In this post we will look at the impact of deferred revenue on a company’s financial statements. As you work through this post keep in mind that deferred revenue, which is also referred to as unearned revenue, represents a liability to the company.

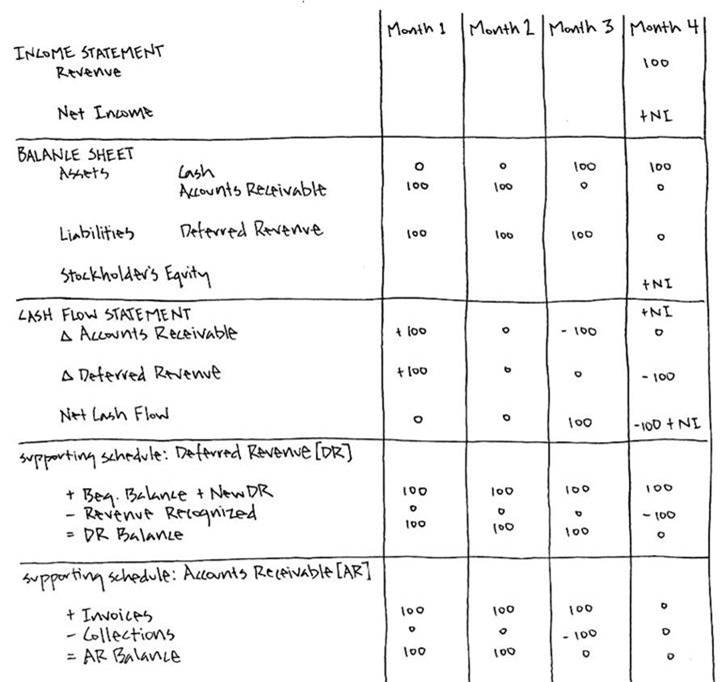

A visual representation of how deferred revenue flows through the three financial statements can be found at the bottom of this post. Please refer to the image for the sequence that follows:

(Note: I have always found it helpful to have an image of the accounting equation available as a reference while working through these exercises.)

MONTH ONE:

The company invoices a customer for a research report that requires payment in Month 3, and will be delivered to the customer in Month 4.

Journal Entry:

Dr: Accounts Receivable $100

Cr: Deferred Revenue $100

Note: In this example no cash is received in Month 1. In many deferred revenue examples cash is received in the first period. In this case you would simply debit cash and credit the deferred revenue account in the first accounting period for the sum received.

Balance Sheet: Accounts receivable (asset) increases by $100, and deferred revenue (liability) increases by $100.

Cash Flow Statement: Since we have an equal increase in both an asset and a liability, the impact to cash is zero.

MONTH TWO:

Nothing happens. You can see that there are no cash adjustments on the CF statement.

MONTH THREE:

In month three the customer pays. You will notice, however, that the report has not been delivered. So while the company has received cash in this period it will not record revenue.

Journal Entry:

Dr: Cash $100

Cr: Accounts Receivable $100

Balance Sheet: The accounts receivable balance is reduced by the amount of cash received, in this case $100. Deferred revenue remains a liability because the company has not yet delivered the product.

Cash Flow Statement: The cash flow statement will take the difference in accounts receivable from the balance sheet, in this case creating a cash inflow of $100.

MONTH FOUR:

In month four the research report is delivered and revenue is recorded.

Journal Entry:

Dr: Deferred Revenue $100

Cr: Revenue $100

Income Statement: The revenue associated with the contract flows through the income statement and (assuming it was priced appropriately) positive Net Income (NI in the image below).

Balance Sheet: Deferred revenue is reduced to zero. Stockholder’s equity (retained earnings specifically) grows by this amount of net income.

Cash Flow Statement: At the top of the cash flow statement, net income grows by the amount associated with the sale of this research report. Deferred revenue, which was reduced from $100 to $0 on the balance sheet reduces cash flow by $100. The impact to cash flow for the period is -$100 + NI. (Note: because we do not show the cost of producing the report in this example, it can be assumed that NI is equal to $100 and that the impact to cash is $0.)