I did not have a formal accounting background when I started working in investment banking. I had taken several courses in college, but that was the extent of my education prior to taking an analyst role. On account of my limited exposure, debits and credits did not come naturally to me at first. But two items really helped as references.

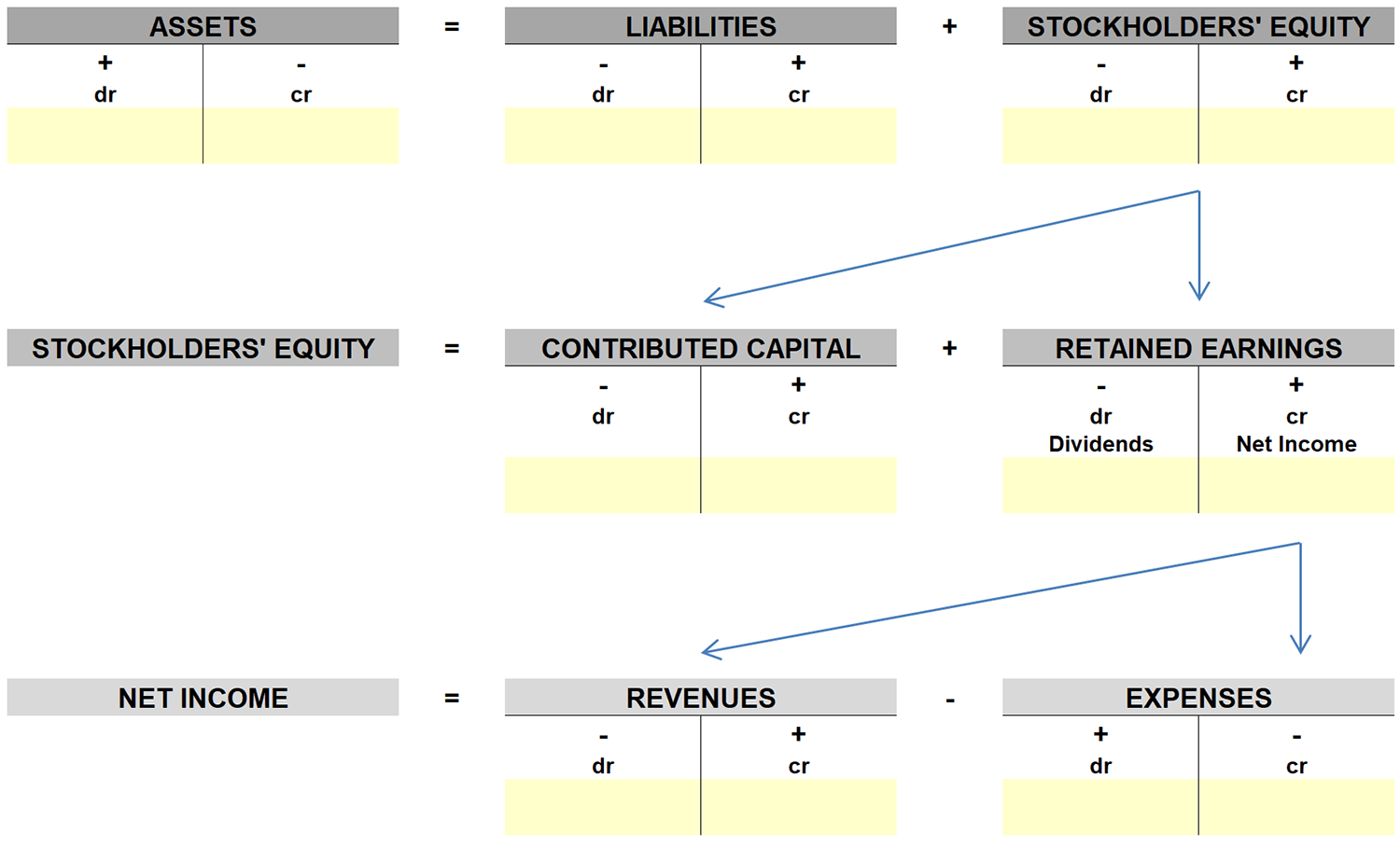

The first was a single sheet of paper with a hand-drawn version of the accounting equation. This sheet was tacked to my cublicle wall immediately to the right of my computer screens. However simple it may be, I found that referencing it frequently helped cement the concept of debits and credits.

The second item was a definition of debits and credits that I found in a book titled Accounting for M&A, Equity and Credit Analysts:

I have read that working with text that is difficult to read improves comprehension (because you have to work harder to read the text). Unfortunately, most people find reading to be enough work already. For those of you that recoil at the site of my hand writing:

“In double-entry accounting, the balance sheet is always kept in balance by making debits equal credits. But debits and credits do not seem to be intuitive concepts for many analysts, so let us think of them in the context of something everyone understands: cash.

Rephrasing the original statement, in double entry accounting, the balance sheet is always kept in balance by making the uses of cash equal the sources of cash. Increasing assets uses cash, and so a DEBIT INCREASES ASSETS (debit = use of cash) because we use cash to ‘buy’ the asset. We get cash from borrowing or increasing liabilities, so a CREDIT INCREASES LIABILITIES (credit = source of cash).”