In this post we will explain the difference between Free Cash Flow to the Firm (FCFF) and Free Cash Flow to Equity (FCFE), and further explain how to convert EBITDA and EBIT to Free Cash Flow. But before we dive into the exercise and the associated Excel template, let’s explore why this is so important.

Understanding how businesses generate free cash flow should be a top priority for any aspiring financial professional or investor. The quote “cash is king” has persisted for a reason. Why? First and foremost, without cash a business will fail, and second, cash flow ultimately determines a company’s value.

But EBITDA became the metric of choice for private equity practitioners in the 80s, and its use has expanded ever since. EBITDA is one of the most common metrics used to arrive at valuation, especially in the context of private equity transactions. It is also frequently used to develop the capital structure for a transaction. Finally, it is frequently cited as a proxy for cash flow, which is dangerous if you don’t understand the difference between the two. So, let’s dive in on FCFF and FCFE.

Download Excel Template: EBITDA to FCFF and FCFE Workbook_ASM

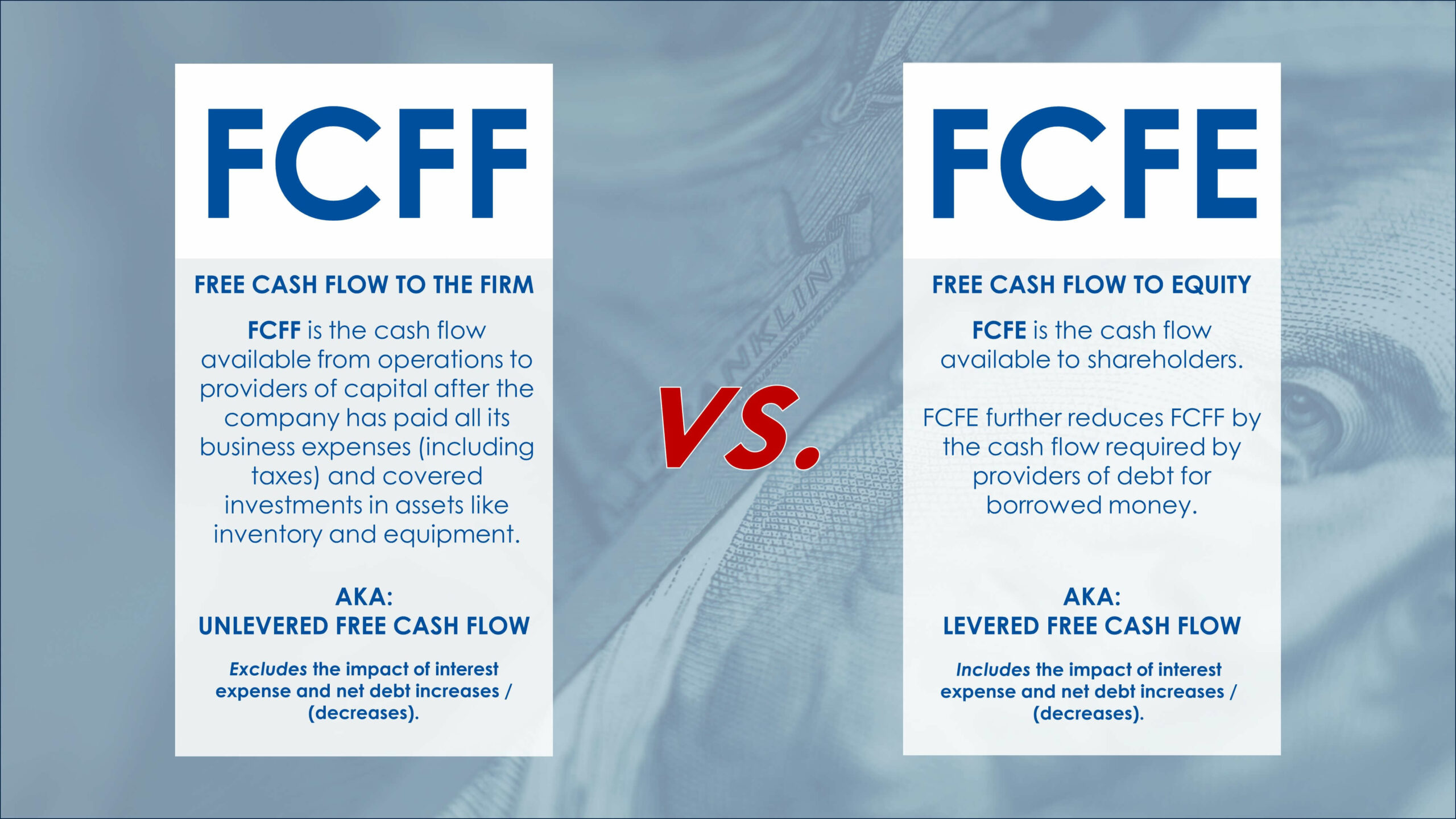

Free Cash Flow to the Firm

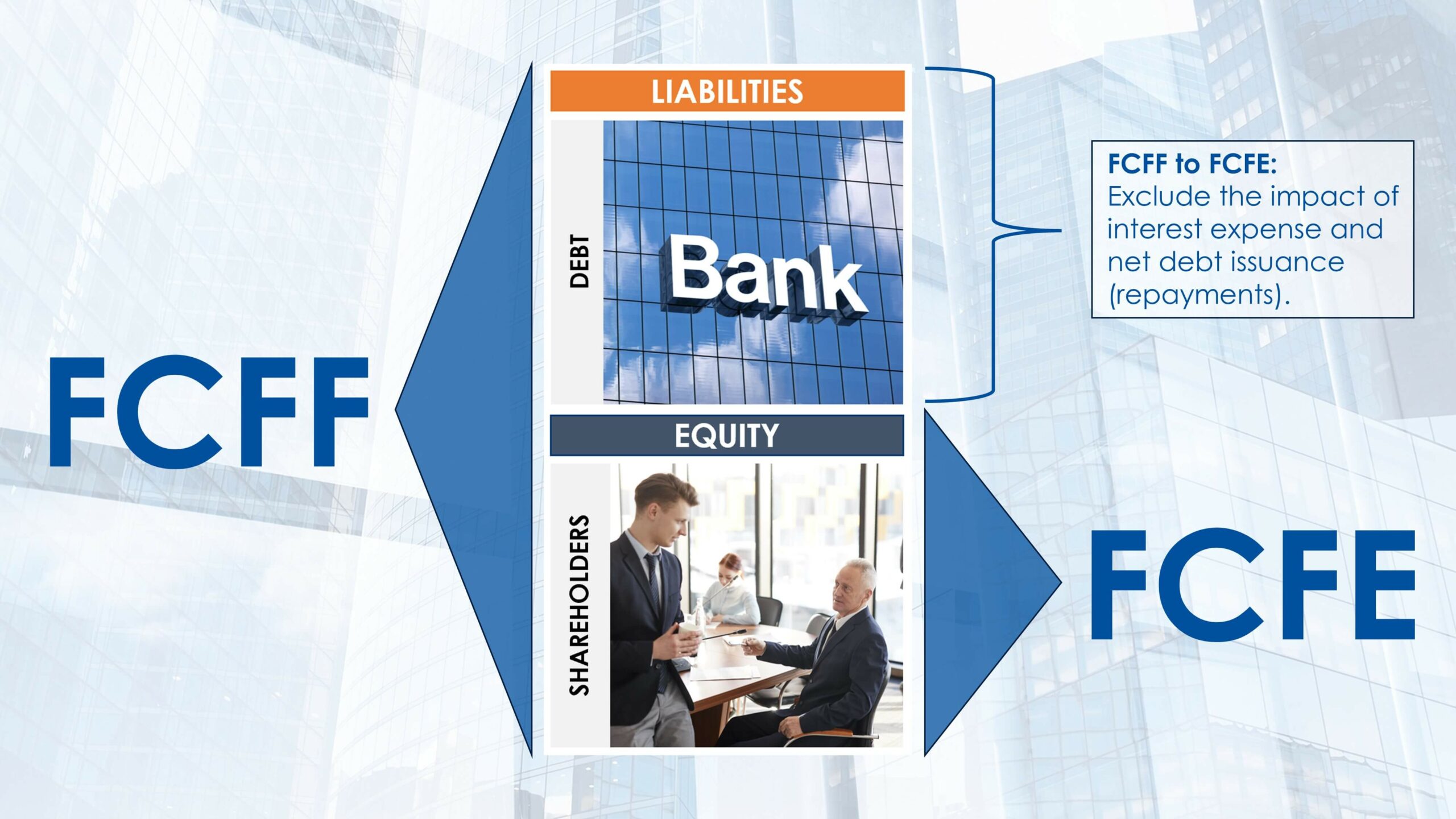

To understand FCFF it helps to review a company’s balance sheet. A balance sheet can be divided into three categories: Assets, Liabilities and Stockholders’ Equity.

A company uses its assets to generate revenue. This is what the company owns. The means of owning these assets is supported by providers of debt and equity.

If you assume that the liability side of the balance sheet is limited to the bank providing debt to purchase assets, and that the equity side of the balance sheet represents shareholders that have contributed capital to fund the business, then Free Cash Flow to the Firm represents the cash available to these two groups.

Note: Per the video explanation, we are making the assumption that liabilities are limited to debt for borrowed money.

