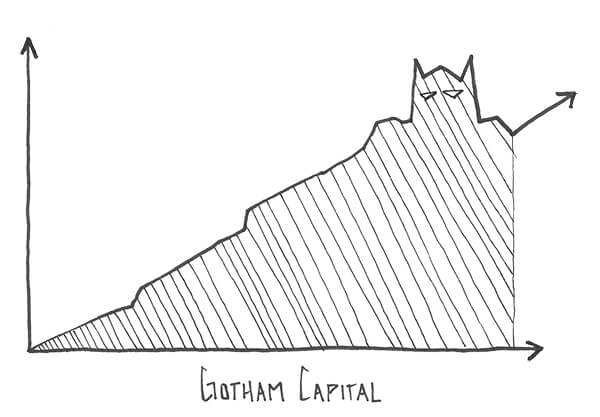

Start with Joel Greenblatt: Not only is he excellent at outperforming the market – he managed an annualized return of 50% over the course of a decade at Gotham Capital – he also has an unusual sense of humor. I like to think it’s why the cover of one of his books is covered in $100 bills and that perhaps he named his fund, Gotham Capital, in homage to Batman.

The Little Book That Still Beats the Market – this book introduces Joel Greenblatt’s “magic formula” for investing. Whether you want to take this approach or not, the book does an excellent job explaining what he believes are the most important metrics: earnings yield and return on capital. This is described in an incredibly simple and insightful way.

I would actually follow with another of Greenblatt’s books: You Can Be a Stock Market Genius – ignore the cheesy title and book cover, this is a brilliant text. It does an incredible job explaining the advantage of the individual over Wall Street professionals, and it does so with simple language. Consider his comments on concentrated investing:

Statistics say that owning just two stocks eliminates 46 percent of the nonmarket risk of owning just one stock. This type of risk is supposedly reduced by 72 percent with a four-stock portfolio, by 81 percent with eight stocks, 93 percent with 16 stocks, 96 percent with 32 stocks, and 99 percent with 500 stocks. Without quibbling over the accuracy of these particular statistics, two things should be remembered:

1. After purchasing six or eight stocks in different industries, the benefit of adding even more stocks to your portfolio in an effort to decrease risk is small, and

2. Overall market risk will not be eliminated merely by adding more stocks to your portfolio.

After that I would move on to Howard Marks’ book The Most Important Thing Illuminated. The book is annotated by some of the greatest investors including Christopher Davis, Joel Greenblatt, Paul Johnson and Seth Klarman, which makes it truly unique. Marks also does an excellent job of explaining difficult concepts in simple terms, and uses a lot of anecdotal or historical references that make the text enjoyable.

Also, read his memos: Memos from Howard Marks

Next, I would pick up The Little Book of Valuation by Aswath Damodaran (professor and investor). This will permit diving a little deeper into the math (not that it’s complicated). In fact, Damodaran writes in his introduction:

I believe that valuation, at its core, is simple, and anyone who is willing to spend time collecting and analyzing information can do it. I show you how in this book.

And in the first chapter:

“When valuing an asset, use the simplest model you can. If you can value an asset with three inputs, don’t use five. If you can value a company with three years of forecasts, forecasting 10 years of cash flows is asking for trouble. Less is more.”

After that the book dives right in with time value of money, acct 101, multiples and specific examples. (Don’t let the title fool you, the book contains an incredible amount of information).

Also, check out his blog: Musings on Markets

Finally, I have to recommend Irrational Exuberance – it is one of my favorite books on markets. The intro describes it well “this book is really about the behavior of all speculative markets, about human vulnerability to error, and about the instabilities of the capitalist system.” Written by Robert Shiller, this text is a little more dense, but it is brilliant.

The amazing thing about all of these texts is that they are pretty easy to read. If this subject genuinely interests you, it should not be difficult to work through these.

Additional writers / resources worth following:

Charlie Munger – Anything he writes is worth reading.

Berkshire Hathaway Annual

Reports – http://www.berkshirehathaway.com…

Michael Mauboussin – Reflections on the Ten Attributes of Great Investors (recent example)

John C Bogle – Founder and retired CEO of Vanguard – http://johncbogle.com/wordpress/…

Barron’s often publishes great interviews that offer a lot of insight as well.

And if you’re willing to commit to dense material:

Security Analysis by Benjamin Graham and David Dodd or The Intelligent Investor by Benjamin Graham

And Valuation

Note: Originally answered on Quora.