In this post we will answer two questions:

- How does an increase in inventory affect the financial statements?

- How does the sale of inventory affect the financial statements?

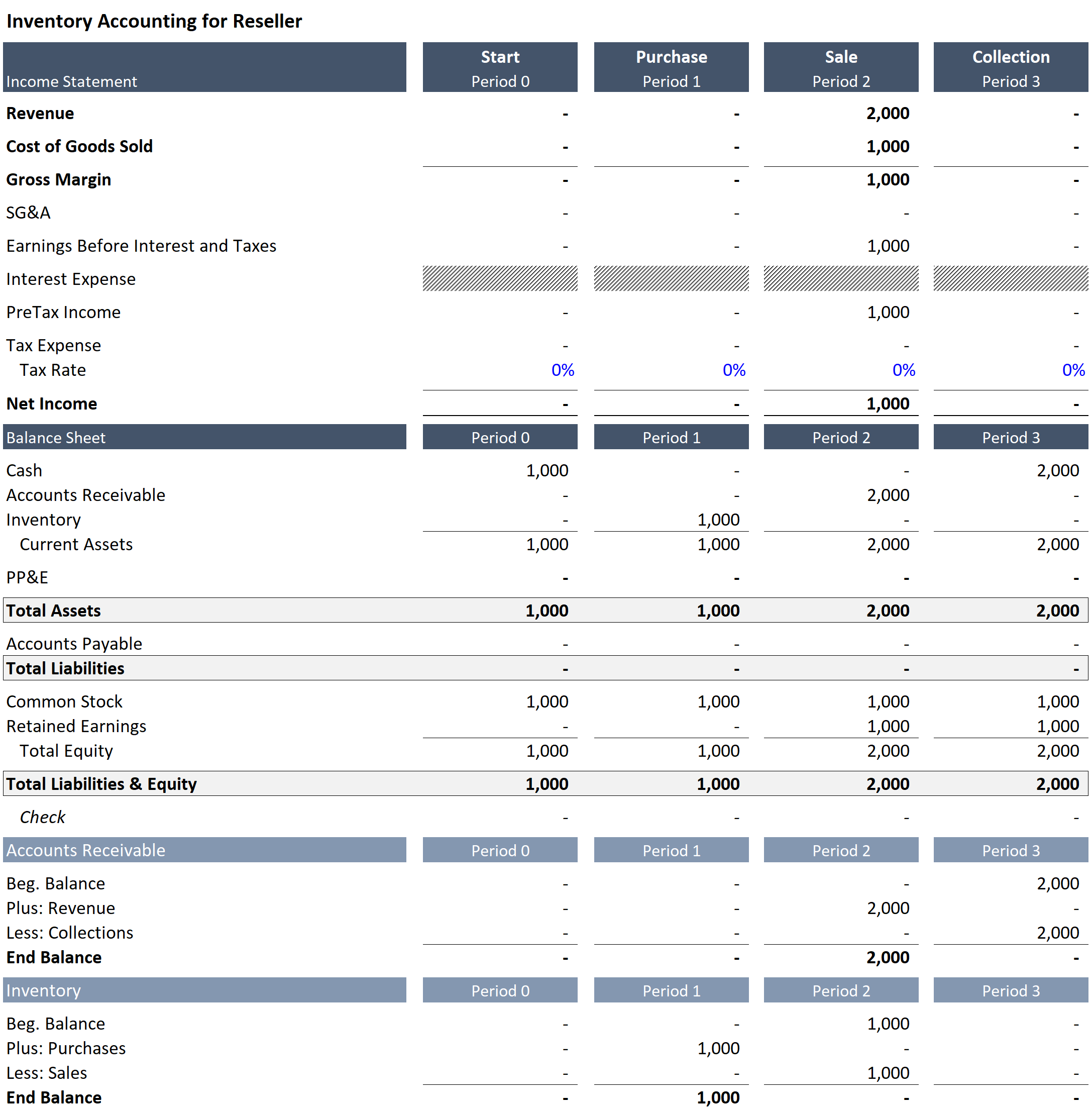

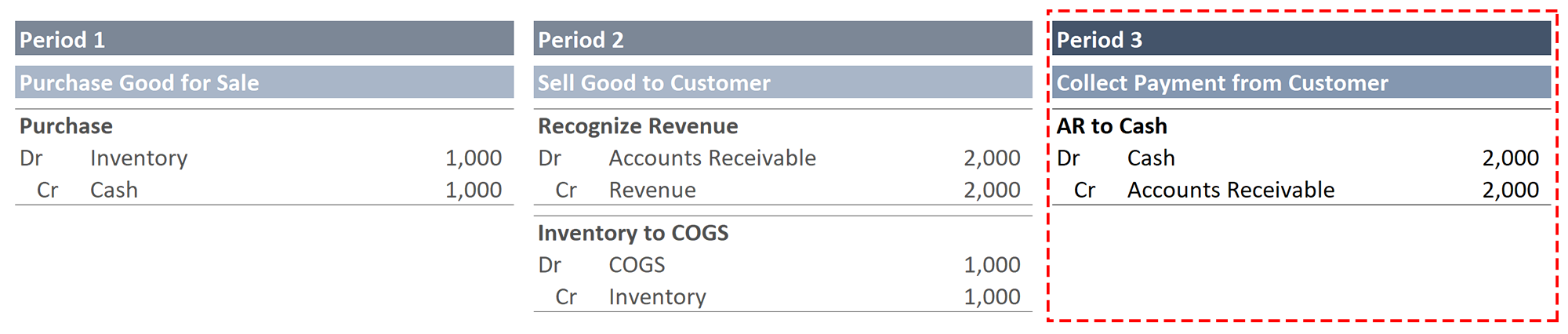

For the purpose of this exercise we are going to assume that a reseller (a company that purchases a finished good with the intention of selling it to a