low risk deals as “difficult to find” (never say never, right?).

That leaves three quadrants in which you can play as an entrepreneurial investor. According to Jacobs, the southwest quadrant should be avoided. Small, hairy deals offer the worst of two worlds, heavy on headaches and scarce on returns. The northwest quadrant, small, low risk deals, is okay, if you want to stay small. The southeast quadrant, what Jacobs calls the “bingo” square, is where you want to be. Those deals will not be easy. But if the problems are solvable, that is where the big money is. And if you want to increase your odds of finding it, I highly recommend you read How to Make a Few Billion Dollars.

Learn more about private equity transactions with ASM’s Private Equity Training course. The Private Equity Training course at ASimpleModel.com was developed by industry professionals. The content below goes beyond the LBO model to explain how private equity professionals source, structure and close transactions.