In other words, it’s the amount of cash available after the company has paid all its business expenses and covered investments in assets like inventory and equipment, but before capital providers realize any benefit.

EBIT to FCFF Formula: EBIT*(1 – Tax Rate) + D&A – Changes in WC – CapEX = FCFF

EBITDA to FCFF Formula: EBITDA*(1 – Tax Rate) + D&A*(Tax Rate) – Changes in WC – CapEX = FCFF

Free Cash Flow to Equity

So Free Cash Flow to the Firm represents the cash available to both the providers of debt (for borrowed money) and equity. Free Cash Flow to Equity, in contrast, represents the cash available to shareholders only. The difference is the payments expected by the company’s debt holders.

Note: Per the video explanation, we are making the assumption that liabilities are limited to debt for borrowed money.

Debt holders expect interest payments and repayments of principal in a timely manner. Once those two items are subtracted, we have Free Cash Flow to Equity.

FCFF to FCFE Formula: FCFF – Interest Expense*(1 – Tax Rate) + Net Borrowing = FCFE

Parting Thoughts:

All these formulas are doing is mirroring the dynamics of a three-statement model. For example, if you start with EBIT and subtract Interest Expense and Taxes, you have Net Income, which is the first line item visible on the cash flow statement.

If you then mirror the changes on the cash flow statement, adding back Depreciation and Amortization, subtracting changes in working capital, subtracting capital expenditures and adding back net borrowing, then you will have successfully calculated free cash flow for the period. (Note: This sequence is easier to follow visually with the video at the top of this post.)

Master the financial statements and the three-statement framework and this stuff will come easy. If you haven’t already, I highly recommend going through these courses on ASM: (1) Introduction to Financial Statements, and (2) Integrating Financial Statements. Both of these courses are available as part of the ASM+ subscription package.