customer) purchases a good for $1,000 and then sells it to a customer for $2,000.

(Note: I have always found it helpful to have an image of the accounting equation available as a reference while working through these exercises.)

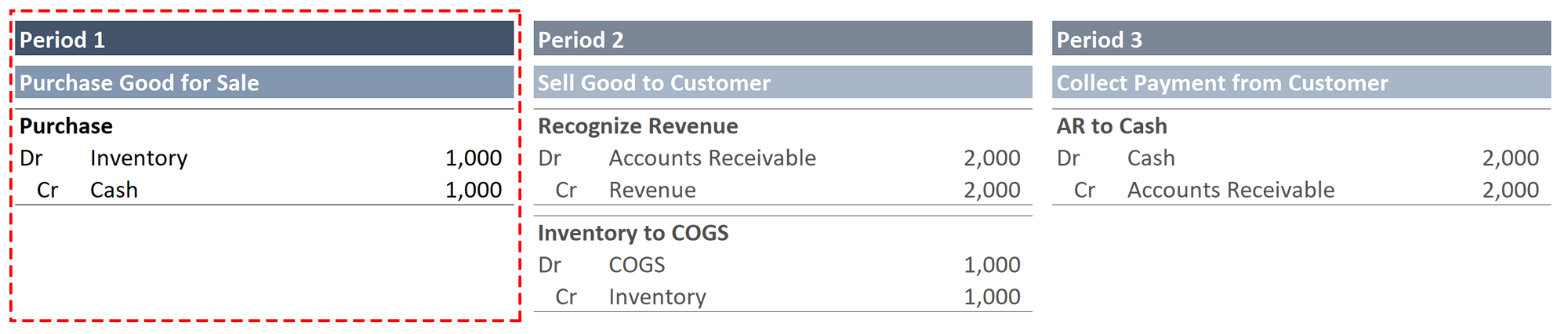

First the company will purchase the good for sale with cash on the balance sheet. This means that everything takes place on the asset side of the balance sheet:

- Increase in Assets: Inventory

- Decrease in Assets: Cash

Journal Entry:

Dr. Inventory

Cr. Cash

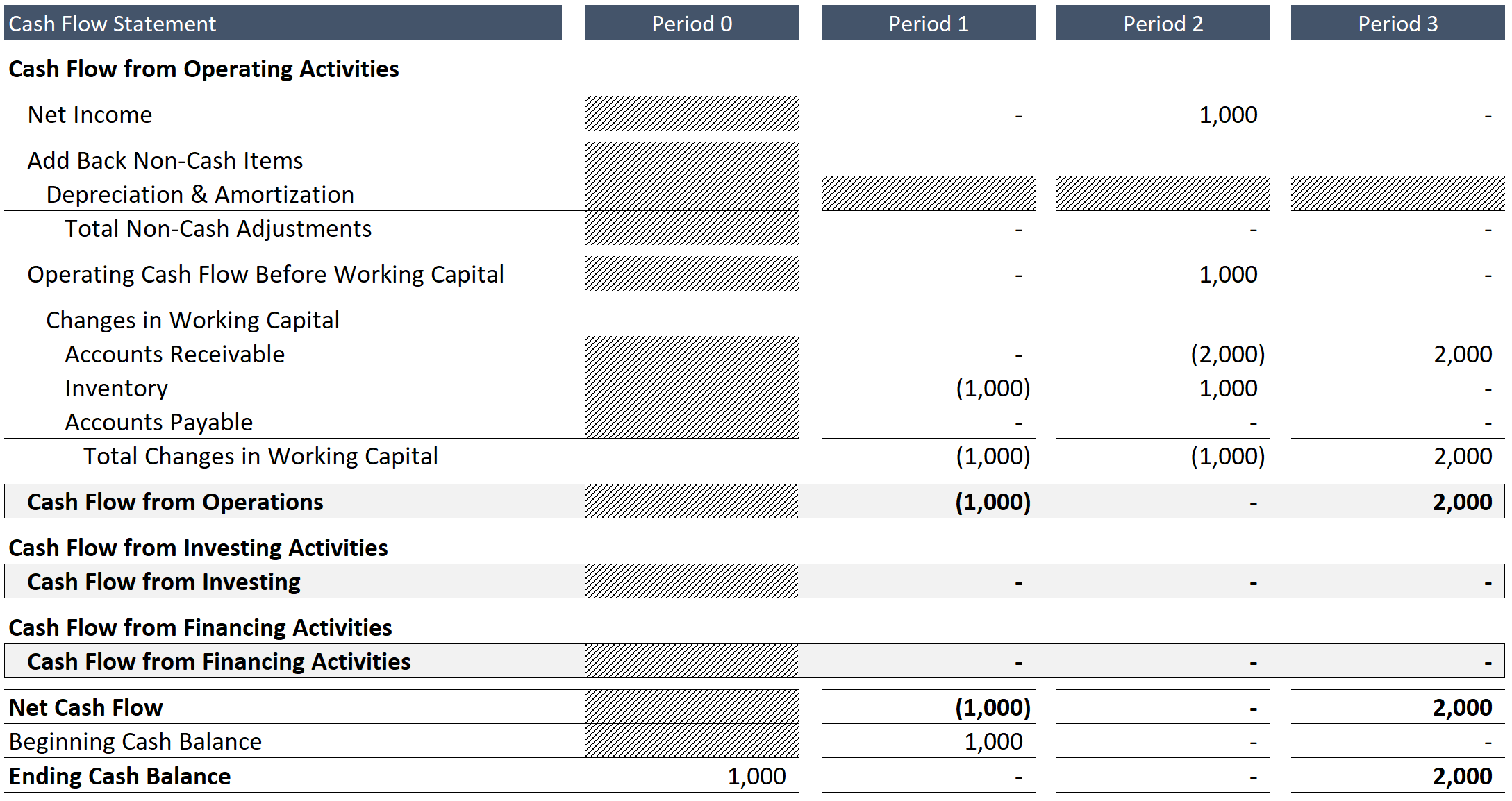

FINANCIAL STATEMENT IMPACT: In addition to the changes to the balance sheet described above, you will see that the resulting increase in inventory, which is a working capital account, is reflected as a cash outflow on the cash flow statement (see image – financial statements available at the conclusion of this post).

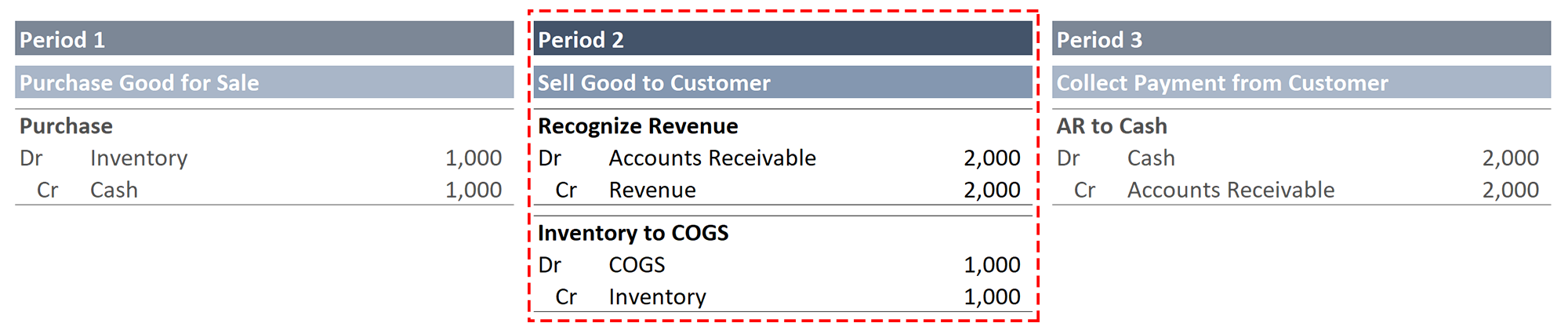

Second, the company sells the good to a customer on a net 30 account. Net 30 terms means that payment in full is due 30 days after the invoice date. This will require two journal entries.

Journal Entry to Recognize Revenue:

Dr. Accounts Receivable

Cr. Revenue

Journal Entry for Inventory:

Dr. COGS

Cr. Inventory

FINANCIAL STATEMENT IMPACT:

Income statement: The recorded sale for $2,000 will be matched with the associated cost of the good providing a gross margin of $1,000.

Balance Sheet: Accounts receivable increases by $2,000 to reflect the customer’s promise to pay for the good purchased, and inventory declines to reflect the sale of the good. Retained earnings gross by the amount of net income (we have assumed zero tax expense in this exercise).

Cash Flow Statement: The cash flow statement will start with net income of $1,000. Changes from working capital will be equivalent to -$1,000 to reflect a cash outflow of $2,000 from the increase in accounts receivable and the cash inflow of $1,000 from the decrease in inventory. Consequently the ending cash balance will be zero.

Third, the company will collect payment from the customer in the period that follows.

Journal Entry to Collect Payment:

Dr. Cash

Cr. Accounts Receivable

FINANCIAL STATEMENT IMPACT:

Balance Sheet: At the conclusion of three periods we are back to a positive cash balance, and the accounts receivable balance is reduced to zero to reflect collection of payment.

Cash Flow Statement: The reduction of accounts receivable to zero from a prior balance of $2,000 creates a $2,000 cash inflow.

Below you will see the transactions described above flowing through the three primary financial statements. For this exercise, everything else has been omitted to make it easier to follow the transactions (Download Template).